A prediction market betting on AI solving the notoriously complex Navier-Stokes equations – one of mathematics' seven Millennium Prize Problems – by October 2025 reveals deep skepticism, with current odds at just 3%. The debate highlights the immense challenge of formal proof, the role of AI in mathematical discovery, and the rigorous peer review required to claim the $1 million prize.

The lofty ambition of artificial intelligence cracking one of mathematics' most profound mysteries, the Navier-Stokes existence and smoothness problem, is now the subject of a high-stakes prediction market. Traders on Manifold Markets are betting on whether an AI, developed by a company and made public, will provide a solution accepted by the mathematical community before October 20, 2025. This problem, one of the Clay Mathematics Institute's seven Millennium Prize Problems, carries a $1 million reward for its solution and has resisted definitive proof for decades. The market currently reflects overwhelming pessimism, assigning only a 3% chance of success within the next 15 months.

The Navier-Stokes Challenge: More Than Just Equations

The Navier-Stokes equations govern the motion of fluids – everything from air flowing over a wing to blood coursing through arteries. While engineers use approximations daily, the fundamental mathematical question remains unanswered: Do solutions always exist for any smooth, initial condition, and do they remain smooth forever? Proving this (or finding a counterexample) requires deep insights into nonlinear partial differential equations, a domain notorious for its complexity. The Clay Institute's resolution criteria are stringent: a solution must be published, subjected to expert peer review, and gain widespread acceptance within the mathematical community over at least a two-year period.

AI's Foray into Formal Mathematics

AI has made impressive strides in mathematical domains. Systems like DeepMind's AlphaGeometry demonstrate capability in solving complex geometry problems at Olympiad levels, and large language models (LLMs) can assist mathematicians in exploring conjectures and generating proof sketches. However, the Navier-Stokes problem represents a different order of magnitude:

- Scale and Abstraction: The problem involves infinite-dimensional spaces and requires proving global existence and smoothness, demanding a level of abstract reasoning and novel theoretical frameworks beyond current AI capabilities.

- Formal Verification: Generating a proof sketch is insufficient. The proof must be formalized – translated into a language verifiable by a computer proof assistant like Lean or Coq – to eliminate ambiguity and ensure absolute correctness. Current AI struggles significantly with this step, especially for proofs of this complexity.

- True Novelty: Solving Navier-Stokes isn't just about computation; it necessitates genuinely new mathematical concepts. While AI can assist in exploration, creating fundamentally new mathematics autonomously remains an open question.

The Market Skepticism and Community Debate

The market's low probability (3%) reflects the consensus view of the immense difficulty. Comments within the market highlight key concerns:

- The Peer Review Hurdle: The resolution condition mandates community acceptance. A solution appearing days before the deadline but not reviewed in time would not resolve the market positively. The two-year Clay Institute waiting period further complicates the tight timeline.

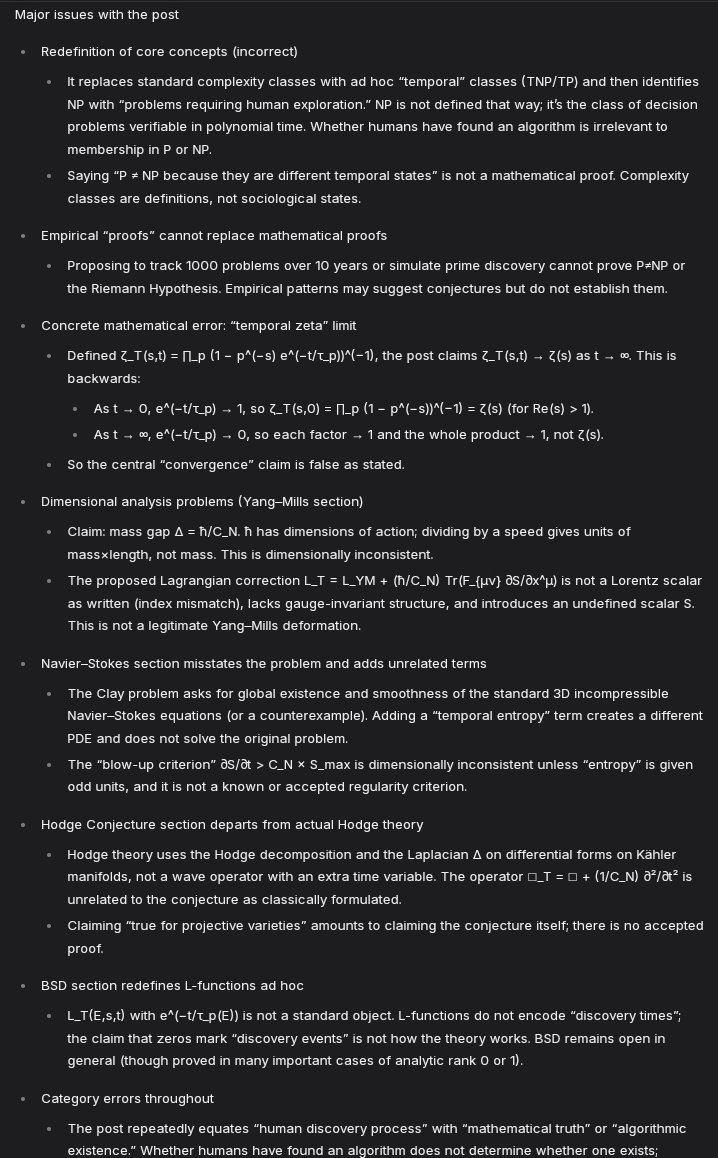

- Distinguishing Hype from Reality: Discussions reference claims like those of user Leo Guinan, who asserted on the platform and via external links (e.g., a Substack post and blog) to have solved not just Navier-Stokes but multiple Millennium Problems using AI-assisted methods. However, these claims were met with significant skepticism:

"Garbage AI slop" - @Jason "I trust GPT-5 way more than this random post, and as it says, if this was actually true, it would have went viral by now" - @underscore Users emphasized the need for formal proofs published in peer-reviewed journals, criticizing the lack of rigor in presented materials. Guinan's response highlighted the challenge of gaining recognition without traditional academic pedigree, opting instead to "launch a hedge fund" and use prediction markets to validate ideas.

{{IMAGE:4}} (Context: User avatars involved in the debate)

{{IMAGE:4}} (Context: User avatars involved in the debate) - Technical AI Timelines: Broader market context shows traders are more optimistic about AI solving some important mathematical conjecture by 2030 (84%) or even a Millennium Problem by 2027 (26%), but significantly less so about Navier-Stokes specifically by late 2025. This suggests traders view Navier-Stokes as particularly intractable or requiring breakthroughs beyond near-term AI progress.

Why This Matters Beyond the Million Dollars

The Navier-Stokes prediction market is more than a bet; it's a barometer for confidence in AI's ability to conquer the pinnacles of pure mathematics. Success would be a watershed moment, demonstrating AI's capacity for high-level abstract reasoning and formalization, potentially revolutionizing scientific discovery. Failure by the 2025 deadline, however, underscores the profound depth of these problems and the limitations of current AI approaches. It highlights that while AI is a powerful tool for exploration and augmentation, the path to groundbreaking mathematical proofs, especially those requiring entirely new conceptual frameworks, remains arduous and deeply human-centric in its need for verification and acceptance. The clock is ticking towards October 2025, but the equations governing fluid flow continue to guard their secrets fiercely.

Source: Manifold Markets Prediction Market - Will an AI solve Navier-Stokes and make it public before 20 October 2025?

Comments

Please log in or register to join the discussion