Explosive investment in AI infrastructure is approaching 2% of US GDP, rivaling historic peaks in railroad and telecom spending. This unprecedented capital allocation is starving other sectors, triggering corporate layoffs, and masking underlying economic weakness while raising concerns about sustainability.

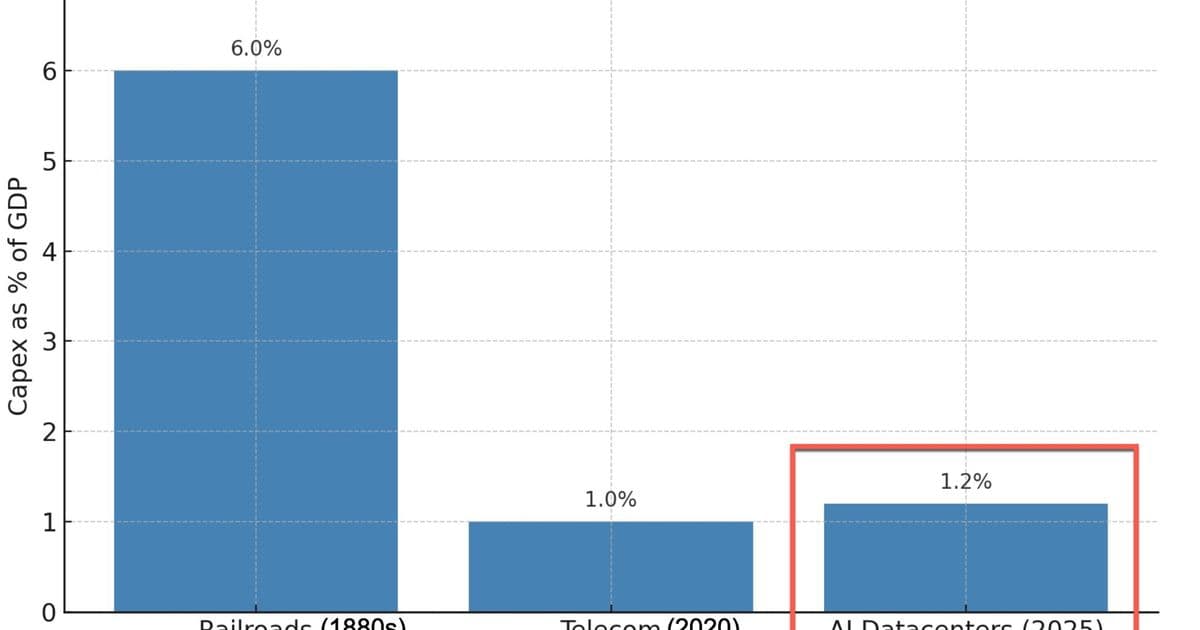

The scale of capital pouring into artificial intelligence infrastructure has reached staggering, economy-altering levels. Recent analysis suggests AI-related datacenter spending could approach 2% of US GDP by 2025, representing a tenfold increase since 2022 and positioning it among the most significant capital expenditure surges in modern economic history.

The Staggering Scale of AI Capex

Key data points highlight the magnitude:

- Nvidia's Q1 FY2026 datacenter sales: $39.1 billion (annualized ~$156.4 billion)

- Nvidia's estimated market share in datacenter AI chips: 25-35%

- Implied total datacenter capex: ~$520 billion

- Economic multiplier effect: 1.5x-2.0x

// Simplified Calculation Logic

US_2025_GDP = 25e12; // $25 trillion

Nvidia_AI_Sales_Annualized = 156.4e9; // $156.4 billion

Nvidia_Share = 0.3; // 30% estimate

Total_Datacenter_Capex = Nvidia_AI_Sales_Annualized / Nvidia_Share; // ~$520 billion

GDP_Percentage = (Total_Datacenter_Capex / US_2025_GDP) * 100; // ~2.08%

This spending eclipses the peak of the dot-com telecom frenzy and approaches levels seen during the 19th-century railroad boom relative to GDP. Crucially, these figures represent raw capital expenditure before accounting for broader economic multiplier effects.

The Capital Reallocation Crisis

This GDP-scale investment isn't conjured from thin air; it represents a massive diversion of capital:

- Internal Corporate Cashflows: Hyperscalers (Microsoft, Google, Amazon, Meta) are redirecting profits.

- Debt & Equity Markets: Increased issuance fuels expansion.

- Venture Capital: Non-AI startups face severe funding droughts as VCs chase AI.

- Off-Balance Sheet Vehicles: SPVs, leasing, and asset-backed financing (e.g., Meta's recent deals) are proliferating.

- Cloud Budgets: Hyperscalers are shifting spend from traditional cloud services to GPU-centric infrastructure, driving layoffs (e.g., Amazon AWS).

The consequence is stark: capital starvation for manufacturing, non-AI tech, and other critical infrastructure sectors. History suggests such frenzies leave long-lasting imbalances, similar to the post-telecom bubble infrastructure deficit.

Solving the Economic Resilience Puzzle

This AI capex surge provides a compelling answer to a current economic mystery: Why has the US economy shown surprising resilience despite political uncertainty and trade tensions? It acts as a massive, private-sector stimulus program.

"Without AI datacenter investment, Q1 GDP contraction could have been closer to –2.1%... AI capex was likely the early-2025 difference between a mild contraction and a deep one, helping mask underlying economic weakness." - Analysis based on Paul Kedrosky's figures

The scale is historically anomalous. Unlike railroads or fiber optics, AI datacenters are short-lived assets. They ride steeply declining cost curves, demanding constant, expensive hardware refreshes to maintain competitiveness. The irony is profound: AI-driven job losses are occurring now – driven by capital reallocation and operational shifts – long before the technology achieves widespread deployment.

This breakneck investment reshapes the economic landscape, creating both unprecedented opportunity and systemic vulnerability as capital floods into rapidly depreciating infrastructure at the expense of broader stability.

Source: Analysis based on data and insights from Paul Kedrosky's 'Honey, AI Capex Ate the Economy' (paulkedrosky.com)

Comments

Please log in or register to join the discussion