Intel has admitted it might abandon development of its 14A process node—a 1.4nm-class technology—if it fails to secure a major external customer or hit key milestones, potentially ceding the semiconductor frontier to TSMC and Samsung. This unprecedented shift highlights the crushing costs of next-gen fabrication and forces a reckoning on the viability of domestic advanced manufacturing. For developers and the tech ecosystem, it signals a future where chip innovation could hinge on fewer players,

Intel's 14A Dilemma: A High-Stakes Gamble in the Semiconductor Wars

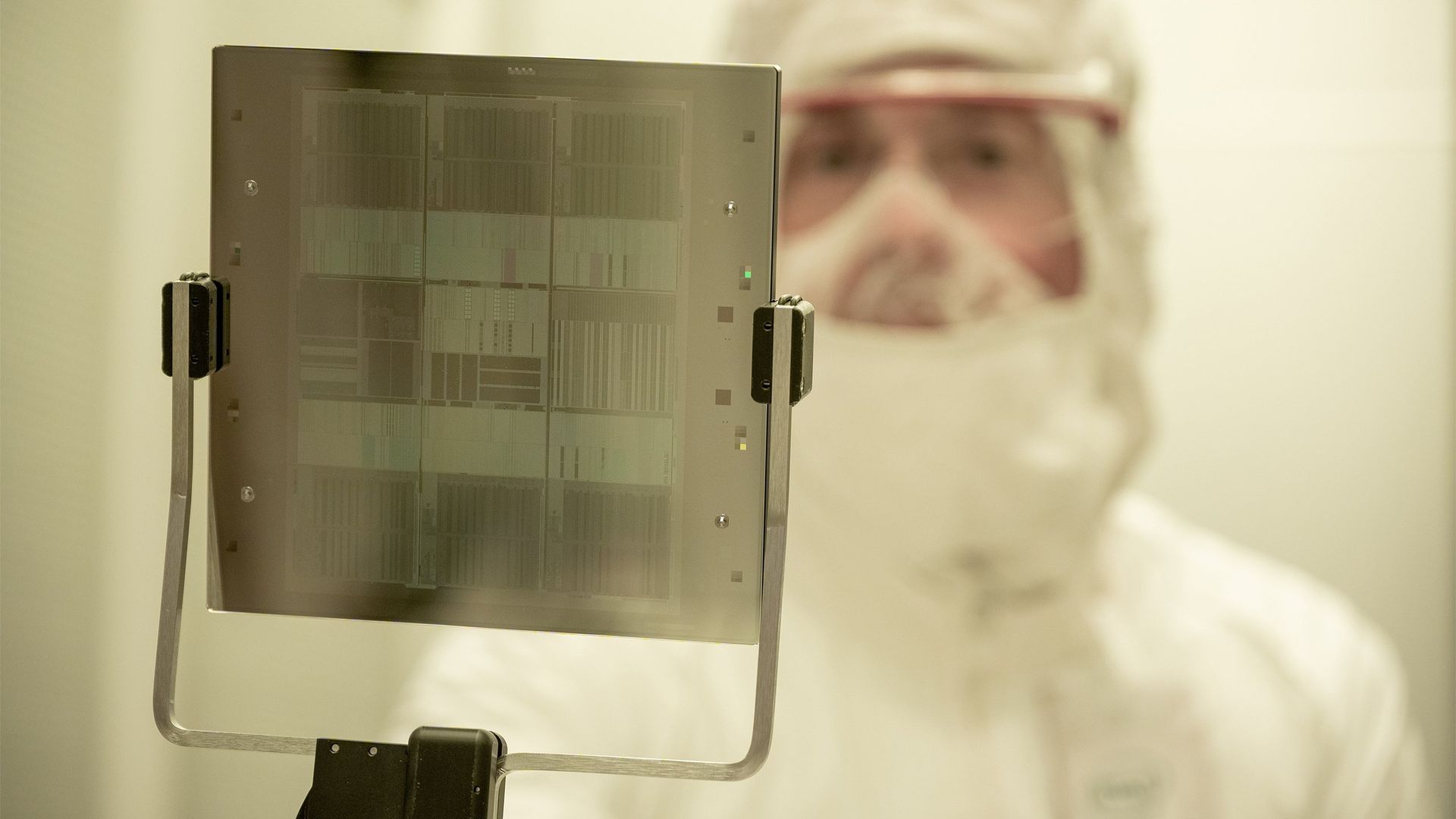

Image credit: Intel

In a move that sent shockwaves through the tech industry, Intel revealed during its recent earnings call that the future of its 14A process technology—its most advanced node targeting 1.4nm-class fabrication—hangs in the balance. For the first time, the company openly acknowledged it might slow down or even cancel 14A development if it fails to land a major external customer or if the node stumbles at critical technical milestones. This admission isn't just a corporate footnote; it's a seismic shift that could redraw the map of global semiconductor leadership, leaving TSMC and Samsung Foundry as the uncontested masters of the leading edge.

The Ultimatum: Market Realities Meet Moore's Law

Buried in Intel's 10Q filing with the SEC was a stark warning: "If we are unable to secure a significant external customer and meet important customer milestones for Intel 14A, we face the prospect that it will not be economical to develop and manufacture Intel 14A and successor leading-edge nodes." The statement continues, "In such event, we may pause or discontinue our pursuit." This isn't merely about one node—14A is the planned successor to Intel's 18A and 18A-P technologies, positioning it as the cornerstone of the company's post-2025 roadmap for both internal chips and external foundry clients.

The calculus is brutally economic. Developing leading-edge process nodes now demands investments measured in billions. Intel's R&D spend hit $16.546 billion in 2024, with a hefty slice dedicated to nodes like 18A and 14A. But the real eye-opener is the cost of enabling high-volume manufacturing (HVM). Intel 14A is slated to be the company's first process to use High-NA EUV lithography for critical layers, with each ASML Twinscan EXE:5000/5200 tool costing approximately $380 million. Procuring just two tools for a single fab would run close to $760 million—a staggering outlay that demands guaranteed volume from both Intel's own products and external partners.

As Intel CEO Lip-Bu Tan emphasized on the earnings call, "The 14A is the process node, but clearly I will make sure that I see the internal customer, external customer, and volume commitment before I put CapEx... It's a lot of responsibility to be serving our customers, make sure that we can deliver consistent, reliable results."

"If we are unable to secure a significant external customer and meet important customer milestones for Intel 14A, we face the prospect that it will not be economical to develop and manufacture Intel 14A and successor leading-edge nodes on a go-forward basis." — Intel SEC Filing

Why This Isn't Just Intel's Problem

For engineers and tech leaders, Intel's dilemma underscores a harsh truth: The era of "build it and they will come" in semiconductor manufacturing is over. The pursuit of Moore's Law now requires not just technical brilliance but proven commercial backing. If Intel pulls back, the implications ripple across the ecosystem:

- Reduced Competition: A retreat would leave TSMC and Samsung as the only players at the bleeding edge, potentially stifling innovation and giving foundry customers fewer options for cutting-edge designs. This could lead to higher costs and slower advances in areas like AI, cloud computing, and edge devices.

- Supply Chain Fragility: With Intel potentially outsourcing its most advanced chips (post-18A-P) to third parties like TSMC, the industry's reliance on a handful of fabs grows—exacerbating geopolitical risks and capacity constraints.

- Internal Ripple Effects: Intel claims it could sustain its product lineup using nodes up to 18A-P through 2030. But if future high-performance CPUs or GPUs are fabbed externally, margins could erode, and Intel's integrated design-manufacturing advantage—once its crown jewel—could vanish.

The Road to 14A: High Risk, Uncertain Reward

Intel insists it has at least one internal design planned for 14A, keeping the door open. Yet, the absence of committed external partners—a gap highlighted by Tan's caution—suggests a tepid market response to Intel Foundry's ambitious pivot. This isn't just about technology; it's about trust. After years of delays and execution stumbles, customers may hesitate to bet their flagship products on Intel's unproven foundry ecosystem.

If 14A falters, Intel's path forward involves a pragmatic, if humbling, reliance on partners. As one forum commenter noted, "Sad to see Intel potentially being relegated to another GloFo," referencing GlobalFoundries' exit from leading-edge nodes. Others, like user bit_user, criticized the announcement as counterproductive: "Threatening to cancel them could end up being a self-fulfilling prophecy."

A Semiconductor Crossroads

Intel's 14A decision isn't merely a corporate strategy tweak—it's a referendum on whether Western semiconductor innovation can withstand the financial and technical onslaught of the cutting edge. The billions required for High-NA EUV tools and process R&D demand more than optimism; they demand a coalition of believers. Without them, the world might witness a historic retreat, concentrating the power to shape tomorrow's technology in fewer hands. For now, Intel walks a tightrope, where the next misstep could echo through server racks, data centers, and devices worldwide.

Source: Tom's Hardware

Comments

Please log in or register to join the discussion