OpenAI projects astronomical revenue growth to $200 billion by 2030 to offset massive infrastructure costs, but new Census Bureau data reveals a troubling decline in corporate AI adoption. This divergence raises existential questions about the sustainability of generative AI's business model amid underwhelming ROI and technical limitations.

The High-Stakes Math Behind OpenAI's Existential Bet

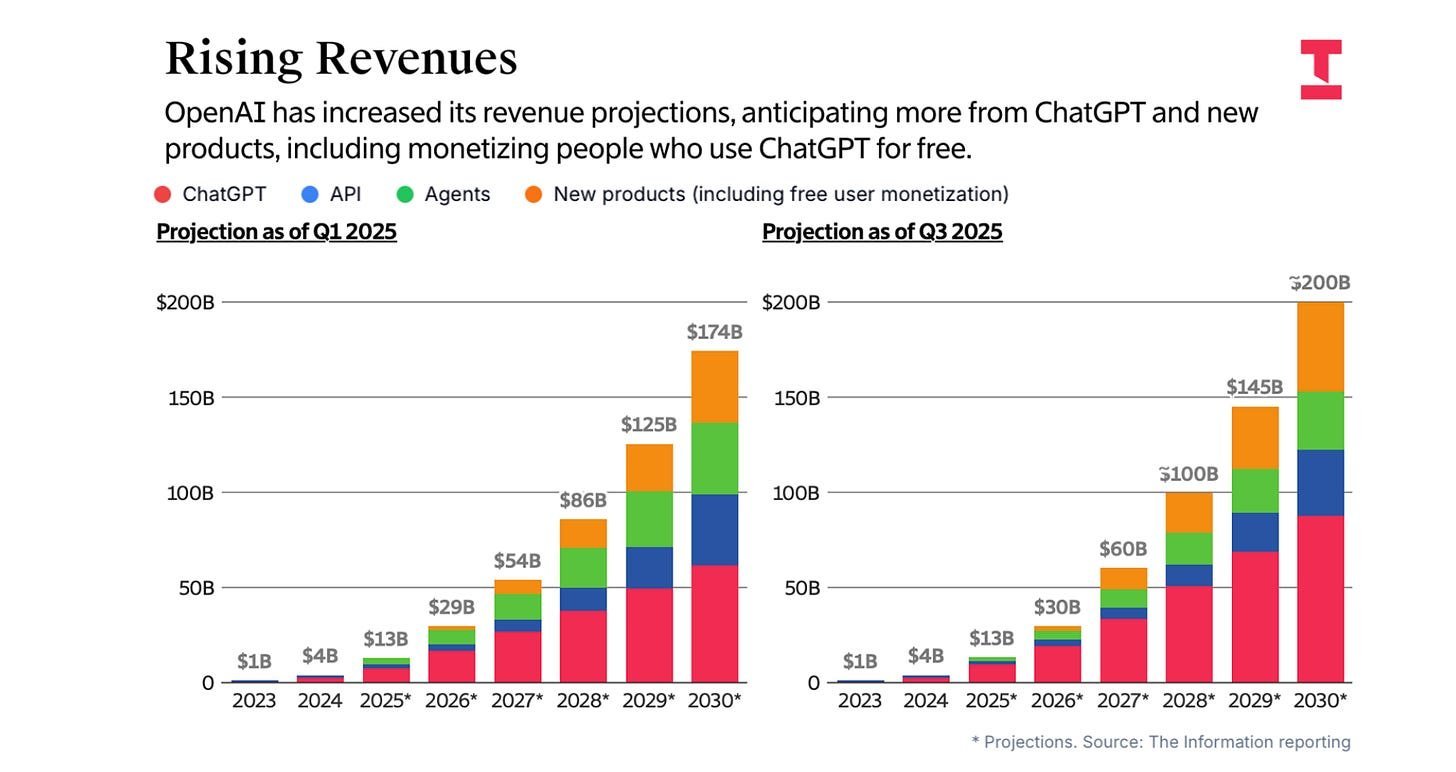

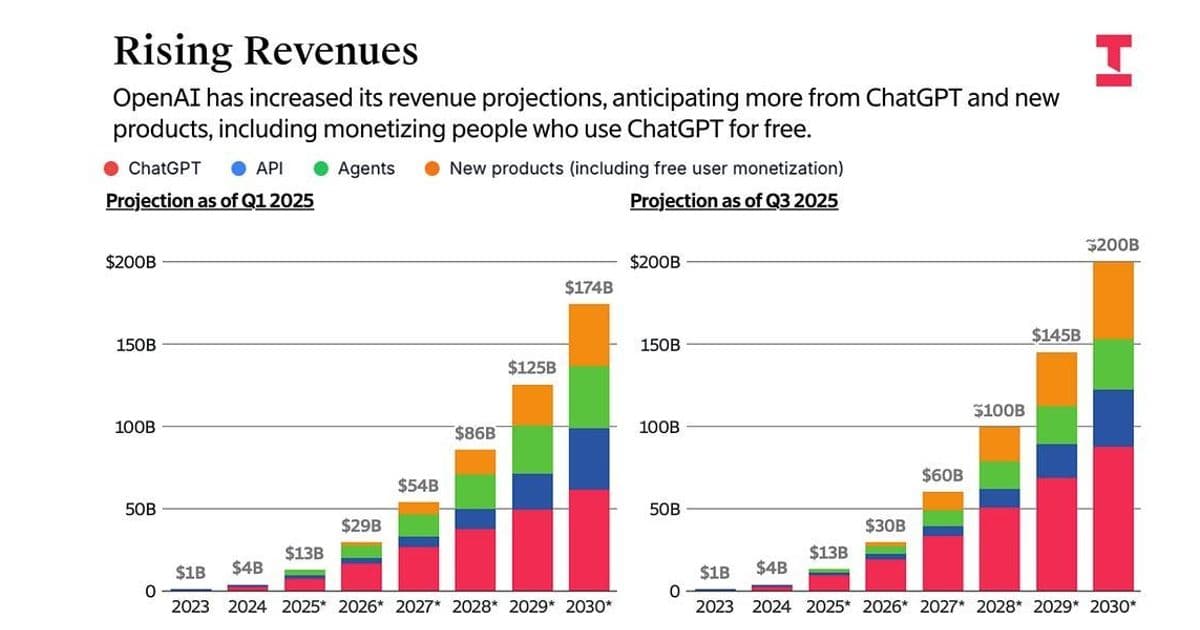

OpenAI's financial ambitions resemble a Silicon Valley moonshot: The AI powerhouse reportedly forecasts $200 billion in annual revenue by 2030, a 15x increase from its projected $13 billion in 2025. This audacious target, reported by The Information, hinges on an unprecedented acceleration of enterprise adoption to offset staggering operational costs. The company anticipates burning $150 billion in computing infrastructure alone between 2025-2030—a bet that assumes exponential growth in paying customers.

OpenAI's revenue projections show aggressive growth targets through 2030 (Source: The Information)

OpenAI's revenue projections show aggressive growth targets through 2030 (Source: The Information)

The Optimism Bubble: Counting on Uninterrupted Growth

Current projections paint a hockey-stick trajectory:

- 2025: $13 billion revenue

- 2027: $50 billion target

- 2030: $200 billion goal

This growth depends entirely on corporations opening wallets wider for generative AI tools. Yet beneath the glossy forecasts, cracks emerge. School assignments and casual ChatGPT use can't fund $5-10 billion monthly infrastructure bills—only deep enterprise commitments can.

The Reality Check: Corporate Adoption Cools

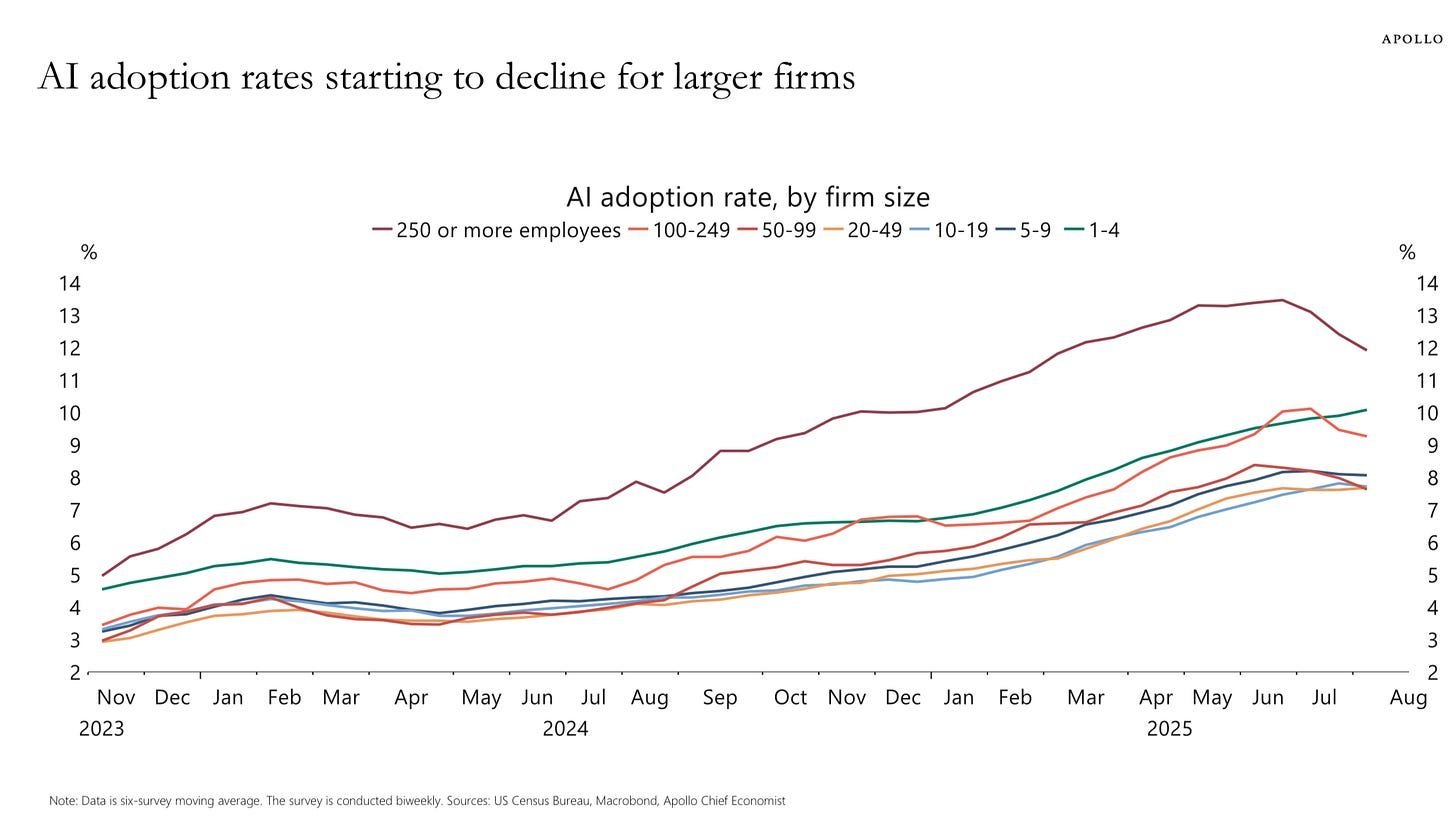

New U.S. Census Bureau data analyzed by Apollo Academy reveals a troubling counter-narrative:

Recent Census data shows declining AI adoption among large businesses (Source: Apollo Academy)

Recent Census data shows declining AI adoption among large businesses (Source: Apollo Academy)

- Large company AI usage dropped from 20% to 16% in two months

- ROI concerns dominate executive discussions

- MIT studies confirm widespread disappointment in generative AI's business value

"Is that decline among big companies just a blip? Or could they have finally lost patience?" questions Apollo's Torsten Slok. The underwhelming performance of GPT-5 in early evaluations compounds these doubts, failing to deliver the revolutionary leap many anticipated.

The Billion-Dollar Balancing Act

Three critical pressure points threaten OpenAI's trajectory:

- Infrastructure Economics: Current $0.36/1M token processing costs demand massive scale to achieve profitability

- Diminishing Returns: Each performance increment requires exponentially more compute for marginally better outputs

- Enterprise Skepticism: Without measurable productivity gains, corporate budgets will remain guarded

As AI researcher Gary Marcus observes: "GenAI certainly sounds amazing—but it hasn't always worked well enough to justify the costs." The coming 18 months will prove decisive. Either OpenAI unlocks transformative enterprise value at unprecedented scale, or the most expensive experiment in tech history hits a reality wall. For developers and investors alike, this high-wire act redefines what's possible—and perilous—in the AI gold rush.

Comments

Please log in or register to join the discussion