Exclusive data reveals a slow rise in software engineering roles driven by explosive AI demand, with Big Tech rebounding from layoffs and San Francisco dominating AI hiring. Remote work options decline while tenure at top firms increases, highlighting a competitive yet opportunity-rich landscape for engineers navigating this evolving market.

The software engineering job market in 2025 feels like a riddle: engineers report ghosting and slow responses to applications, while hiring managers struggle to fill roles—even as overall tech vacancies creep upward. This paradox underscores a market in flux, where AI's relentless growth reshapes demand, Big Tech regains its hiring momentum, and geographic hubs like San Francisco tighten their grip on innovation. Drawing on exclusive datasets from TrueUp, Workforce.ai, and SignalFire—sources scanning millions of job changes and open roles—we dissect the forces redefining engineering careers.

Tech Jobs Climb Steadily, But Senior Roles Dominate

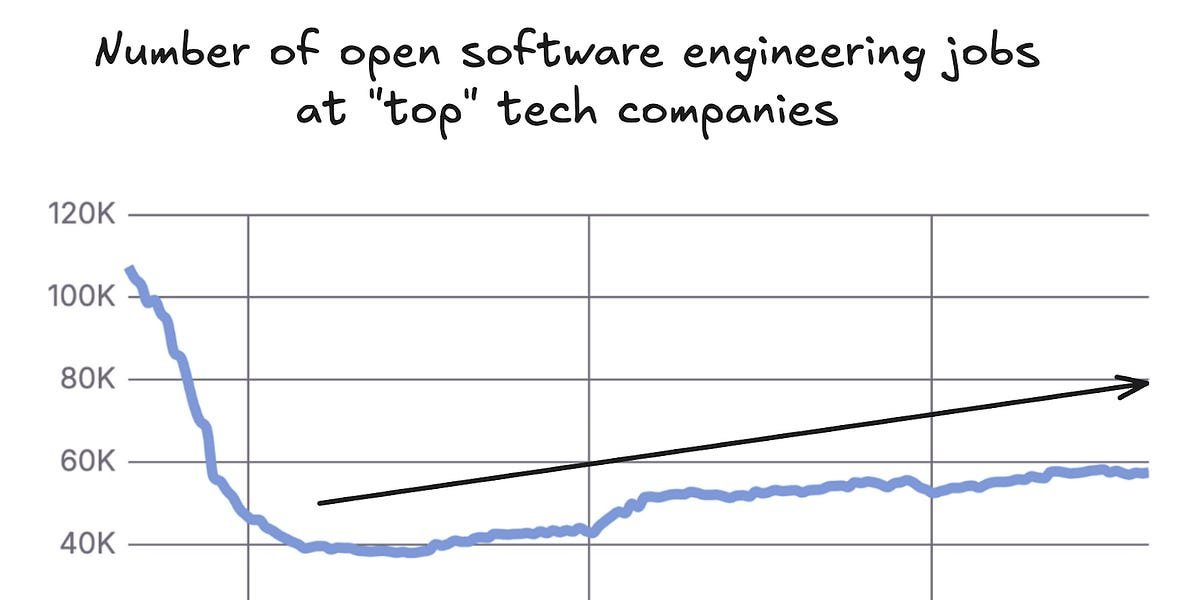

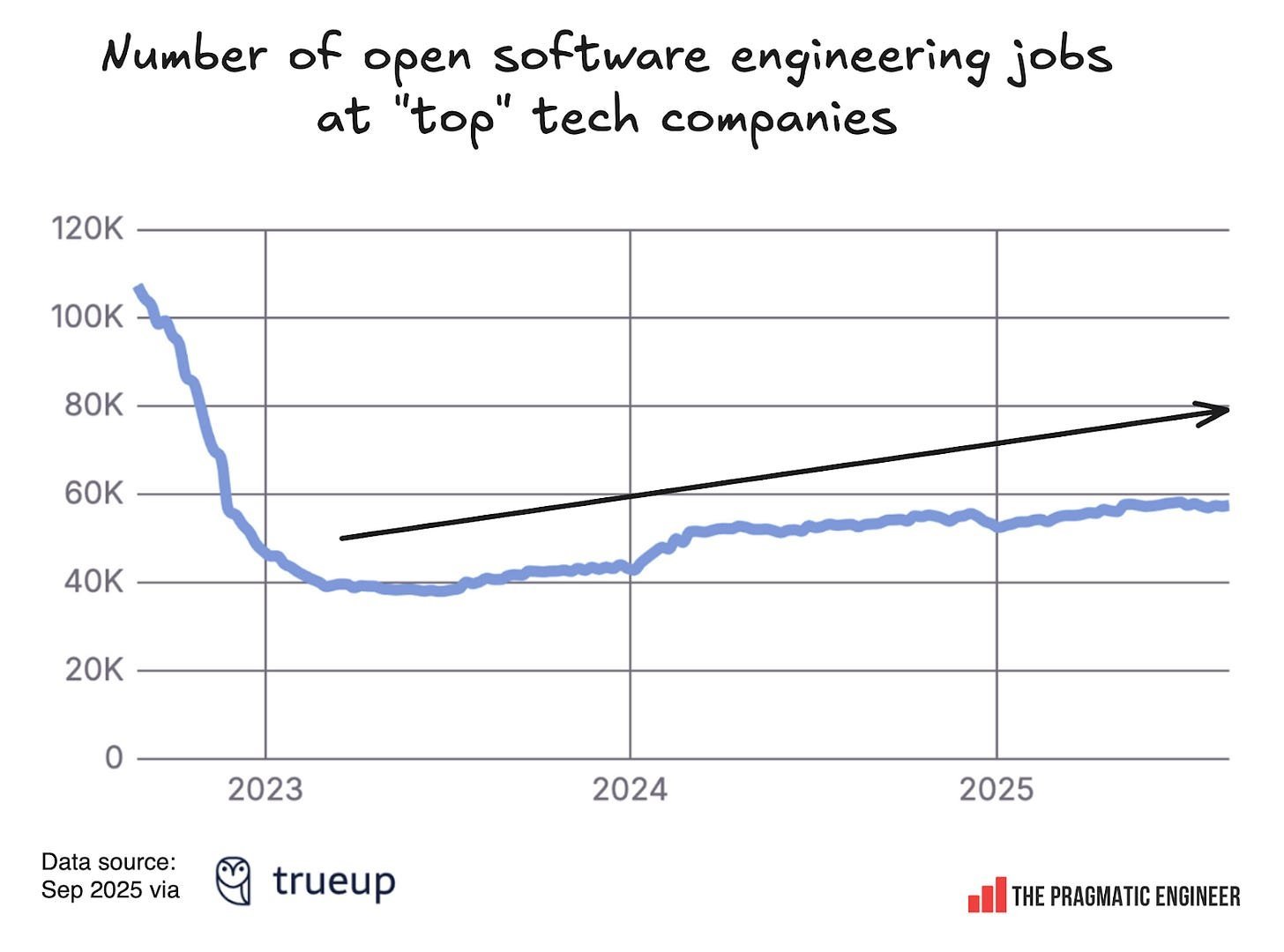

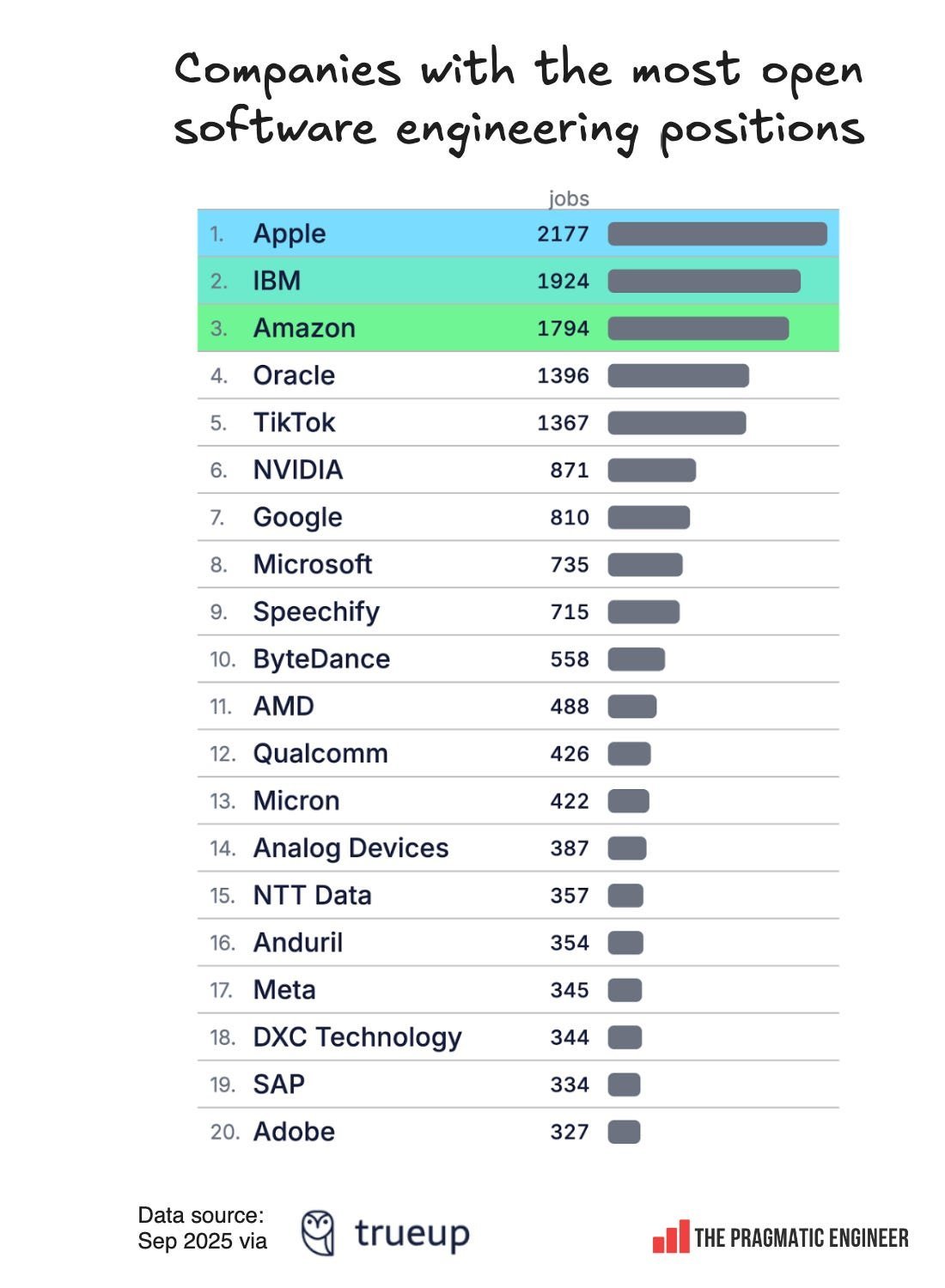

Despite the hiring friction, the broader trend is positive: software engineering vacancies at top-paying companies (those in the upper tiers of the trimodal compensation model) have risen consistently over the past two years. TrueUp's analysis shows a slow but steady recovery, with public tech giants leading the charge. Companies like Apple, Amazon, and IBM are hiring aggressively—IBM, for instance, hit a record $295B valuation this year and is recruiting heavily for backend engineers and specialized roles like AWS DevOps.

Unexpectedly, senior positions now make up over half of all openings, a shift from historical norms where mid-level roles dominated. This senior-heavy landscape, as shown in the data, could pressure experienced engineers to apply for lower-level positions, hoping for upleveling during interviews.

AI Engineering: The Unstoppable Surge

AI engineering roles are the market's brightest spot, with demand skyrocketing since mid-2023. TrueUp data indicates a near-vertical growth curve, fueled by companies integrating large language models (LLMs) into products. This isn't just hype—software engineers can pivot into AI roles relatively easily by leveraging existing skills. As one analysis notes:

"AI engineering is 'just' working with LLMs and applying software engineering principles. Any engineer can start by integrating APIs; if those APIs use LLMs, you're doing AI engineering."

San Francisco's Bay Area is the epicenter, hosting 32% of all AI engineering jobs—more than the next nine locations combined. Companies like OpenAI, Anthropic, and NVIDIA are hiring furiously, with job descriptions emphasizing hands-on experience with PyTorch, TensorFlow, and building LLM applications. The roles split between platform engineers (focused on infrastructure) and product engineers (shipping user-facing features), mirroring broader software engineering trends.

Pedigree matters: Workforce.ai data reveals that top AI firms predominantly hire from Big Tech or elite peers, creating a closed-loop talent ecosystem. For engineers eyeing this space, self-education is key—resources like the Pragmatic Engineer Podcast with OpenAI's Janvi Kalra offer practical pathways.

Big Tech's Hiring Rebound and Tenure Trends

After the layoffs of 2022–2023, Big Tech is rebuilding. Live Data Technologies reports engineering headcounts are up across the board: Meta leads with a 19% increase since 2022, followed by Google (16%) and Apple (13%). Amazon and Microsoft trail with slower growth (8% and minimal gains, respectively). This resurgence is uneven—Amazon is cutting engineering managers, while most Big Tech firms reduce director-level roles.

Concurrently, tenure at these companies is rising at an unprecedented rate. This could signal reduced attrition in a tighter market or a strategic slowdown in external hiring, pushing engineers to stay put longer. The implication? Big Tech is becoming a more insular talent pool, with Workforce.ai data showing most hires come from similar-sized companies, limiting opportunities for outsiders.

Location Looms Large, Remote Work Fades

Geography is increasingly decisive. AI engineering's concentration in San Francisco exemplifies how tech hubs amplify job mobility—engineers in such areas switch roles more easily. Meanwhile, remote work options continue to decline overall, with one exception: AI engineering roles are bucking the trend by offering more remote listings than other sectors. This divergence highlights AI's unique leverage in a market where on-site presence is regaining emphasis.

Navigating the New Normal

For engineers, this data paints a landscape of contrasts: abundant AI opportunities amid broader market caution, and geographic flexibility in high-demand niches despite a pull toward hubs. Upskilling in LLM integration is a clear imperative, while understanding Big Tech's internal shifts can inform career longevity. As hiring slowly accelerates, the real winners will be those who adapt to AI's dominance and the evolving rhythms of tech's giants—turning today's paradox into tomorrow's advantage. All data sourced from TrueUp, Workforce.ai, and SignalFire via Gergely Orosz's Pragmatic Engineer report.

Comments

Please log in or register to join the discussion