Massive investments in AI data centers by Big Tech giants are driving unprecedented capital expenditure, rivaling historic booms like the dot-com era. However, escalating reliance on opaque private credit markets and correlated debt exposure raises alarming parallels to pre-crash financial systems. This analysis explores whether the AI infrastructure surge could trigger systemic economic instability.

The U.S. economy shows mixed signals, but one sector blazes forward: an unprecedented artificial intelligence infrastructure boom. Tech giants—Meta, Google, Microsoft, and Amazon—are pouring staggering sums into data centers to fuel the voracious compute demands of AI. Unlike the initial training phase, today's generative AI models require immense computational power for inference—the real-time processing of user queries—driving an insatiable need for more infrastructure.

Source: Amazon

Source: Amazon

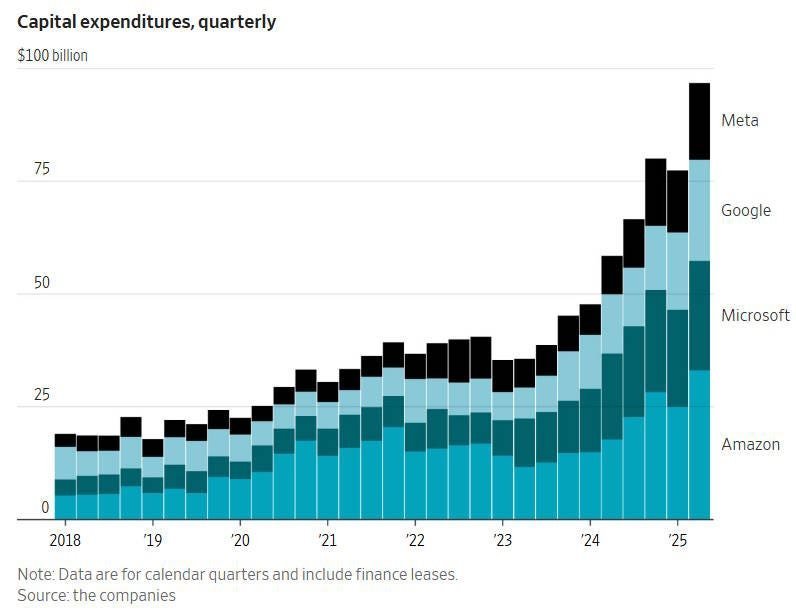

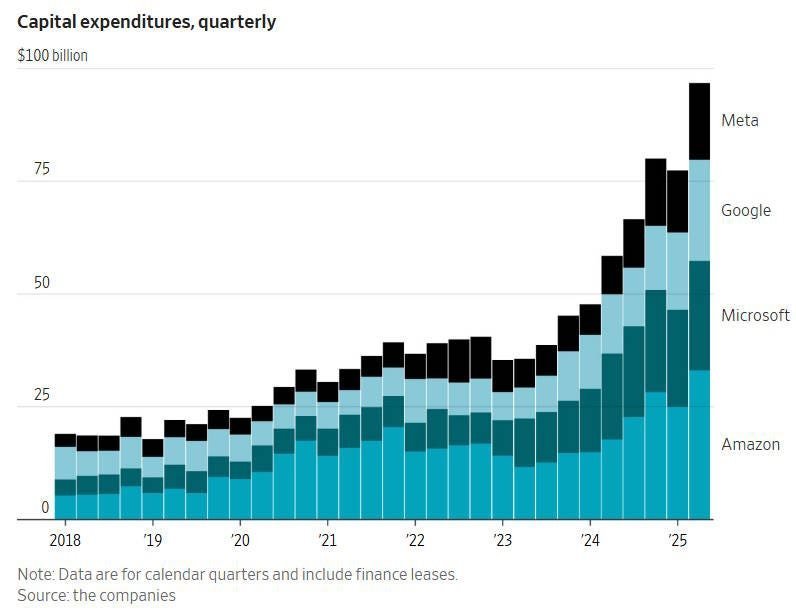

The Scale of the Spending Surge

Recent capital expenditure (capex) figures are staggering:

- $102.5 billion spent collectively by the "Magnificent 7" tech firms in their most recent quarters, predominantly from the AI-focused players.

- For Microsoft and Meta, capex now exceeds one-third of their total sales.

- As investor Paul Kedrosky notes, AI infrastructure spending exceeds telecom investment during the dot-com boom relative to GDP and is still climbing.

Source: Chris Mims / WSJ

Source: Chris Mims / WSJ

Neil Dutta of Renaissance Macro Research reveals this spending contributed more to U.S. economic growth in the past two quarters than all consumer spending combined.

Historical Echoes and the Bust Risk

This investment frenzy evokes historical infrastructure booms—railroads in the 1870s and telecom in the 1990s—both culminating in devastating crashes when supply outstripped demand. While the long-term utility of the infrastructure eventually materialized, the short-term financial devastation was real.

Crucially, research by Jorda, Schularick, and Taylor highlights that the source of financing determines crash severity. Stock or bond-funded busts (like the dot-com crash) cause wealth destruction but limited systemic contagion. Busts fueled by bank debt trigger cascading financial crises, as seen in 2008.

The Opaque Debt Fueling the Boom

Here lies the modern risk. Big Tech's data center capex increasingly relies on complex, opaque debt structures beyond traditional bonds or cash reserves:

- Exploding Corporate Debt: Tech firm debt issuance surged 70% year-over-year in H1 2024. Microsoft's data-center-related finance leases tripled to $46 billion.

- Private Credit Surge: Firms like Meta seek ~$30 billion from private credit lenders (Apollo, Brookfield, Carlyle). Startups like CoreWeave and xAI leverage heavy borrowing, often using AI chips as collateral.

- Securitization: The data-center-backed debt securities market ballooned from near zero in 2018 to ~$50 billion.

Systemic Risk: Banks and Shadow Banking

This debt isn't isolated. Banks are deeply enmeshed:

- Bank lending to Private Credit funds soared from 1% of loans to non-bank financials in 2013 to 14% today (Berrospide et al., Fed 2025).

- Banks also fund Private Credit via credit lines and purchases of Collateralized Loan Obligations (CLOs).

Private Credit Exposure Growth (Federal Reserve Data)

Private Credit Exposure Growth (Federal Reserve Data)

Boston Fed researchers (Fillat et al.) warn this creates indirect bank exposure to high-risk loans. Crucially, they note potential "tail risk" if defaults correlate unexpectedly—a distinct possibility if numerous data center projects fail simultaneously during an AI slowdown.

Life insurers, major investors in private credit, now hold more below-investment-grade firm debt than they held subprime mortgage-backed securities in 2007 (Carlino et al., 2025), adding another layer of systemic vulnerability.

Why This Time Could Be Different (In a Bad Way)

Four factors converge, raising crisis potential:

- Narrative-Driven Investment: The "AI will change everything" belief justifies massive, correlated bets.

- Concentrated Debt: Vast sums funneled into one sector (data centers) via correlated loans.

- Opacity: Private Credit markets lack transparency, hiding true risk exposure.

- Systemic Links: Banks and insurers are now significant lenders/funders to these opaque markets.

JP Morgan CEO Jamie Dimon warns private credit could be the epicenter of the next financial crisis, even as his bank expands into the sector—echoing the pre-2008 sentiment: "As long as the music is playing, you’ve got to get up and dance."

The AI revolution demands immense infrastructure, but the financing mechanisms powering this gold rush carry echoes of past financial calamities. Vigilance on the structure and interconnectedness of this debt is no longer optional—it's critical for economic stability.

Source Analysis: Based on reporting by Noah Smith (Noahpinion), incorporating data from Paul Kedrosky, Chris Mims (WSJ), The Economist, and Federal Reserve research papers (Berrospide et al. 2025, Fillat et al.).

Comments

Please log in or register to join the discussion