India has overtaken China for the first time as the leading source of US smartphone imports, capturing 44% market share in Q2—a dramatic surge fueled by Apple's strategic pivot and escalating tariffs. This shift highlights a broader realignment in global tech manufacturing, even as Meta's earnings reveal how AI is transforming advertising without displacing agencies.

For decades, China dominated global electronics manufacturing, but new data signals a seismic shift: India shipped nearly half of all US smartphone imports last quarter, edging out China for the first time in history. According to Canalys estimates, India's share of US smartphone imports skyrocketed to 44% in Q2, more than triple its 13% share a year ago. Meanwhile, China's portion more than halved to just 25%, falling behind even Vietnam. This isn't a random fluctuation—it's a calculated response to geopolitical pressures. Apple, a key driver of this trend, has aggressively redirected US-bound iPhone production to India after facing a cumulative 145% tariff rate on Chinese imports in April. CEO Tim Cook confirmed in the company's recent earnings call that the "majority" of iPhones sold in the US were manufactured in India during Q2.

"This is a watershed moment for supply chain diversification," explains a Canalys analyst. "Companies are hedging against tariffs and political risks by localizing production for specific markets."

What makes this shift particularly nuanced is its regional focus. While India now leads for US exports, China remains Apple's global powerhouse, producing roughly 90% of iPhones worldwide. Cook emphasized that China will continue as the primary hub for devices sold outside the US. Other tech giants like Samsung and Motorola are also migrating US assembly to India, albeit slower, lured by favorable tariff math: US importers pay 20% on Chinese smartphones but zero from India since electronics were exempted from reciprocal tariffs earlier this year.

Yet this relief may be short-lived. Commerce Secretary Howard Lutnick has warned the exemption is likely temporary, and former President Trump has threatened a 25% tariff on foreign-made iPhones. Critical deadlines loom—India's 26% reciprocal tariff is set for August 1, and China faces broader reinstatements by August 12—adding volatility to an already fragile ecosystem. This reshuffling underscores a broader truth: in today's tech landscape, supply chains are no longer monolithic but are fragmenting into regional silos driven by policy as much as economics.

Amid this manufacturing upheaval, Meta's latest earnings offered a parallel narrative on AI's role in advertising—one that defies doom-and-gloom predictions. While Meta's generative-AI tools for ad creation have sparked fears of agency obsolescence, CEO Mark Zuckerberg reframed them as enablers rather than replacements. "This is going to be especially valuable for smaller advertisers with limited budgets," he stated, "while agencies will continue the important work to help larger brands apply these tools strategically." CFO Susan Li echoed this, noting strong adoption among SMBs but emphasizing agencies' enduring role for big brands. This nuanced view aligns with Sherwood News' earlier reporting and highlights how AI augments rather than automates complex creative processes.

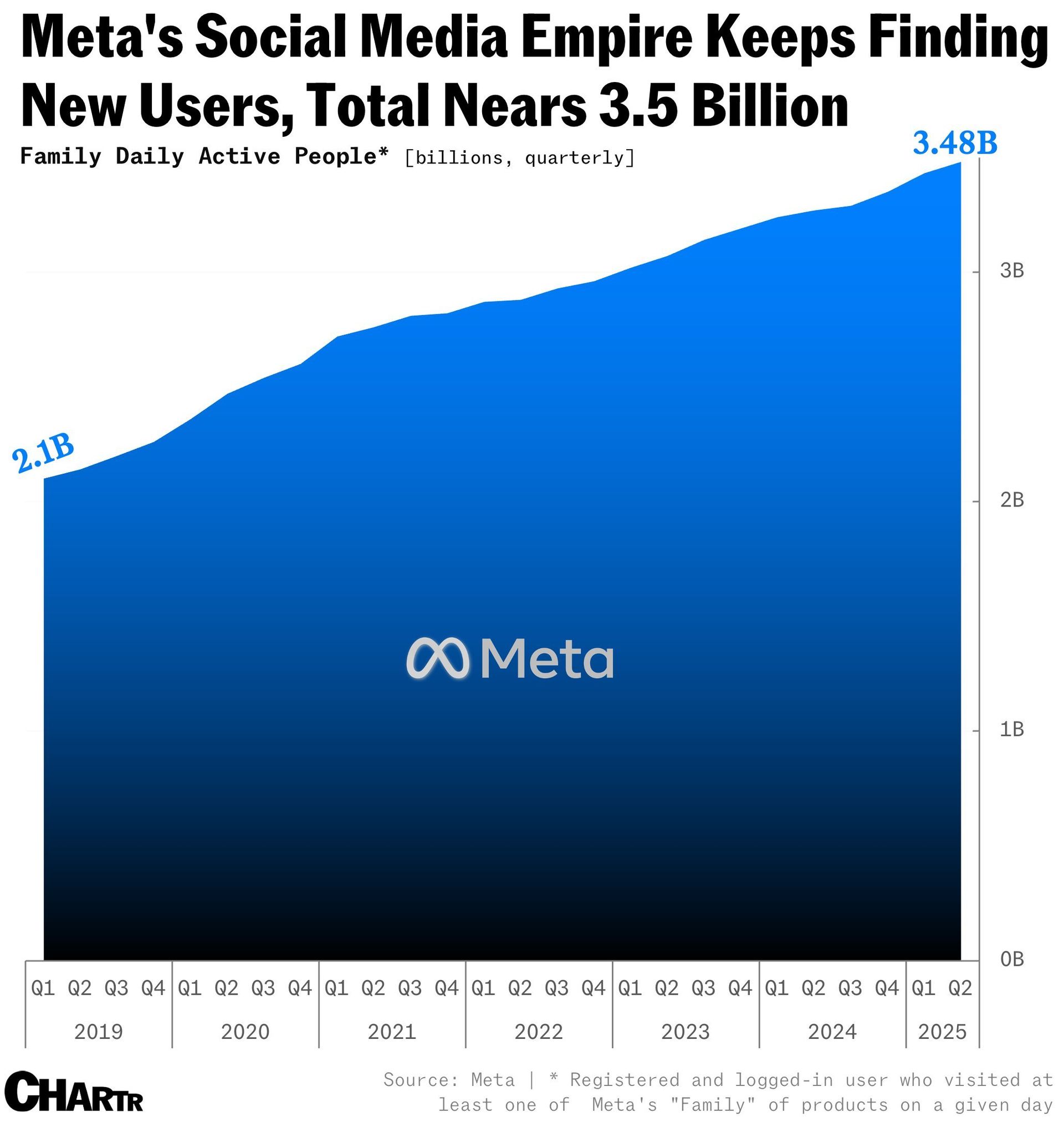

Meta's results further underscored its resilience, with its Family of Apps (Facebook, Instagram, WhatsApp, Messenger) generating $46.6 billion in Q2 revenue—up 21% year-on-year and smashing expectations. The division accounted for 98% of Meta's total revenue, fueled by a 9% increase in ad prices and a growing user base of 3.48 billion daily actives. Despite massive investments in AI "superintelligence," Meta's core ad business thrives by balancing automation with human expertise, proving that even in an AI-driven world, strategic partnerships and audience reach remain irreplaceable assets.

Together, these developments paint a picture of an industry at an inflection point: manufacturing is fragmenting under geopolitical strain, while AI is reshaping workflows without erasing human roles. As companies navigate tariff cliffs and AI integration, adaptability—not wholesale reinvention—will define the next era of tech innovation.

Comments

Please log in or register to join the discussion