The UK has chosen Anglesey’s Wylfa site for its first fleet of small modular reactors, a move pitched as a cornerstone of energy independence, industrial renewal, and low-carbon baseload power. Behind the political fanfare lies a hard technical question for engineers and investors: can SMRs finally turn nuclear into a scalable, manufacturable product rather than a generation-long mega-project?

)

)

A Factory-Built Nuclear Gamble on the Edge of Wales

On a windswept corner of Anglesey’s north coast, the UK is about to test whether nuclear power can be industrialised like modern manufacturing.

The Wylfa site — once home to a now-decommissioned Magnox plant — has been selected as the location for the country’s first three small modular reactors (SMRs), with construction due to begin next year and first power targeted for the mid-2030s. The project, led by the publicly owned Great British Energy–Nuclear and backed by £2.5bn in UK government funding, is framed as both an energy-security play and a signal that Britain intends to compete in the next generation of nuclear technology.

If fully built out, Wylfa could eventually host up to eight SMR units and power around three million homes. But for developers, systems architects, and infrastructure strategists, the more important story is what Wylfa represents: a concrete test of whether SMRs can break nuclear out of its bespoke, one-off, over-budget trap.

What Makes SMRs Different (Beyond the Acronym)

SMRs are often sold with a simple pitch: same physics, smaller package.

Technically, they:

- Use the same core principle as conventional reactors — fission heat driving steam turbines.

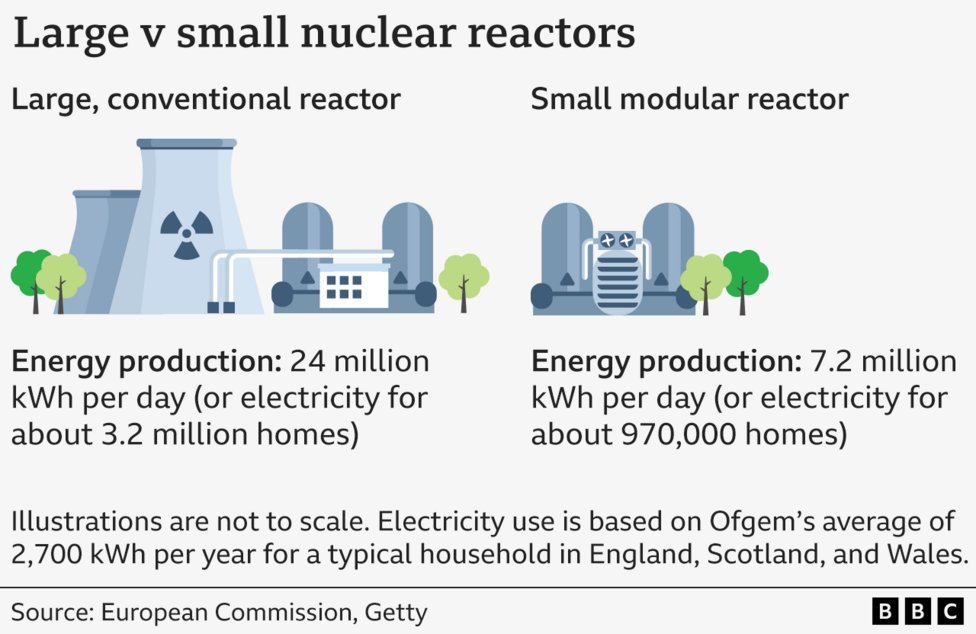

- Operate at roughly a third (or less) of the electrical output of a gigawatt-scale plant.

- Are designed to be manufactured as repeatable modules in factories and transported to site for assembly.

One expert quoted in the announcement likened them to the "nuclear equivalent of an Ikea chair" — factory-produced components shipped to site and assembled there. It’s not just a metaphor; it reflects a deliberate architectural shift that software and cloud engineers will recognise:

Move complexity upstream into standardized components; reduce uncertainty at deployment.

In theory, this modularisation delivers several advantages familiar to anyone who has watched the evolution of cloud-native systems:

- Standardised Design: A certifiable, repeat-deployable reactor design, rather than bespoke one-off plants.

- Shorter Delivery Cycles: Parallel fabrication of modules and site preparation, reducing schedule risk.

- Learning Curve Effects: Each additional unit benefits from accumulated manufacturing and integration experience.

- Right-Sized Capacity: The ability to match generation to local grid constraints and industrial loads instead of forcing a 3+ GW decision.

At Wylfa specifically, the planned SMRs are said to "fit nicely" with the existing grid capacity and echo the output of the previous station. That’s a crucial systems-integration detail: retrofitting a site with compatible electrical characteristics reduces both technical friction and local opposition.

Industrialisation vs. Reality: The Engineering and Delivery Challenge

For all the optimism, SMRs are not yet a solved problem. Globally, most SMR designs remain on paper or in early licensing stages. The UK is effectively betting that it can execute in four intertwined domains:

Regulatory Convergence

A fleet model only works if reactor designs clear the Office for Nuclear Regulation (ONR) once, then scale. Fragmented, design-by-design licensing would erode the economic case. Achieving a streamlined, yet rigorous, approval regime is a non-trivial institutional engineering task.Manufacturing Infrastructure

SMRs assume high-integrity, high-throughput nuclear manufacturing — precision pressure vessels, modules, control systems — with consistent quality. This is closer to aerospace-plus than traditional construction. Factory capability, supply-chain resilience, and QA automation will make or break the cost model.Skilled Workforce at Scale

Ministers have flagged partnerships with local colleges to build a talent pipeline. That needs to span nuclear engineering, welding, digital I&C (instrumentation and control), safety case modelling, and cyber-physical security. For developers and engineers, this is an inflection point: if the SMR program is serious, we will see multi-decade demand for skills that blend nuclear, software, data, and systems reliability.Program Discipline

SMRs are supposed to be the antidote to mega-project drift. If Wylfa slides into the same pattern of delays and cost overruns seen at large-scale projects like Hinkley Point C, the narrative collapses — and so does investor confidence in fleet deployment.

The contrast with the previous attempt at Wylfa is stark. Hitachi’s large-scale project died in 2021 under the weight of spiralling costs and funding deadlock. SMRs are now being tested as the lighter, more modular alternative. The engineering community will be watching whether that promise survives contact with UK procurement, planning law, and regulatory reality.

Energy Strategy, Not Just Optics

On paper, Wylfa’s SMRs support three strategic aims that matter to technically literate stakeholders:

- Firm Low-Carbon Baseload: As the UK grid leans heavily on intermittent renewables, dispatchable low-carbon sources reduce dependence on gas peakers and interconnectors.

- Geopolitical Resilience: Domestic nuclear capacity is framed as insulation against volatile global gas and power markets.

- Industrial Policy: Backing Rolls-Royce-designed SMRs and a UK-centric supply chain is a bid to turn nuclear expertise into exportable IP, components, and services.

But the decision has not landed without friction.

- The US ambassador’s public disappointment reflects a competing vision: go big with a gigawatt-scale Westinghouse reactor to deliver more immediate, large-volume generation. That signals live tension between allied industrial strategies.

- The Wales Green Party and local campaigners describe SMRs as an expensive diversion from wind, solar, and marine energy — especially pointed given the unresolved issue of a geological disposal facility for high-level waste.

- Critics frame SMRs as “unproven technology”, which is partially fair: while the underlying reactor physics is mature, the modular manufacturing and financing ecosystems are not.

For engineers used to production systems, the right mental model is this: SMRs are not an experimental stack so much as a new deployment architecture for a battle-tested core technology. The technical risk is lower than the commercial and programmatic risk — but none are negligible.

What This Means for Developers, Engineers, and Tech Leaders

Beyond the politics, Wylfa’s announcement signals several concrete shifts that technical leaders should track:

Growth of Nuclear-Grade Digital Systems

SMRs will be saturated with sensor networks, advanced diagnostics, digital twins, and safety PLCs. There will be demand for:- high-integrity real-time control software,

- formal verification for safety-critical paths,

- secure remote monitoring and analytics infrastructure.

Cybersecurity as Critical Infrastructure DNA

A fleet of modular reactors is also a fleet of attractive cyber-physical targets. Expect:- hardened, isolated control networks with rigorously audited supply chains,

- regulatory pressure for verifiable software provenance and firmware integrity,

- opportunities for specialists in ICS/OT security, red-teaming, and incident response.

Data-Driven Operations

Standardised units make fleet-level optimisation viable: predictive maintenance, anomaly detection, and cross-site benchmarking can be built into the architecture. SMRs succeed economically if operators can treat units more like nodes in a distributed system than one-off handcrafted plants.Ecosystem and Vendor Lock-in

If Rolls-Royce SMRs become the de facto UK standard, a vertically integrated stack of tooling, training, components, and digital platforms will follow. Leaders should read Wylfa as an early signal of where nuclear-adjacent markets — from simulation software to robotics for maintenance — may cluster.

When the Concrete Sets

Wylfa is no longer a theoretical case study in energy policy decks; it is the chosen proving ground for whether nuclear can adopt the logic of modern engineering: modular, repeatable, automatable.

If Great British Energy–Nuclear delivers three SMRs to time and budget, the project won’t just reboot Anglesey’s economy; it will validate a model that could be templated across the UK and exported abroad. If it stumbles into the familiar pattern of delays, legal challenges, and opaque cost escalations, SMRs risk being written off as just another promise that couldn’t survive contact with concrete.

For now, the UK has put a stake in the ground — and for technologists across infrastructure, cybersecurity, advanced manufacturing, and industrial software, Wylfa is a signal worth watching closely.

Source: Original reporting and details from BBC News - Wylfa nuclear power project announcement.

Comments

Please log in or register to join the discussion