Amazon has launched used and certified pre-owned car sales through its Amazon Auto platform, offering no-haggle pricing and a fully digital purchasing experience. Starting in Los Angeles, the expansion intensifies competition with disruptors like Carvana while showcasing Amazon's push to digitize high-value retail transactions. For developers, this signals growing demand for scalable e-commerce integrations and frictionless user journeys in traditionally offline industries.

Amazon is accelerating its disruption of the automotive retail sector with the expansion of its Amazon Auto platform to include used and certified pre-owned vehicles. Announced on August 5, 2025, the move builds on last year’s debut of new-car sales, now enabling customers in Los Angeles to browse, finance, and purchase second-hand cars entirely online—bypassing traditional dealership negotiations. Partnering with local dealers to list inventory, Amazon Auto promises transparent pricing, detailed vehicle histories, and a streamlined checkout process that handles financing and documentation digitally. As one of the largest e-commerce platforms wading into the $1.2 trillion used car market, Amazon is leveraging its tech infrastructure to redefine consumer expectations, with implications for developers, retailers, and the future of high-stakes online transactions.

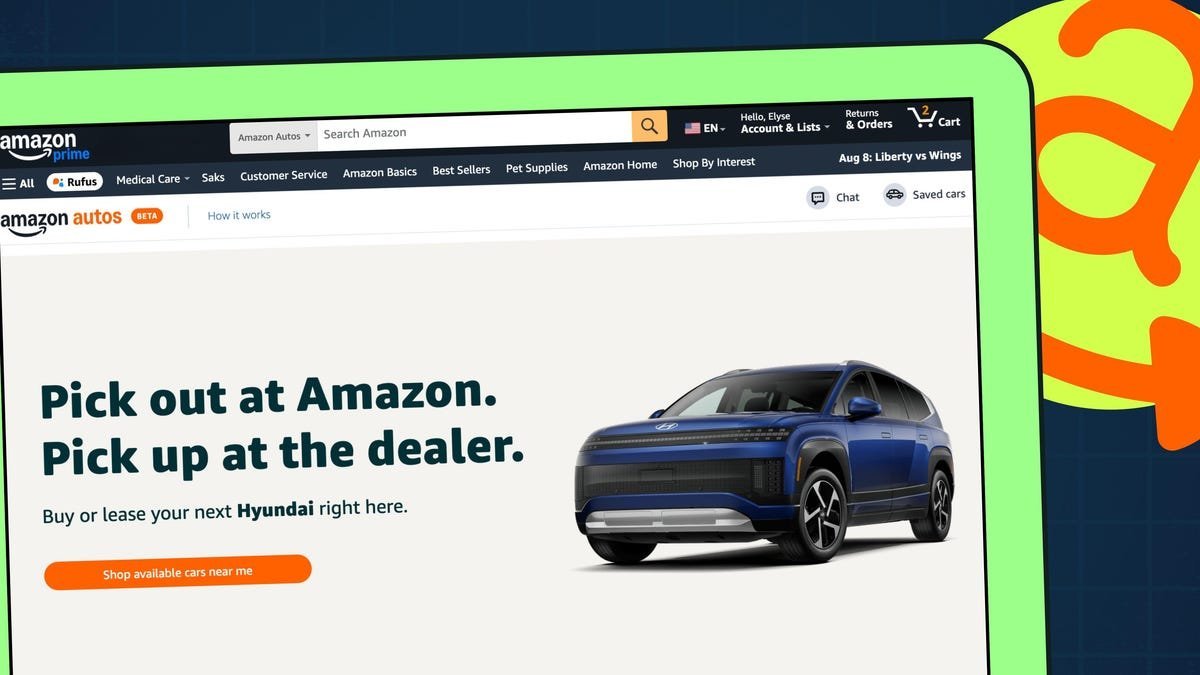

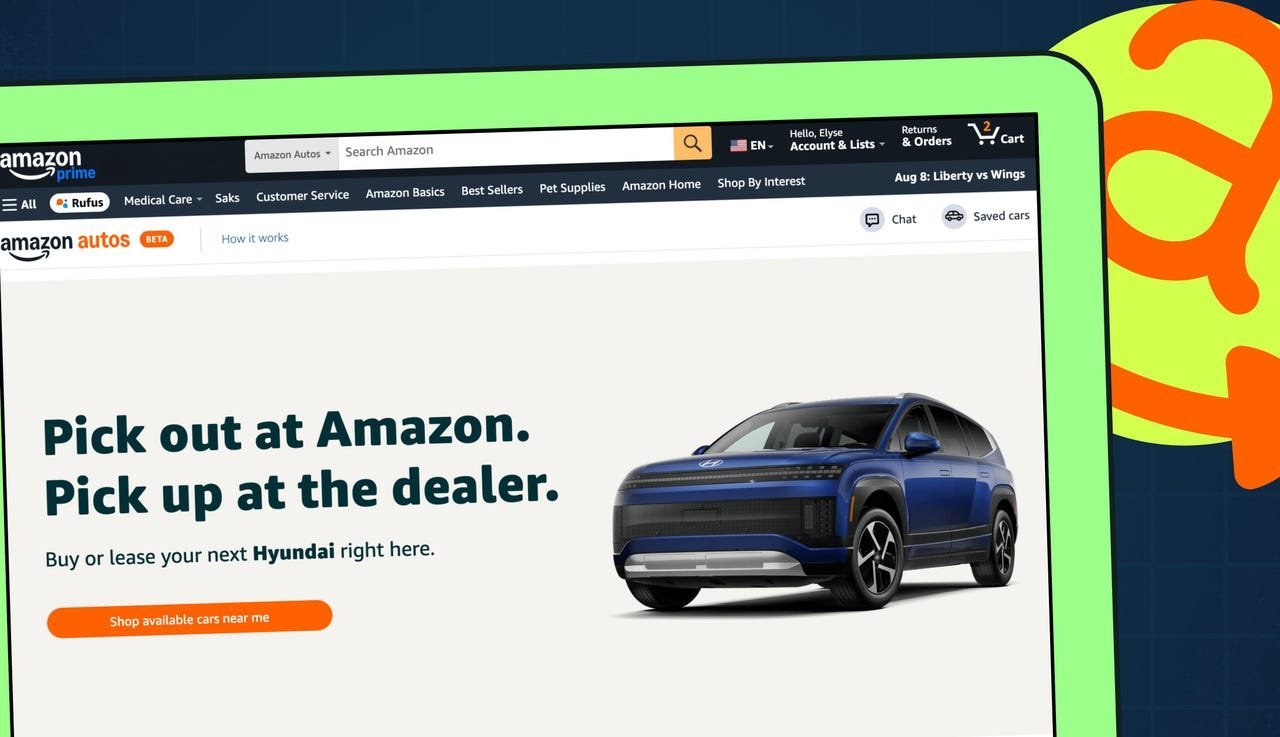

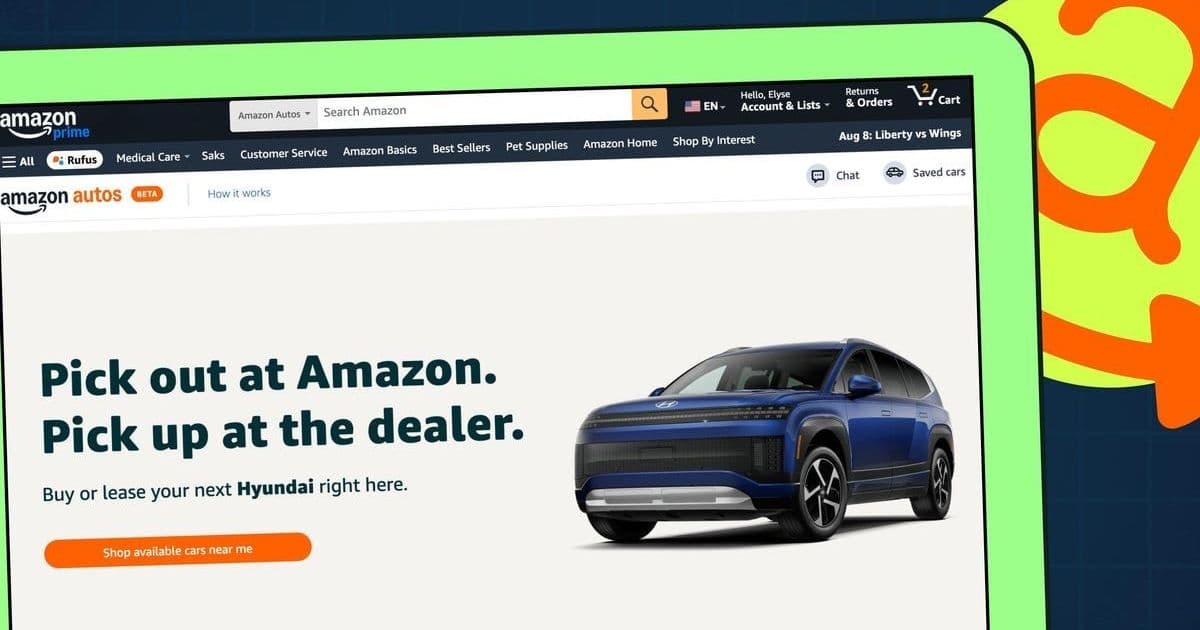

How Amazon Auto Works: A Digital-First Overhaul

Amazon Auto functions as a curated marketplace where dealerships list vehicles, but Amazon manages the entire customer experience:

- No-Haggle Pricing: Every listing shows a fixed price, with Amazon providing a full cost breakdown (including taxes and fees) before purchase. This eliminates traditional dealership markups and pressure tactics, mirroring models like Carvana but integrated into Amazon’s trusted ecosystem.

- Advanced Filtering: Users can search by model, mileage, features, and even seating capacity, with AI-driven recommendations surfacing options based on preferences.

- Seamless Financing: Buyers apply for loans directly through Amazon, which also identifies eligible rebates. The platform handles all paperwork, with customers only visiting the dealer for vehicle pickup.

- Buyer Protections: All purchases include a 3-day/300-mile return policy and a 30-day/1,000-mile warranty, addressing common anxieties about online car buying.

Image: Amazon Auto’s interface for browsing used vehicles, emphasizing transparent pricing and filters. Source: Elyse Betters Picaro / ZDNET

Image: Amazon Auto’s interface for browsing used vehicles, emphasizing transparent pricing and filters. Source: Elyse Betters Picaro / ZDNET

Technical Backbone and Developer Implications

For engineers, Amazon Auto exemplifies the scaling of complex e-commerce workflows:

- API Integrations: Dealerships connect inventory systems via APIs, requiring robust synchronization for real-time pricing and availability—a challenge given fluctuating demand and localized supply chains.

- Fraud Prevention: High-value transactions necessitate advanced identity verification and payment security, likely leveraging Amazon’s existing AWS fraud-detection tools.

- Data Utilization: Amazon aggregates vehicle history reports (e.g., accidents, maintenance) from sources like Carfax, showcasing how big data can build consumer trust in opaque markets.

- Scalability Lessons: The rapid expansion from 50 to 130 cities for new cars demonstrates cloud infrastructure’s role in handling regional compliance (e.g., titling laws), offering blueprints for developers building similar platforms.

Why This Matters Beyond Convenience

Amazon’s push into used cars isn’t just about selling more products—it’s a strategic play to dominate experiential retail:

- Market Pressure: By undercutting dealership margins with flat fees, Amazon forces competitors to accelerate their own digital transformations, spurring innovation across automotive tech stacks.

- Consumer Shift: Gen Z and millennial buyers increasingly favor online, hassle-free purchases; platforms ignoring this risk obsolescence. Early tests in LA show pricing parity with dealer sites, but Amazon’s convenience could justify premiums.

- Broader Tech Trends: This expansion highlights how giants like Amazon are blurring industry lines, using tech to enter regulated sectors (like autos and healthcare) where trust and compliance are paramount. For startups, it underscores opportunities in niches where legacy players lag digitally.

As Amazon Auto rolls out nationwide, its success will hinge on sustaining the delicate balance between dealer partnerships and consumer-centric innovation—a tension familiar to any tech team building platform ecosystems. While traditional showrooms won’t vanish overnight, this move confirms that even the most tactile purchases are being reshaped by code, data, and relentless user-experience optimization.

Source: Based on reporting from ZDNET.

Comments

Please log in or register to join the discussion