While Apple pushes to diversify production out of China, Chinese companies are securing a larger stake in high-value components like memory chips and camera lenses, revealing a deepening entanglement in global tech manufacturing. This shift underscores the complexities of decoupling and highlights how China's industrial strategy is reshaping supply chain dynamics worldwide.

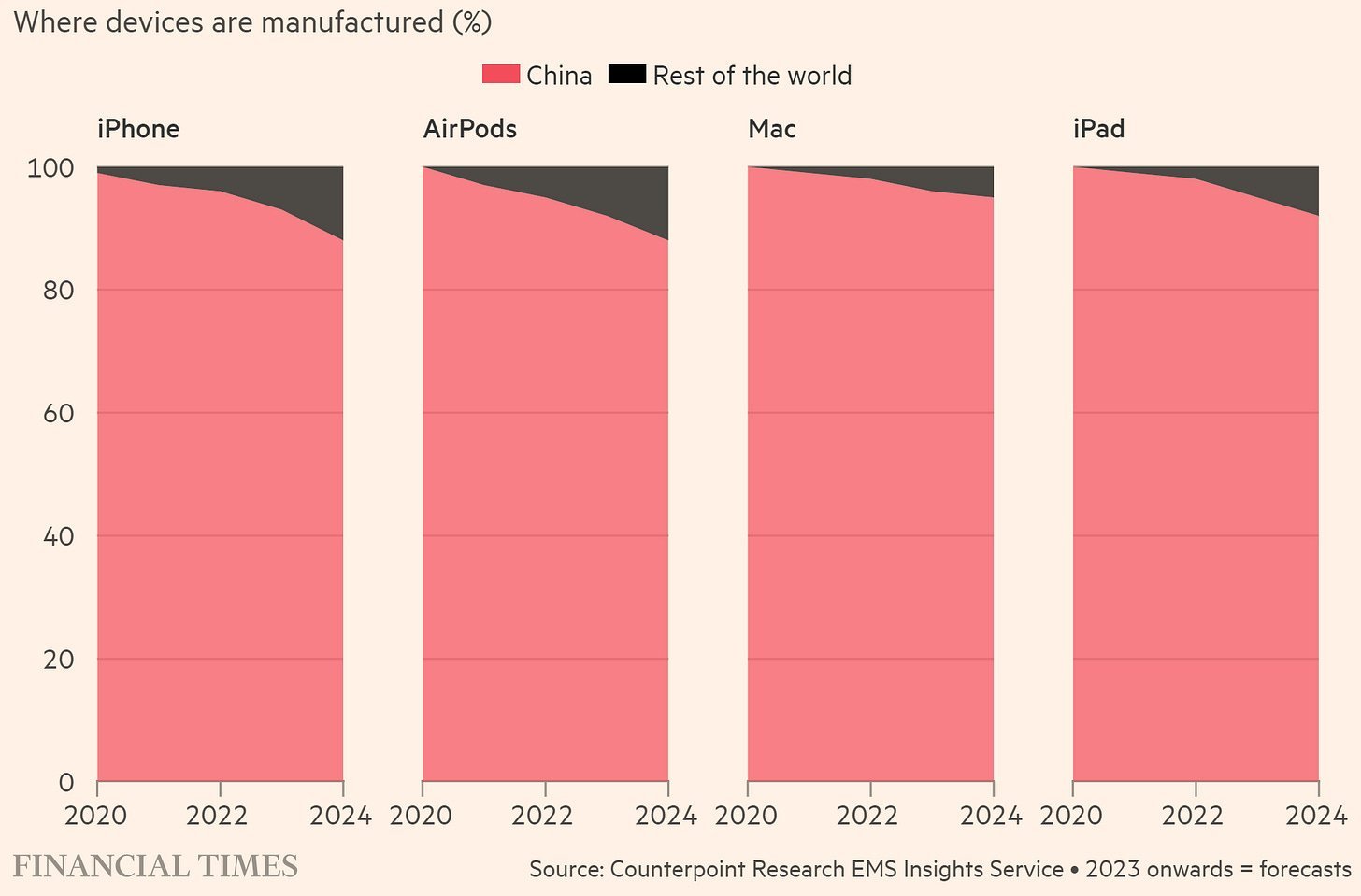

Apple's public efforts to shift iPhone production to India and Vietnam paint a picture of geopolitical diversification. Yet beneath the surface, a counterintuitive trend is unfolding: Chinese firms are climbing Apple's value chain, moving from low-cost assembly to high-tech manufacturing of critical components. This paradox reveals the resilience of China's industrial ecosystem and the challenges of true supply chain decoupling.

The Illusion of Low Chinese Value

At first glance, China's role in Apple's supply chain appears modest. A Nikkei Asia analysis of the iPhone 15 Pro Max found that parts from Chinese firms contribute just 2.5% of the device's total cost, with over 80% sourced from U.S., South Korean, Japanese, and Taiwanese companies like TSMC (chips), Samsung (displays), and Sony (camera sensors). Labor costs, historically 2-5% of an iPhone's price, reinforce the perception of China as a hub for low-value work.

But this surface-level view is misleading. Crucially, 87% of Apple's 187 suppliers operate production facilities in China, according to another Nikkei study. Companies headquartered in China and Hong Kong now constitute over half of Apple's supplier base—a share that grew year-over-year. This points to a critical nuance: while foreign brands dominate component design, much of the high-value manufacturing occurs on Chinese soil.

Chinese Suppliers Moving Up the Ladder

Chinese firms are no longer confined to assembly. They're increasingly producing sophisticated components:

- YMTC: The state-backed memory chipmaker nearly became a key iPhone NAND supplier in 2022, with Apple planning to source up to 40% of its flash memory from the firm. U.S. sanctions halted the deal, but YMTC's breakthrough in developing the world's most advanced 3D NAND chip demonstrates China's rapid technological ascent.

- Sunny Optical: Once a small-town enterprise, it now supplies main camera lenses for iPhones—displacing Taiwanese rivals—and is building a $300 million camera module plant in India with Apple.

- Luxshare: Founded by a former Foxconn worker, Luxshare evolved from cable manufacturing to become Apple's exclusive producer for the Vision Pro headset. It exemplifies China's contract manufacturer rise, leveraging knowledge transfers from Apple to compete globally.

Foxconn's production of titanium iPhone 15 Pro frames—costing 43% more than stainless steel—further highlights this shift. China's dominance in titanium (over 60% of global supply) enables such high-margin work, with production remaining exclusively in China.

The Decoupling Dilemma

Apple's diversification efforts are paradoxically bolstered by Chinese firms. Luxshare operates iPhone factories in Vietnam, BYD makes iPads there, and Desay is establishing battery plants in India. Yet this "decoupling" is superficial: Chinese-owned facilities abroad still anchor the supply chain, and China's manufacturing ecosystem thrives through homegrown giants like Huawei and Xiaomi, which share suppliers with Apple.

As a Rhodium Group report notes, diversification is masked by China's expanding high-value output. This creates a ceiling for emerging hubs like India, which handles 14% of iPhone assembly but struggles to move into deeper supply chain tiers. China's strategy—pressuring foreign firms like Apple to upskill local partners, as seen in Tim Cook's 2016 $275 billion deal—has built an industrial base that supports sectors from EVs to semiconductors.

The takeaway for tech leaders is stark: supply chains aren't just relocating—they're stratifying. China's climb into high-tech manufacturing ensures its centrality, even as assembly disperses. In this new reality, resilience demands not just geographic diversity but deeper innovation in materials and components, where China is already setting the pace.

Source content derived from High Capacity's analysis, citing Nikkei Asia, Financial Times, and Counterpoint Research.

Comments

Please log in or register to join the discussion