In a striking circular economy play, Nvidia has signed deals worth approximately $1.5 billion to lease back 18,000 of its own AI GPUs from cloud provider Lambda, a company it previously supplied and invested in. The chips, including 10,000 high-value units under a $1.3 billion four-year agreement, will reportedly fuel Nvidia's internal AI research, mirroring how hyperscalers use Lambda's infrastructure. This unprecedented move highlights Nvidia's strategic control over the constrained AI hardwar

Nvidia, the undisputed engine powering the global AI revolution, is executing a remarkable financial and logistical maneuver: renting back its own processors. According to reports detailed by The Information and covered by Tom's Hardware, the chipmaker has inked agreements with cloud startup Lambda – a company it has strategically invested in – to lease approximately 18,000 Nvidia GPUs over several years. The total value of these deals is estimated at a staggering $1.5 billion.

The core agreement involves a four-year lease for 10,000 GPUs, valued at roughly $1.3 billion. A separate deal covers an additional 8,000 GPUs (likely older or lower-tier models) for about $200 million. Crucially, these are servers housing Nvidia silicon that Lambda originally purchased from Nvidia itself. This contract instantly catapults Nvidia to become Lambda's largest customer.

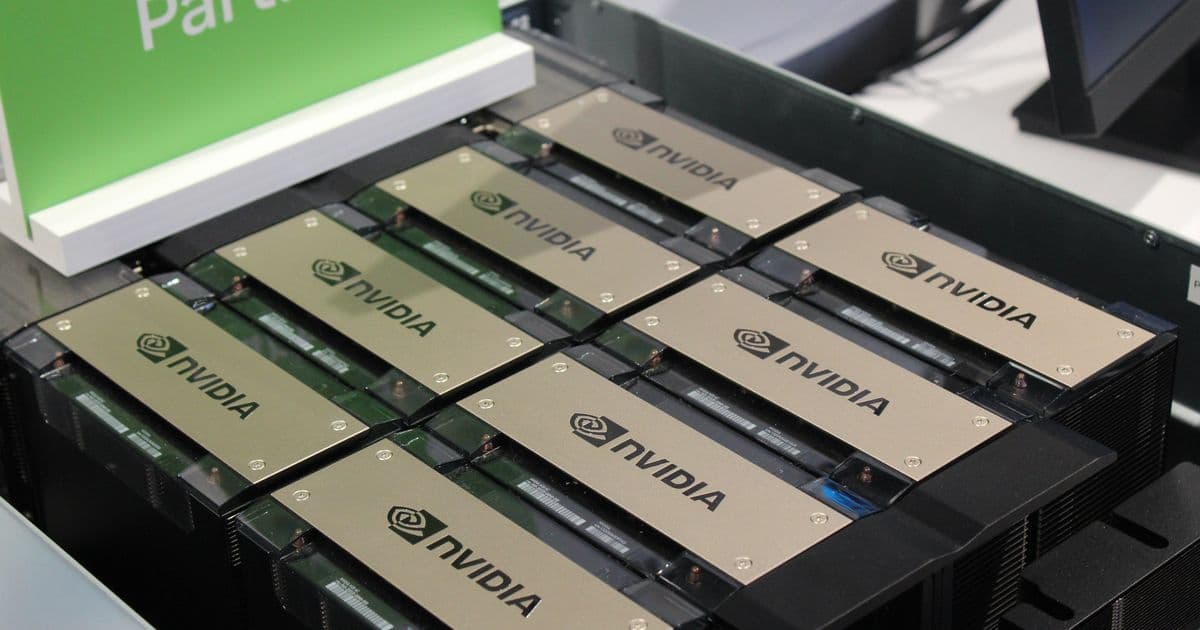

Nvidia's insatiable demand for its own chips extends to powering its internal research teams. (Image credit: Nvidia)

Nvidia's insatiable demand for its own chips extends to powering its internal research teams. (Image credit: Nvidia)

Why Lease Back Your Own Chips?

Lambda, founded in 2012, operates a cloud platform renting AI server capacity primarily to tech giants like Microsoft and Amazon, and is positioned to serve others including Google, OpenAI, xAI, and Anthropic. Reports indicate Nvidia intends to use these leased servers in-house for its own AI research efforts. This mirrors how hyperscalers like Amazon and Microsoft utilize Lambda's infrastructure for internal projects rather than reselling capacity through their public cloud platforms (AWS and Azure).

For Nvidia, this move serves multiple strategic purposes:

- Securing Scarce Compute: Despite being the manufacturer, securing sufficient high-end GPU capacity for its massive internal R&D needs remains challenging amidst unprecedented global demand. Leasing back chips guarantees supply.

- Financial Engineering & Partner Support: The long-term, high-value lease provides Lambda with stable, massive revenue as it reportedly gears up for an Initial Public Offering (IPO). This strengthens a key partner in Nvidia's ecosystem.

- Market Signal & Control: It reinforces Nvidia's dominant position, demonstrating it can orchestrate complex financial deals to ensure its own needs are met, even leveraging its partners' infrastructure.

A Established Pattern: The CoreWeave Blueprint

This deal with Lambda echoes Nvidia's previous strategy with CoreWeave, another AI cloud infrastructure startup. Nvidia provided CoreWeave with significant investment and a similar GPU supply/leaseback arrangement, enabling its rapid growth. CoreWeave even famously used its reserve of Nvidia H100 GPUs as collateral for a $2.3 billion loan last year.

Hyperscalers like Amazon (AWS shown) use Lambda for internal workloads, a model Nvidia now adopts with its own chips. (Image credit: Bloomberg/Getty)

Hyperscalers like Amazon (AWS shown) use Lambda for internal workloads, a model Nvidia now adopts with its own chips. (Image credit: Bloomberg/Getty)

Beyond the Transaction: Implications for the AI Ecosystem

Nvidia's loopback lease is more than a curious financial arrangement; it underscores several critical dynamics in the AI infrastructure market:

- Supply Chain Leverage: Nvidia isn't just selling chips; it's actively managing the downstream ecosystem, using its market power to ensure partners thrive while simultaneously guaranteeing its own access to compute.

- The Value of Scarcity: The fact that Nvidia must resort to leasing its own hardware back highlights the extreme scarcity of high-performance AI accelerators and the lengths even the manufacturer will go to secure them.

- Blurring Lines: The distinction between supplier, partner, and customer is becoming increasingly fluid. Nvidia is simultaneously Lambda's investor, original supplier, and now largest customer.

- R&D at Scale: The sheer volume of compute (18,000 GPUs) dedicated to Nvidia's internal research illustrates the monumental resources required to stay at the bleeding edge of AI development. Renting this scale avoids massive upfront capital expenditure while providing flexibility.

This intricate dance between manufacturing dominance, strategic investment, and creative financing reveals Nvidia's sophisticated approach to maintaining its leadership. By renting its own silicon, Nvidia not only fuels its voracious research needs but also actively cultivates and stabilizes the cloud partners essential for the broader adoption of its architecture, ensuring the AI boom it ignited continues to run on its terms.

Comments

Please log in or register to join the discussion