Apple faces a critical glass cloth shortage impacting chip production as AI industry demand strains supply chains, with no resolution expected before late 2027.

Apple is confronting a severe shortage of specialized glass cloth materials essential for advanced chip production, as surging demand from artificial intelligence hardware manufacturers strains global supply chains. According to a Nikkei Asia report, this supply crunch could persist until at least the second half of 2027, directly impacting Apple's ability to produce chips for iPhones and other devices.

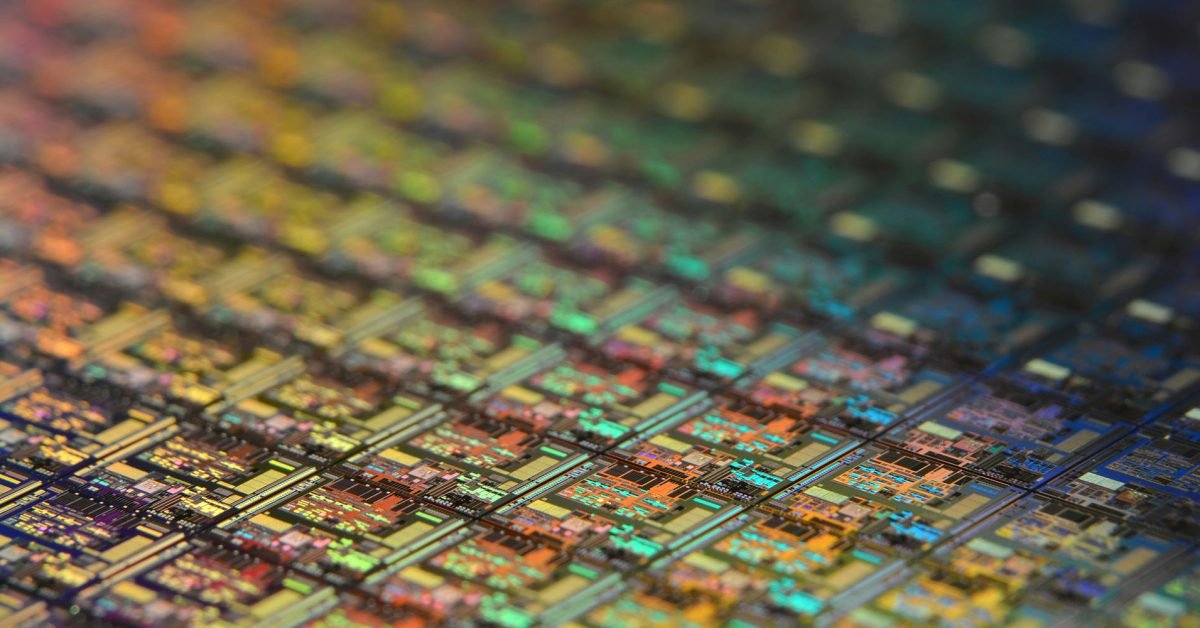

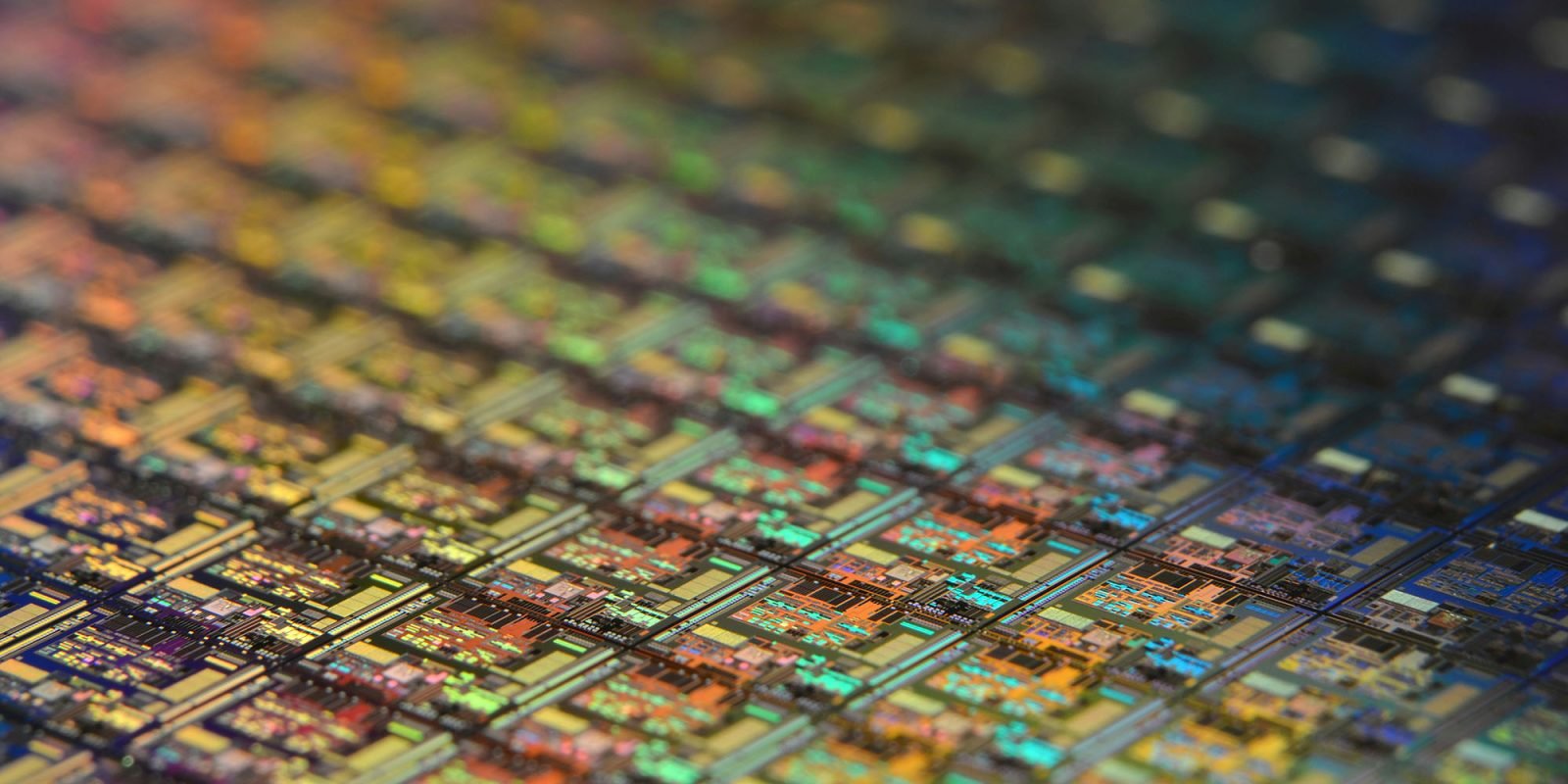

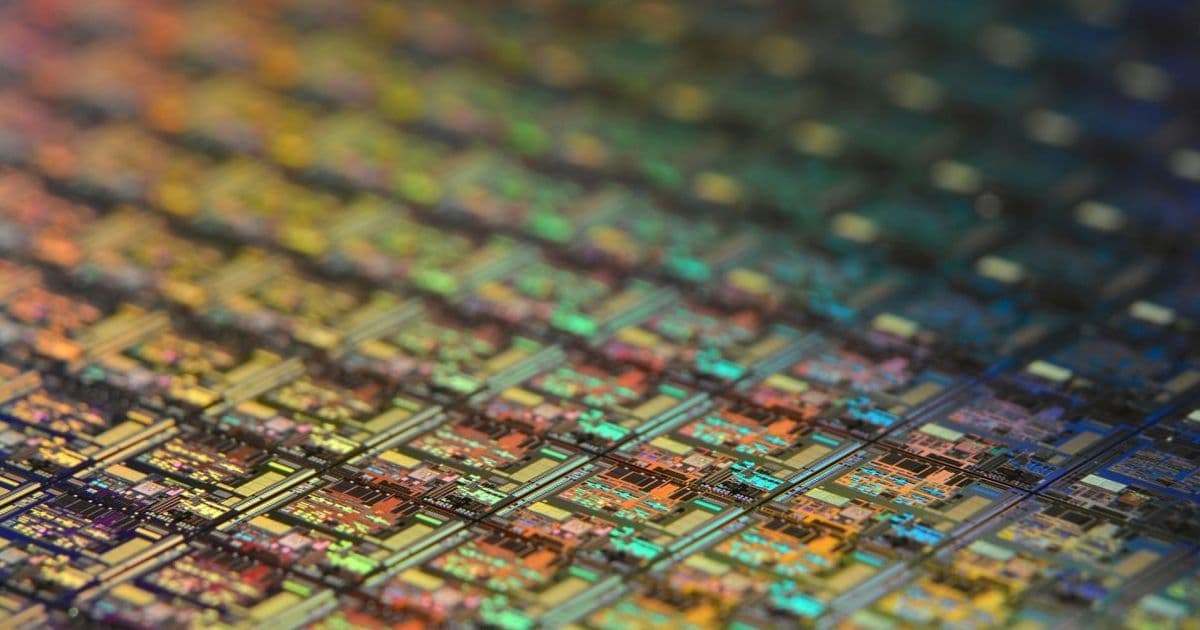

Glass cloth—a fiber thinner than human hair with exceptional dimensional stability and rigidity—forms critical components in chip substrates and printed circuit boards. Nitto Boseki (Nittobo), a Japanese firm, manufactures nearly all advanced versions of this material. Apple adopted glass cloth early for its chip substrates to enable high-speed data transmission in compact devices like iPhones.

The AI industry boom has intensified competition for these materials, with NVIDIA, Google, Amazon, and others requiring high-end glass cloth for AI accelerator chips. This sudden demand surge created a supply bottleneck reminiscent of recent memory chip shortages. Despite Apple, AMD, and NVIDIA dispatching teams to Japan to secure additional capacity, Nittobo reportedly has no immediate production flexibility, with one source stating: "No additional capacity is no additional capacity, even if you pressure Nittobo."

Apple's contingency plan involves cultivating alternative suppliers, including Chinese manufacturer Grace Fabric Technology (GFT). The company has deployed engineers to GFT facilities and enlisted Japanese chemical firm Mitsubishi Gas Chemical to oversee quality improvements. However, newcomers like Taiwan Glass and China's Taishan Fiberglass face significant technical barriers. Producing flawlessly spherical, bubble-free glass fibers at industrial scale requires precision that new entrants struggle to achieve consistently.

Industry executives emphasize that no tech company will risk mounting expensive chips on substandard substrates, making quality control paramount. Qualcomm has also joined efforts to mitigate the shortage, though Nikkei Asia notes no near-term solution exists. This shortage highlights the fragility of specialized component supply chains as AI and mobile computing demands converge, potentially affecting device production timelines across the industry through 2027.

Comments

Please log in or register to join the discussion