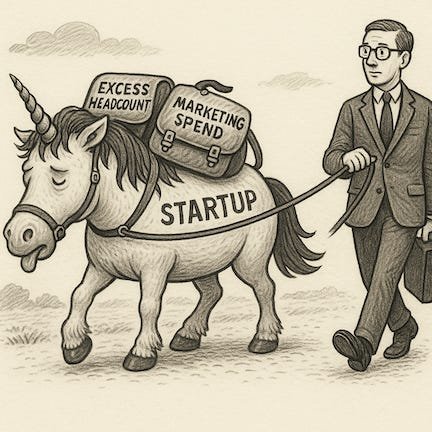

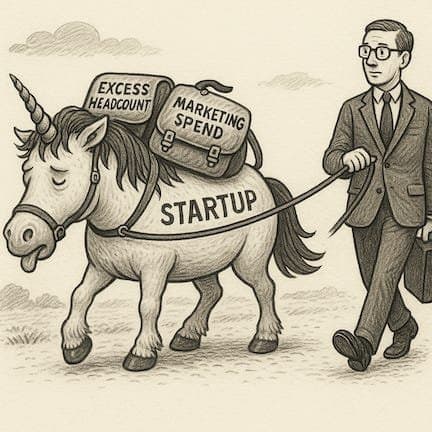

Flooding startups with easy capital erodes discipline, fuels reckless expansion, and traps companies in a cycle of unsustainable valuations. Drawing from failures like WeWork and climate tech ventures, this analysis reveals why financial abundance often hinders long-term growth. For developers and investors, it's a critical lesson in the art of measured resource allocation.

Capital Poison: How Excessive Funding Strangles Tech Startup Innovation

"Money, like medicine, can turn poisonous in excessive doses. Too much cash too early often transforms a promising startup into a lethargic flop." — Sophie Bakalar, Venture Capitalist

In the high-stakes arena of tech startups, securing massive funding is celebrated as a triumph—but what if it's secretly a death sentence? Venture capitalist Sophie Bakalar's incisive analysis exposes a counterintuitive truth: the very capital meant to fuel innovation can cripple companies by stripping away the scarcity that breeds focus and resilience. This isn't abstract theory; it's a pattern witnessed across sectors like AI, climate tech, and robotics, where overfunded startups like WeWork and Brandless collapsed under the weight of their own abundance. For developers building the next generation of software and investors backing them, understanding this dynamic is crucial to avoiding pitfalls that turn potential into ruin.

The SoftBank Effect: A Cautionary Tale of Unchecked Capital

SoftBank's $100 billion Vision Fund epitomizes the dangers of capital overdose. It injected hundreds of millions into companies such as Wag and WeWork before they validated product-market fit or achieved positive unit economics. WeWork's implosion—where boundless ambition met zero financial guardrails—became a global spectacle, but Bakalar emphasizes this was no outlier. It reflected a systemic "disease" infecting startups when money flows too freely, divorcing teams from market realities. The result? Bloat replaces ingenuity, and growth becomes a performance metric rather than a sustainable goal.

How Excess Cash Corrodes Startup Culture and Strategy

Internally, abundant capital triggers a psychological shift that undermines core startup virtues:

- Erosion of Validation Pressure: Why rigorously test customer demand when you can hire more engineers and build features indiscriminately? Teams skip essential iteration, leading to products that miss market needs.

- Structural Bloat: Overhiring creates unwieldy teams, while premature office expansions and retail leases lock in high fixed costs. Unlike marketing overspend—which can be halted—these decisions build irreversible momentum toward inefficiency.

- The Valuation Trap: Sky-high early valuations (e.g., $100M+ for pre-revenue climate tech startups in 2020–2021) force companies into a vicious cycle. They must chase unrealistic growth to justify their worth, leading to aggressive spending, faster cash burn, and desperate fundraises. Eventually, down rounds or bankruptcy become the only exits, damaging morale and investor trust.

Bakalar cites climate tech as a poignant example: brilliant teams tackling critical problems like renewable energy were hamstrung by funds prioritizing deal wins over realistic pricing. Now, many face painful corrections as markets cool—a scenario echoing in biotech, defense tech, and other deep-tech fields where long development arcs clash with impatient capital.

Why Disciplined Funding Fuels Real Innovation

The solution isn't austerity but strategic calibration. Savvy investors provide "enough capital to achieve the next milestone," not a surplus that dulls urgency. Constraints, Bakalar argues, foster creativity and focus—traits evident in startups that build robust unit economics and resilient cultures. For founders, this means resisting the temptation to raise "as much as possible"; for investors, it demands discipline in valuation to avoid market-wide ripple effects. As venture cycles swing back toward abundance post-downturn, this balanced approach could safeguard the next wave of AI, cloud, and infrastructure ventures.

Ultimately, capital is a tool, not an end goal. The startups that thrive will be those that harness it with precision, ensuring every dollar spent reinforces their mission rather than diluting it. In an era of rapid technological change, that discipline might be the ultimate competitive edge.

Source: Too Much Capital is a Disease by Sophie Bakalar

Comments

Please log in or register to join the discussion