After years of rapid evolution and uncertainty, key AI markets like foundation models, coding tools, and legal AI have crystallized with dominant players now apparent. Venture capitalist Elad Gil reveals how capital moats, hyperscaler partnerships, and agentic workflows are reshaping competition, offering critical insights for developers and tech leaders navigating this transformed landscape.

For years, the generative AI landscape resembled a turbulent sea—startups surged, models evolved unpredictably, and winners were anyone’s guess. Now, that chaos is giving way to clarity. According to prominent investor Elad Gil, core markets have solidified, with clear leaders emerging in foundational areas like large language models (LLMs), coding assistance, and legal automation. This maturation signals a pivotal shift: AI is no longer a futuristic experiment but a tangible industry with defined front-runners, profound implications for developer ecosystems, and trillion-dollar stakes.

The New AI Hierarchy: Where Winners Have Pulled Ahead

Gil’s analysis pinpoints six markets where leaders have distanced themselves from the pack, driven by scale, capital advantages, and strategic hyperscaler alliances. These aren’t just abstract rankings—they’re blueprints for where developers should focus their integrations and enterprises their investments.

1. Foundation Models: The Trillion-Dollar Moats

"Scale means capital, so to win in the LLM market you need high availability of capital now entering the many billions." —Elad Gil

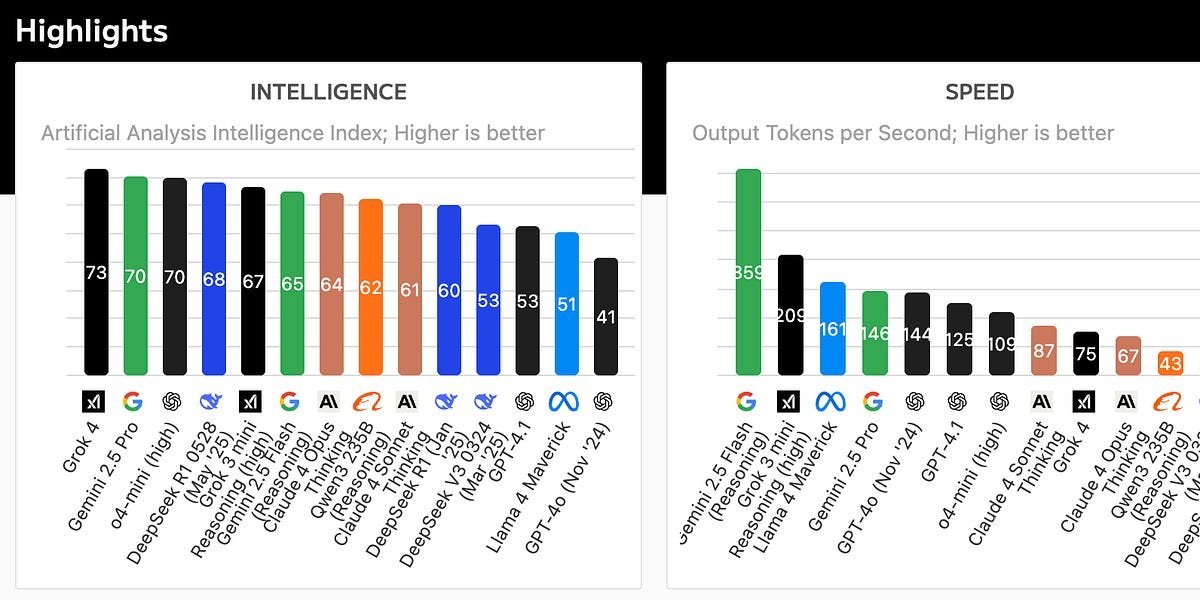

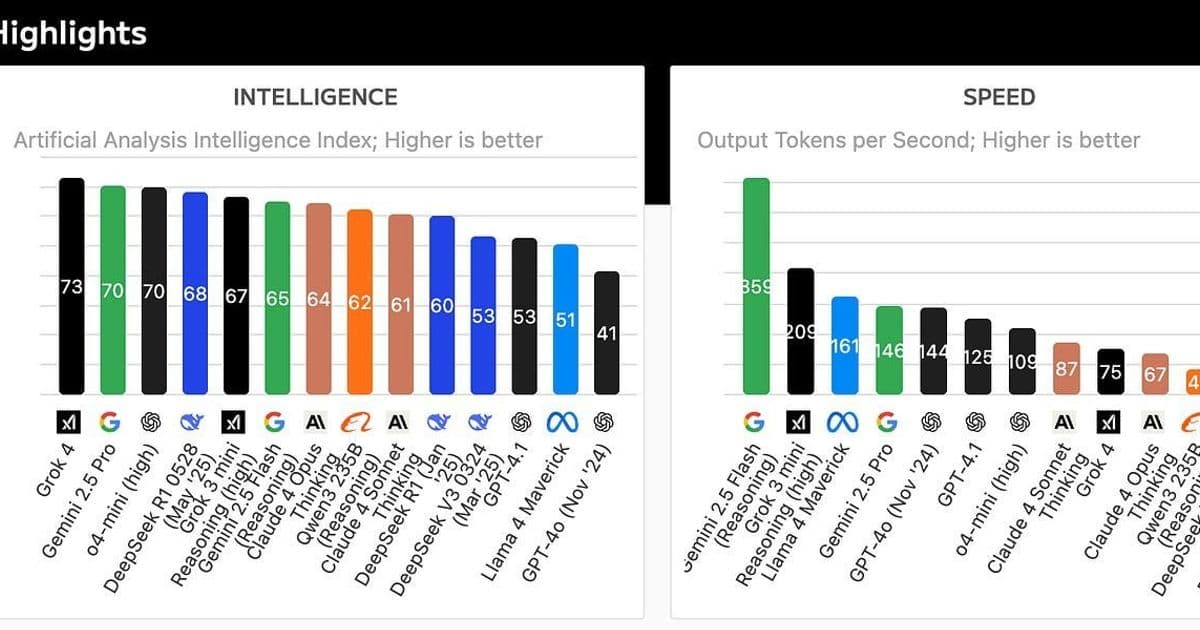

The LLM arena is now dominated by a handful of players: Anthropic (backed by Amazon), Google’s Gemini, Meta’s Llama, Microsoft (via OpenAI), Mistral, and Elon Musk’s xAI. These leaders benefit from massive cloud partnerships—like Azure with OpenAI or AWS with Anthropic—that provide near-limitless compute resources. Revenue is skyrocketing, with AI cloud spend hitting "billions per quarter," creating barriers so high that new entrants face near-impossible odds without breakthrough innovations. While open-source alternatives like DeepSeek and Alibaba’s Qwen thrive in China, the global race is effectively down to these giants. For developers, this means betting on interoperable tools that leverage these platforms’ APIs is safer than niche alternatives.

2. Coding Tools: From Autocomplete to Autonomous Agents

Coding remains AI’s killer app, with tools like GitHub Copilot (Microsoft), Cursor, and Cognition’s Devin driving "insanely fast" revenue growth—from zero to $500 million in under two years. The market has coalesced around players integrating deeply with IDEs while pioneering agentic workflows, where AI doesn’t just suggest code but executes tasks. Gil highlights a critical convergence: "Agentic vs IDE-based workflows will undoubtedly merge," blurring lines between tools from startups like Magic and incumbents. For engineers, this signals a move beyond autocomplete toward AI collaborators that handle entire development cycles, raising stakes for skills in prompt engineering and oversight.

3. Legal, Medical, and Customer Experience: Vertical Domination

- Legal AI: Harvey leads for law firms and enterprises, automating end-to-end workflows like contract review, with CaseText and newcomers like Legora expanding into niches. Gil notes legal’s "centrality" could let Harvey expand into adjacent professional services.

- Medical Scribing: Abridge, Ambience, and Microsoft’s Nuance dominate, using AI to transcribe and analyze patient interactions. Their next battle? Expanding into broader healthcare stacks like diagnostics.

- Customer Service: Startups like Sierra and Decagon are displacing human agents with AI that handles complex queries, while incumbents like Zendesk scramble to adapt. This shift highlights a broader trend: "Selling units of cognition" over traditional seat-based pricing, a seismic change for SaaS economics.

Emerging Frontiers: Where Disruption Looms

Markets like accounting, compliance, security, and sales tooling remain wide open. Gil identifies these as prime for disruption, with AI’s "GPT Ladder" enabling new entrants: As models advance (e.g., GPT-5 or Claude X), previously intractable markets become viable. For instance, legal workflows only took off post-GPT-4, suggesting similar leaps could unlock areas like real-time financial analysis or pharmaceutical compliance. Developers should watch for:

- Agentic infrastructure: Tools that manage AI agents performing actions (e.g., booking travel or auditing code), with companies like Perplexity pioneering via its Comet browser.

- Security and compliance: Urgent needs for AI-specific safeguards against data leaks, with startups like Blue Note Health emerging in regulated sectors.

Consolidation and the Agentic Future

The clarity in today’s markets foreshadows a wave of M&A, as Gil’s concept of "market ending moves" takes hold: Combining leaders or partnering with hyperscalers could decisively win categories. He’s already backing "AI-driven roll-ups," where acquiring firms enables faster AI integration than selling software—turning organizational hurdles into advantages. Simultaneously, the pivot to agentic workflows is accelerating, with Sierra and Devin exemplifying how AI sells "human equivalent labor" instead of software seats. For tech leaders, this means prioritizing platforms with action-oriented APIs and scalability.

As Gil puts it, "AI markets are now the clearest they have been in a few years." The winners have emerged not just through superior tech, but by mastering capital, distribution, and the shift from assistance to autonomy. For innovators, the call is clear: Build where models open new rungs on the GPT Ladder, or risk being sidelined in an industry hurtling toward consolidation.

Source: Analysis based on AI Market Clarity by Elad Gil, July 2025.

Comments

Please log in or register to join the discussion