Micron's VP justifies abandoning consumer memory brand Crucial by citing overwhelming enterprise AI demand, admitting corporate clients are too lucrative to ignore despite impacting gamers.

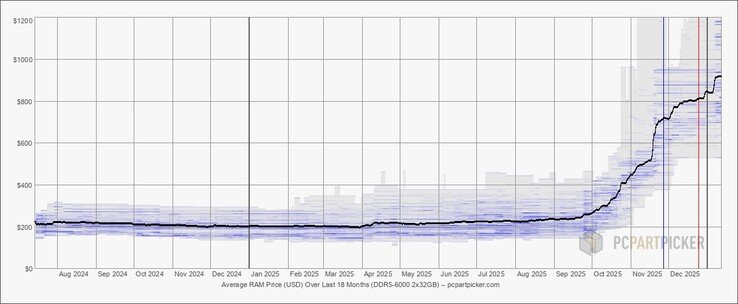

The dramatic shutdown of Micron's Crucial consumer division marks a pivotal shift in memory manufacturing priorities. As DRAM prices surge nearly 60% since late 2025 due to unprecedented AI industry demand, Micron's controversial decision to abandon consumer-grade memory production has drawn fierce criticism from gamers and PC enthusiasts. In a revealing interview, Micron VP Christopher Moore defended the move as necessary to address overwhelming enterprise requirements.

Strategic Shift Towards Enterprise Gold Rush

Moore confirmed Micron has completely redirected manufacturing resources toward high-margin enterprise clients, stating: "The TAM [Total Addressable Market] in data centers is growing absolutely tremendously." This strategic pivot prioritizes AI infrastructure demands over consumer components, with Micron now supplying DRAM exclusively through partners like Dell and Asus rather than its own Crucial brand.

The economics are undeniable: Enterprise DDR5 modules command 300-400% premiums over consumer equivalents due to rigorous validation requirements and bulk purchasing power. With hyperscalers like Google and Meta consuming entire production runs, Moore bluntly admitted "the demand from the data center space is far too high to be ignored."

Consumer Market Consequences

The impact on PC builders is immediate and severe:

- Price Surges: DDR5-6000 kits have jumped from $120 to $200+ within months

- Supply Scarcity: Major retailers list premium RAM kits as backordered for 4-6 weeks

- Quality Concerns: OEM modules lack the rigorous binning Crucial applied to gaming-specific products

Moore's claim that Micron still serves consumers through partners rings hollow to enthusiasts. Third-party implementations often use lower-grade memory dies not meeting Crucial's previous standards for XMP profiles. As one industry analyst noted: "Gamers aren't buying enterprise modules at 4x the price. They're getting leftover components rejected from data center batches."

Market Domino Effect

Industry reports suggest SK Hynix may follow Micron's exit strategy within 18 months, potentially leaving Samsung as the only major consumer DRAM supplier. This consolidation could extend the memory shortage through 2028 according to supply chain forecasts. Manufacturers are locking suppliers into 3-year contracts, freezing allocation percentages that marginalize consumer channels.

Practical Buyer Guidance

For PC builders facing this new reality:

- Prioritize RAM purchases - Inventory shortages will worsen through Q3 2026

- Consider last-gen platforms - DDR4 systems offer better value amid DDR5 inflation

- Verify OEM specs - Demand full XMP/DOCP validation sheets from system integrators

- Explore secondary markets - Used DDR5 kits currently resell near MSRP due to scarcity

While Moore stated Micron is "trying to help consumers around the world," the company's actions reveal a harsh reality: The AI gold rush has permanently altered memory manufacturing economics. Gamers face prolonged component scarcity as corporations pay premiums that consumer markets can't match. As Moore conceded, this isn't altruism - it's simply acknowledging where the money lies.

Sources:

Wccftech Interview

DRAMeXchange Price Tracking

PCPartPicker Historical Pricing Data

Comments

Please log in or register to join the discussion