Canada's sixth-largest commercial bank is grappling with a major technical outage, leaving over 2.4 million customers without online or mobile banking access. The incident highlights the fragility of digital financial infrastructure.

National Bank of Canada Paralyzed by Widespread Technical Outage

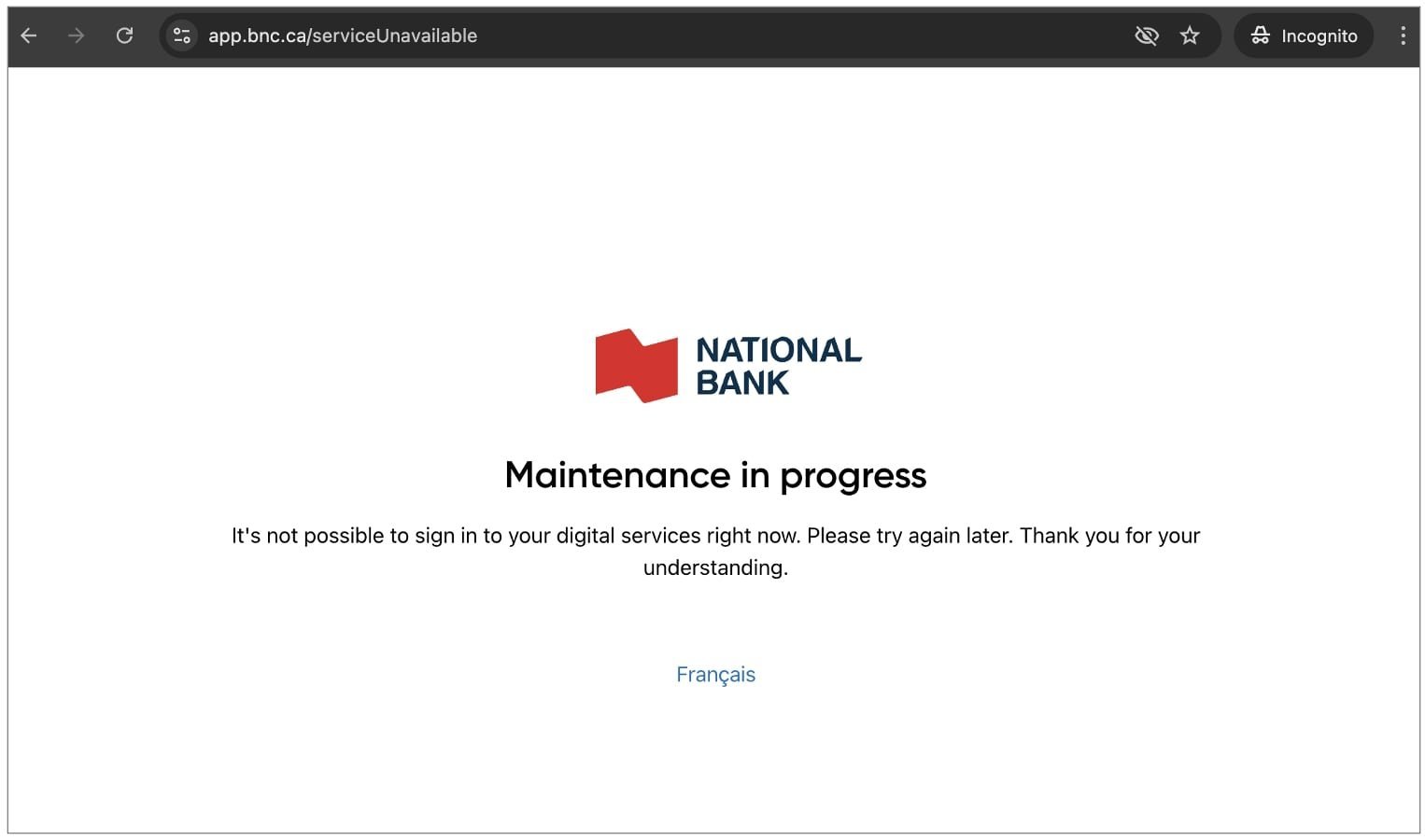

Canada's banking sector faced significant disruption today as the National Bank of Canada (NBC), the country's sixth-largest commercial institution, experienced a full-scale collapse of its digital banking services. Since early morning on August 6, 2025, customers across Canada have been locked out of online accounts and mobile apps, greeted instead by a stark "Maintenance in progress" message—despite the bank confirming this was an unplanned technical failure.

National Bank of Canada's website displays maintenance message during nationwide outage (BleepingComputer)

National Bank of Canada's website displays maintenance message during nationwide outage (BleepingComputer)

The Montreal-based bank, serving 2.4 million clients and employing over 30,000 staff, acknowledged the crisis on social media, stating:

"Due to a technical issue, our mobile and Internet banking solutions are currently unavailable. Our teams are working to restore the service as soon as possible."

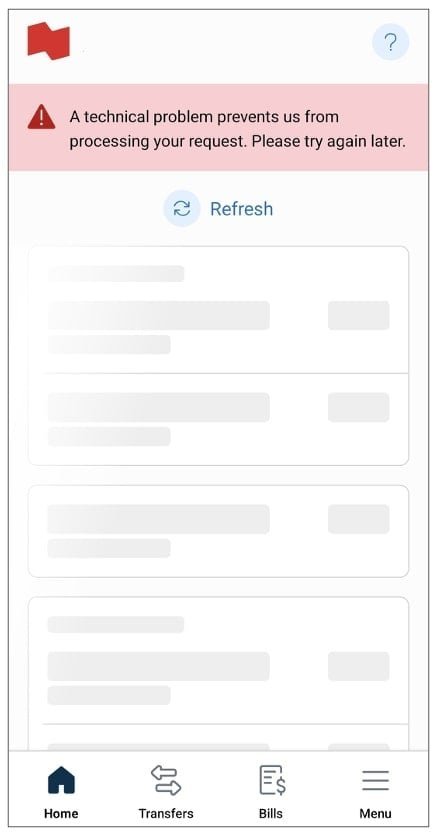

Mobile app failures compounded customer frustrations during the outage (BleepingComputer)

Mobile app failures compounded customer frustrations during the outage (BleepingComputer)

Cascading Customer Impact

The outage triggered immediate backlash on social media, with customers reporting inability to conduct essential transactions:

"@nationalbank I am not able to open my account either through app or through website since last night. Need help here."

— Ankit Mehta (@Ankit_2905)

Technical teams are racing to diagnose the root cause, which remains undisclosed. Potential scenarios range from infrastructure failures and software bugs to cybersecurity incidents—though the bank hasn't indicated any malicious activity. This incident mirrors recent high-profile outages at major financial institutions, spotlighting systemic vulnerabilities in banking technology stacks.

The Reliability Imperative

For developers and infrastructure engineers, this outage underscores critical considerations:

- Architectural Resilience: Single points of failure in banking systems can trigger nationwide service collapse

- Communication Protocols: Automated status updates during outages reduce customer frustration

- Failover Testing: Regular chaos engineering exercises are essential for critical financial infrastructure

- Third-Party Dependencies: Many banking systems rely on external APIs and cloud services that can introduce cascade risks

As digital banking becomes the primary channel for consumers, the cost of downtime escalates exponentially—impacting customer trust, stock valuations, and operational continuity. While National Bank works to restore services, this incident serves as a sobering case study in the high-stakes world of financial technology where resilience isn't optional—it's the foundation of consumer confidence.

This story is developing. Source: BleepingComputer

Comments

Please log in or register to join the discussion