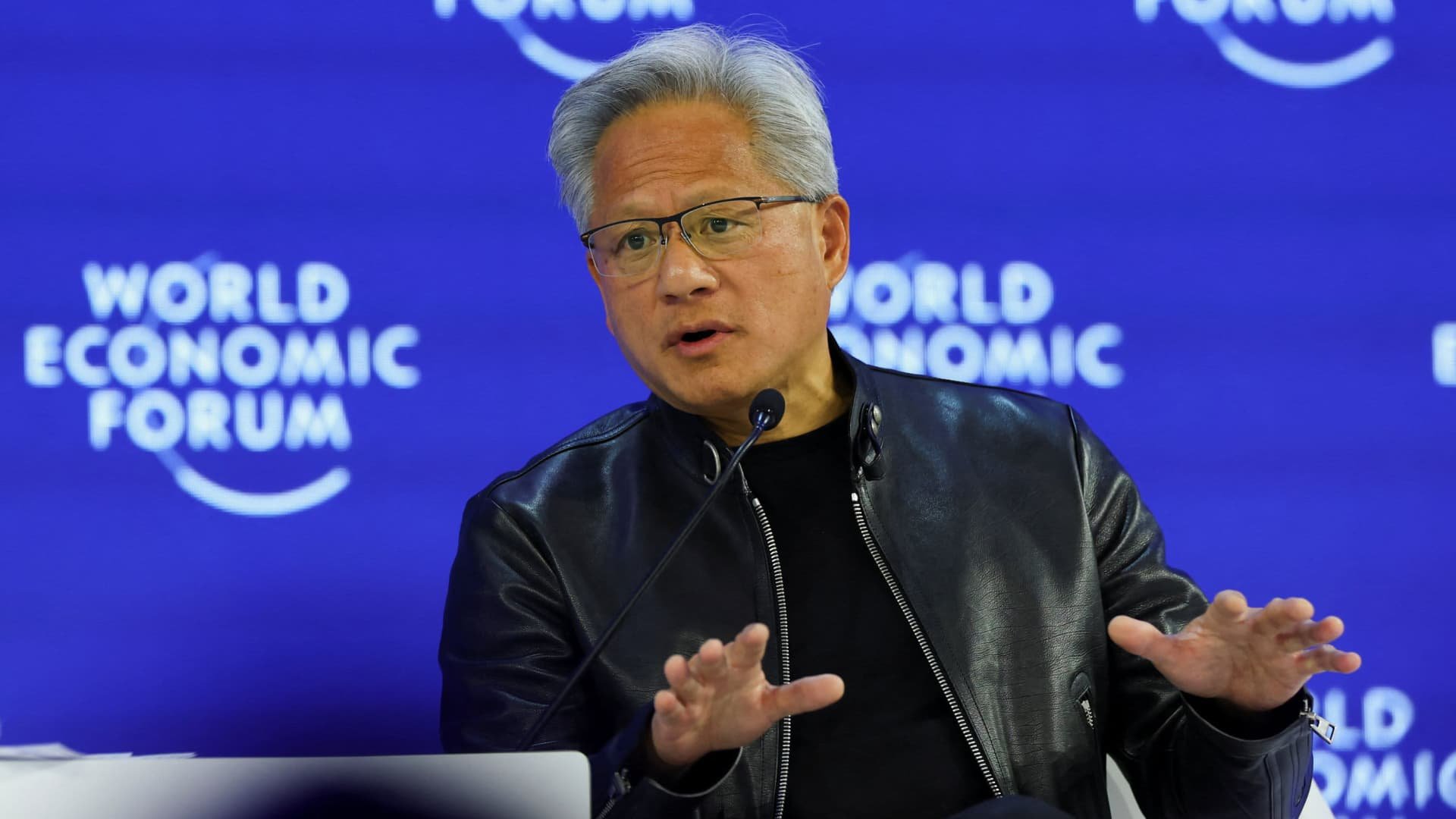

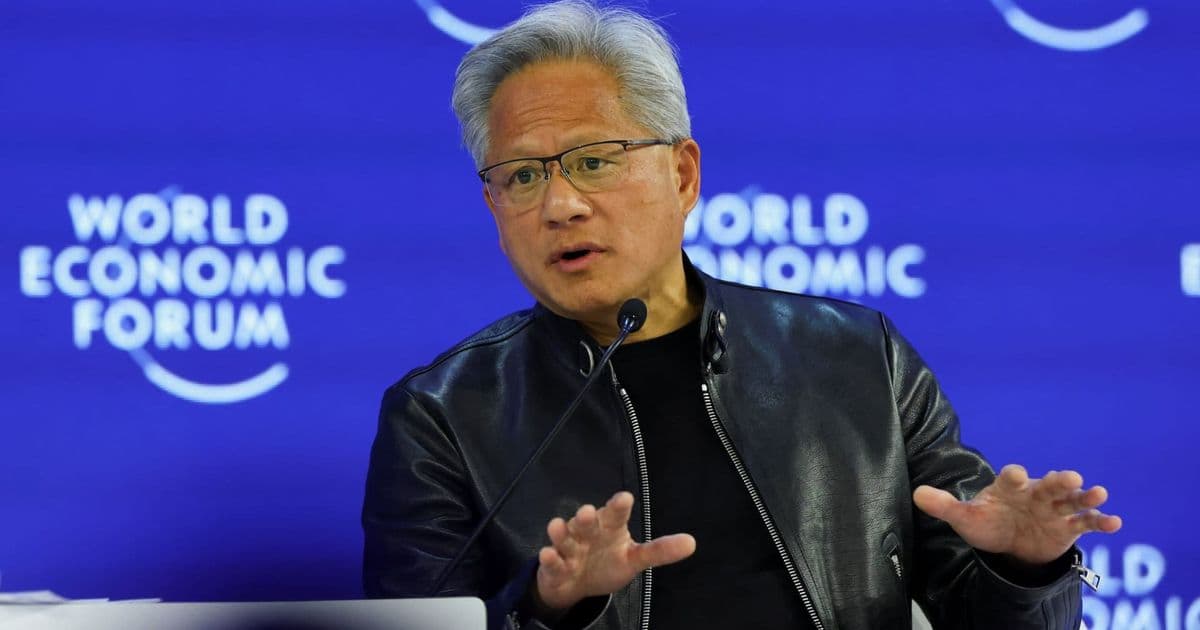

Nvidia's stock jumped 7.87% after CEO Jensen Huang told investors that massive tech industry capital expenditures on AI infrastructure are "justified, appropriate, and sustainable," as major tech companies forecast $650 billion in combined 2026 capex.

Nvidia's stock price closed up 7.87% on Friday following CEO Jensen Huang's comments defending the tech industry's massive surge in capital expenditures for AI infrastructure. Speaking to investors, Huang characterized the spending as "justified, appropriate, and sustainable," providing reassurance amid concerns about whether the AI investment boom could lead to an infrastructure glut.

Tech Giants Forecast $650 Billion in Combined 2026 Capex

The validation from Nvidia's leadership comes as four of the largest US technology companies—Alphabet, Amazon, Meta, and Microsoft—have collectively forecast approximately $650 billion in capital expenditures for 2026. This represents an estimated 60% year-over-year increase, driven primarily by data center construction and AI infrastructure development.

The scale of investment underscores how central AI has become to the strategic priorities of major tech companies. Each firm is racing to build out the computational infrastructure necessary to train increasingly large AI models and serve AI-powered products to billions of users.

Goldman Sachs Automates with Anthropic AI Agents

Separately, Goldman Sachs revealed it has been working with AI startup Anthropic to develop AI agents that automate various banking functions. The bank is deploying these agents for tasks including trades, transactions, client vetting, and onboarding processes.

This represents one of the most significant deployments of AI automation in the financial services sector, potentially reshaping how investment banks operate and raising questions about the future of certain white-collar roles.

Waymo Leverages DeepMind's Genie 3 for Autonomous Training

Alphabet's Waymo announced it is using DeepMind's Genie 3 AI model to create realistic digital worlds for training its autonomous driving technology. The synthetic environments allow Waymo to simulate edge-case scenarios that would be difficult or dangerous to reproduce in the real world.

The partnership between Waymo and DeepMind demonstrates how AI is accelerating progress in autonomous vehicles by enabling more comprehensive and safer training methodologies.

OpenAI Launches Frontier Agent Management Platform

OpenAI unveiled Frontier, an AI agent management platform designed to provide shared context, onboarding, and permission boundaries for enterprise customers. The platform is being rolled out to "a limited set of customers" initially.

Frontier represents OpenAI's push into enterprise AI management, addressing the growing need for organizations to coordinate multiple AI agents across different business functions while maintaining security and compliance.

Semiconductor Industry Poised for $1 Trillion in Sales

The Semiconductor Industry Association reported that chip sales hit $791.7 billion in 2025, up 25.6% year-over-year. Advanced chips from Nvidia, AMD, and Intel accounted for $301.9 billion of that total, representing a 40% increase. The SIA expects global semiconductor sales to reach $1 trillion in 2026, driven by continued demand for AI processors and other advanced computing components.

Market Implications of AI Infrastructure Investment

The massive capital expenditures being planned by tech giants create a complex dynamic for the AI industry. While the investments validate the long-term potential of AI, they also raise questions about return on investment and the risk of overcapacity.

Nvidia's strong stock performance suggests investors are currently siding with Huang's optimistic assessment. The company's GPUs remain the dominant hardware for AI training and inference, positioning Nvidia to benefit regardless of which specific AI applications ultimately succeed.

However, the sustainability of the current investment pace will depend on whether AI applications can generate sufficient revenue to justify the infrastructure costs. The next 12-24 months will be critical in determining whether this represents a fundamental reshaping of the tech industry or an unsustainable bubble.

The breadth of AI adoption across industries—from autonomous vehicles to financial services to content creation—suggests the former, but execution and monetization challenges remain significant hurdles for the AI ecosystem.

Comments

Please log in or register to join the discussion