After years witnessing the potential and pitfalls of blockchain infrastructure, a team of crypto veterans is tackling the compliance and operational challenges that prevent stablecoins from revolutionizing B2B payments. Their new venture, Infinite, aims to create the seamless infrastructure needed for global businesses to adopt cryptocurrency payments at scale.

Playing the Infinite Game: Building the Missing Infrastructure for B2B Stablecoin Payments

In the high-stakes world of Silicon Valley, the power law drives outsized returns from a small number of winners, often incentivizing founders to chase what's hot rather than build toward a differentiated view of the future. But as James Carse once observed, "A finite game is played for the purpose of winning, an infinite game for the purpose of continuing the play."

This philosophical distinction is at the heart of a new venture from crypto industry veterans who have chosen to tackle one of blockchain's most persistent challenges: making stablecoins work seamlessly for business-to-business (B2B) payments.

From Coinbase to Sardine: Lessons in Crypto Infrastructure

The journey began in 2018 when the author joined Coinbase during a period of explosive growth in blockchain infrastructure. There, they witnessed firsthand the launch and scaling of USDC (USD Coin), one of the most widely adopted stablecoins in the ecosystem.

Later, at Sardine, a fintech company focused on payments and risk management, the author helped lead the risk platform as it expanded to serve stablecoin use cases. These experiences revealed a fundamental truth: while stablecoins work beautifully for consumers, they're fundamentally broken for businesses.

As Peter Thiel famously noted, "Competition is for losers." The most ambitious ventures aren't about winning a market but redefining it entirely. This requires choosing a problem worth dedicating a decade to solving, one that founders would burn the midnight oil to address despite the opportunity costs.

The B2B Stablecoin Conundrum

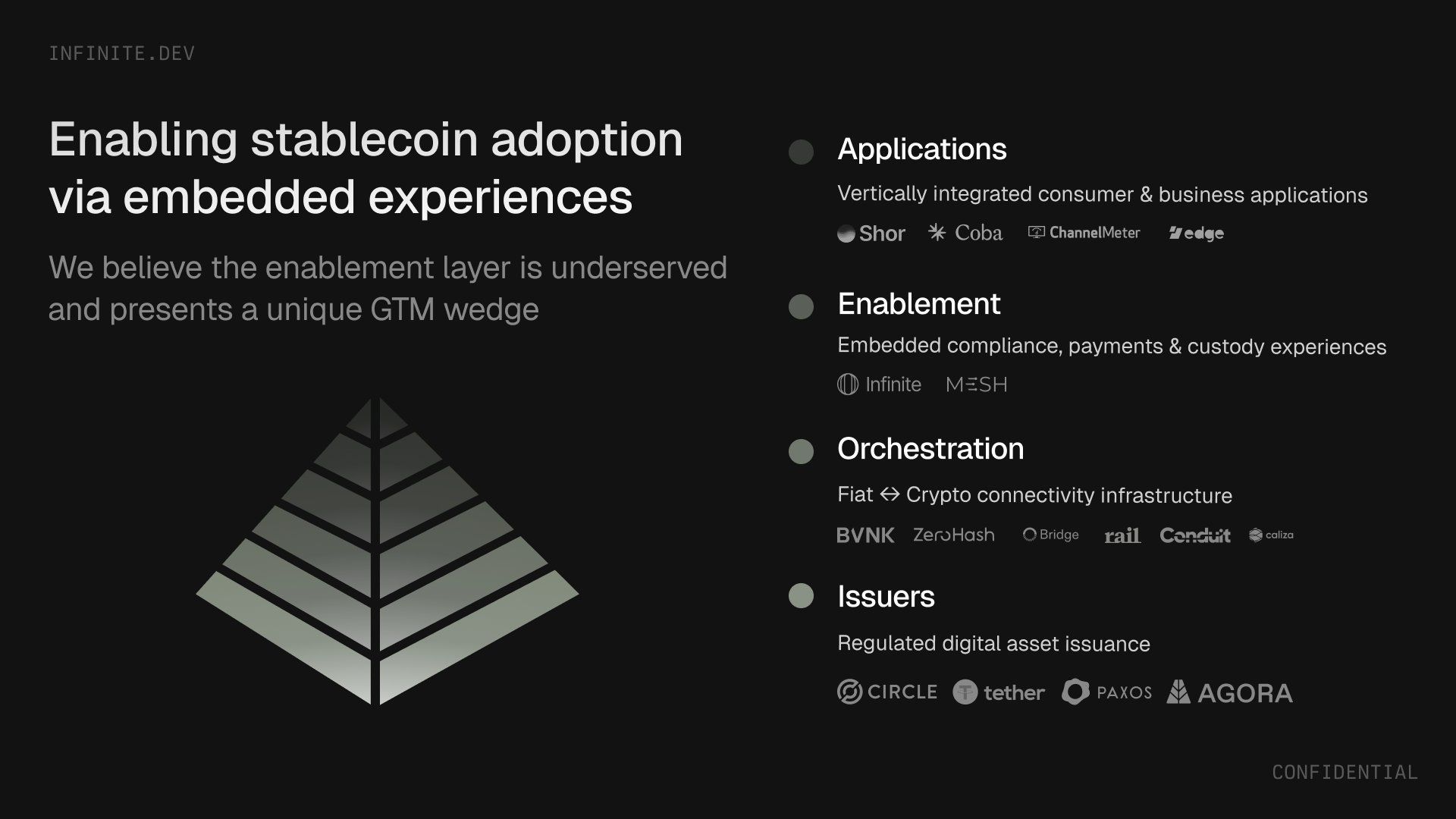

For businesses looking to support global stablecoin payments, the current landscape is fragmented and complex. Companies need different providers for different stablecoins, payment methods, and jurisdictions. This creates a massive gap in the operational and technical capabilities needed to offer a seamless end-user experience.

"The technology works," the author explains. "The infrastructure around it doesn't exist."

This isn't just a technical challenge—it's a compliance and operational one. On a long enough time horizon, the marginal cost of a stablecoin payment converges with the cost of associated risks: how funds are segregated, how transactions are screened, and how operations are automated.

As the author noted in a recent PitchBook report:

"If stablecoins are instant or near instant, then your limiting factor now becomes compliance... We've built the compliance infrastructure in the same subsystem as our payments so everything is tightly coupled instead of bolted on."

This tight coupling of payments and compliance is precisely what's missing in today's fragmented landscape.

Introducing Infinite: The Infinite Game of B2B Payments

To address this gap, the author has launched Infinite alongside Raj Lad and Krisan Nichani, former colleagues from Sardine. Between them, the team has built fraud and compliance systems for the largest crypto companies in the world for decades.

"We know where the stablecoin sandwich breaks because we spent years building it out and seeing where it fails," the author explains.

The cross-border B2B payments market is valued in the trillions of dollars, yet most transactions still rely on traditional methods like checks, wires, and SWIFT payments—processes that can take days or even weeks to complete. The Infinite team believes this will inevitably change, and they're building the infrastructure to support it.

"We've built fraud and compliance systems for the largest crypto companies in the world for decades," the author states. "We know where the stablecoin sandwich breaks because we spent years building it out and seeing where it fails."

The Future of Cross-Border Payments

As blockchain technology matures, the distinction between traditional and cryptocurrency payments continues to blur. For businesses, the promise of instant, low-cost cross-border settlements using stablecoins is too compelling to ignore. However, realizing this potential requires solving the compliance and operational challenges that have thus far limited adoption.

Infinite represents a bet that the future of global business payments will be built on blockchain infrastructure, but with the robust compliance frameworks that traditional financial systems have spent decades developing. By tightly coupling these two previously separate domains, the company aims to create a platform that offers both the efficiency of cryptocurrency and the security of traditional banking.

This is, as the author puts it, their "infinite game"—a long-term commitment to building the foundational infrastructure that will enable the next generation of global commerce. In a world where technology is advancing at breakneck speed, the most valuable companies may not be those that win today's battles, but those that build the platforms for tomorrow's wars.

Comments

Please log in or register to join the discussion