Nitto Boseki's near-monopoly on T-Glass fiberglass substrate material creates production bottlenecks that could disrupt CPU availability and increase prices industry-wide.

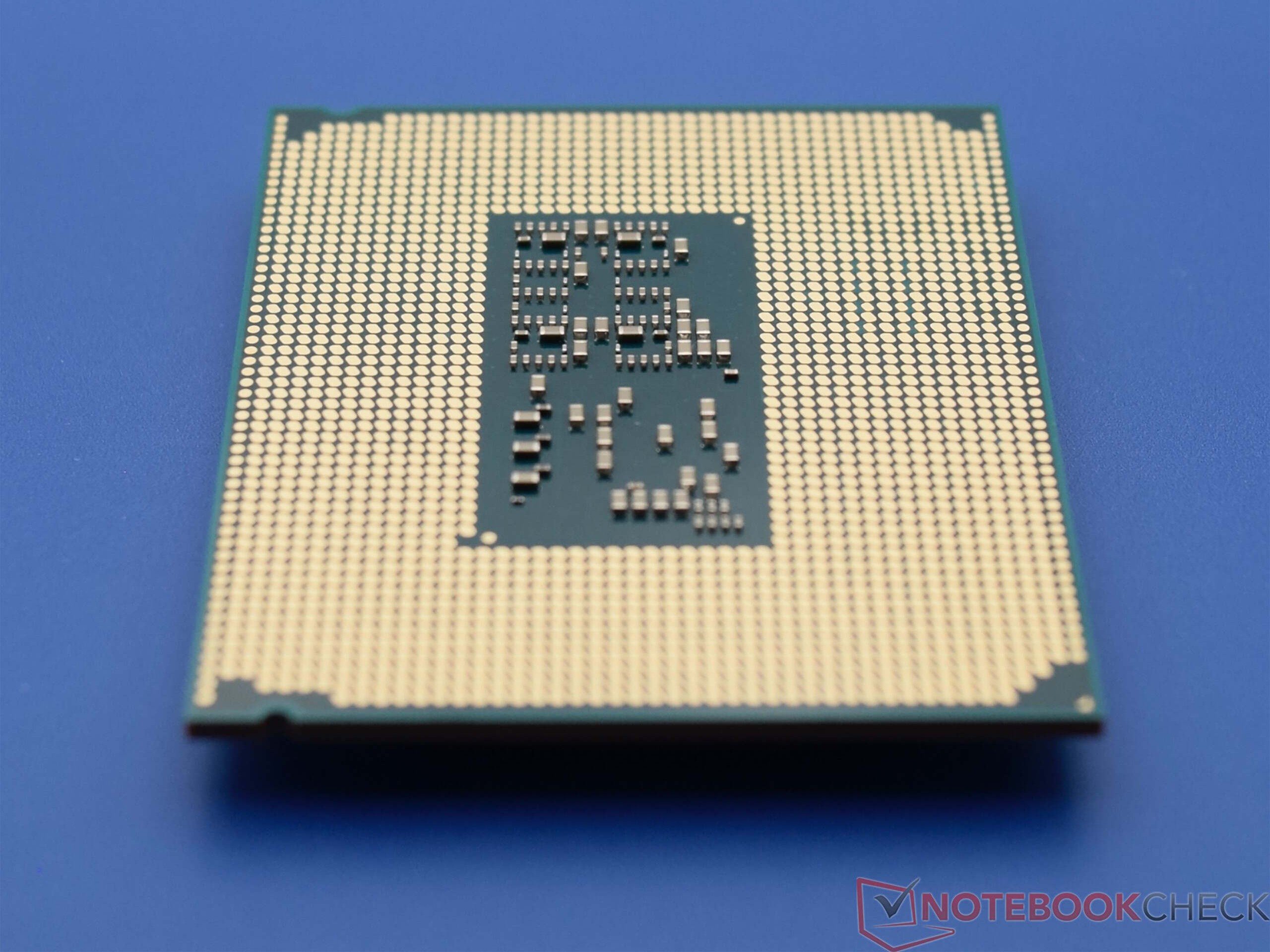

The complex web of global electronics manufacturing faces renewed pressure as a specialized material essential for processor production faces constrained supply. T-Glass, a proprietary fiberglass cloth manufactured almost exclusively by Japanese firm Nitto Boseki, serves as the mechanical backbone preventing warpage in CPU substrates. This revelation highlights a critical vulnerability in semiconductor supply chains that could impact everything from laptops to servers.

Why T-Glass Matters

Contrary to silicon wafers or transistor materials, T-Glass operates in the substrate layer - the foundation connecting chips to circuit boards. When processors generate heat during operation (typically 60-100°C for mobile CPUs, 80-110°C for desktops), thermal expansion creates torsion forces. Without T-Glass's rigid reinforcement, substrates warp at microscopic levels. Even 0.1mm of deformation can fracture solder joints or sever copper traces, causing immediate component failure. Current alternatives like E-Glass lack the thermal stability for modern chips, making T-Glass non-negotiable for performance hardware.

Production Reality vs Industry Demands

Nitto Boseki's dominant market position creates inherent supply risks. Expanding production requires constructing new cleanroom facilities and specialized looms - a 12-18 month process even with unlimited capital. With quarterly CPU shipments exceeding 100 million units globally, even minor allocation shortfalls cascade through manufacturing pipelines. Industry sources confirm T-Glass prices have risen 15-20% since Q4 2025, contrasting sharply with the 3-5% annual declines seen during 2021-2023.

Comparative Impact Analysis

This shortage differs fundamentally from pandemic-era chip shortages in three key aspects:

- Concentration Risk: Unlike multi-sourced silicon wafers, T-Glass lacks viable alternatives

- Downstream Effects: Substrate shortages halt assembly at later production stages than wafer shortages

- Mitigation Difficulty: Material science limitations prevent quick substitutions

Previous substrate material issues (like 2021 ABF shortages) caused 5-10% price inflation and 2-3 month delays. Current projections suggest T-Glass constraints could drive 15-25% premium on high-core-count CPUs if unresolved by Q3 2026.

Practical Implications for Buyers

For enterprise purchasers:

- Expect tighter allocation for server/workstation CPUs

- Build in 10-15% budget contingency for H2 2026 deployments

Consumer buyers should:

- Prioritize purchasing during seasonal sales cycles

- Consider previous-gen hardware if next-gen launches experience delays

- Monitor inventory on configurable systems (Dell XPS, Lenovo ThinkPads) where shortages manifest first

Notebook manufacturers face compounded pressure, as laptop substrates require thinner T-Glass laminates (0.2mm vs 0.8mm for desktops) with tighter tolerances. Industry confirmation of Apple's direct negotiations with Nitto Boseki signals the severity, though alternative substrate designs remain 2-3 years from mass production. While immediate shortages appear unlikely, this vulnerability underscores the fragility of global hardware ecosystems where a single material can disrupt entire industries.

Comments

Please log in or register to join the discussion