Berkshire Hathaway slashes Amazon stake by 77% while adding NYT position, revealing Buffett's return to traditional media and defensive sectors amid economic uncertainty.

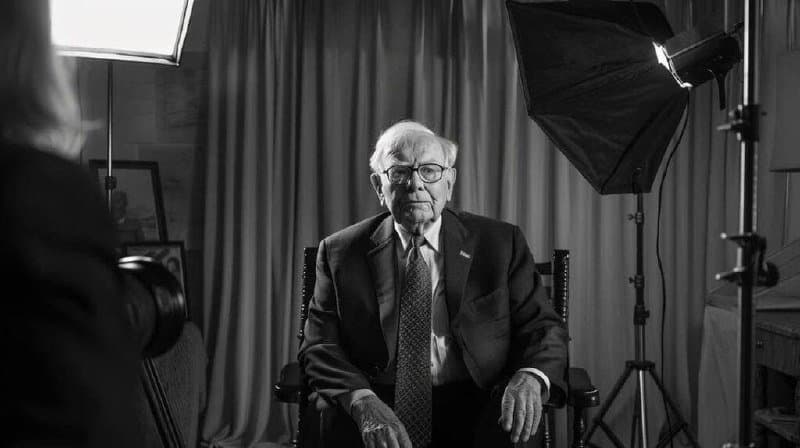

Warren Buffett's Berkshire Hathaway has dramatically reshaped its investment portfolio, with the most striking move being a 77% reduction in its Amazon stake, amounting to a $1.7 billion sell-off of 7.7 million shares. The February 17, 2026 13-F filing reveals this significant shift as Buffett appears to be pivoting away from big tech toward traditional media and defensive sectors.

[IMAGE:1]

This Amazon reduction isn't an isolated incident but part of a broader pattern. Berkshire also trimmed its Apple holdings to a 1.5% position, suggesting a systematic retreat from large technology names that have dominated the market in recent years. The moves come as Buffett, often called "The Oracle of Omaha," seems to be returning to his classic investment playbook focused on businesses built to withstand economic turbulence.

[IMAGE:2]

Perhaps most intriguingly, the filing revealed Berkshire's new position in the New York Times, with a purchase of 5 million shares valued at approximately $352 million. This investment sent NYT shares up around 10% as markets reacted to Buffett's endorsement of traditional media. The move signals confidence in established publishing brands at a time when many investors have written off print media as a dying industry.

The portfolio adjustments extend beyond tech and media. Berkshire expanded its stake in Chubb, a steady insurance company, and increased its position in Chevron, suggesting continued confidence in energy solutions. Additionally, Berkshire agreed to acquire Occidental Petroleum Corp.'s petrochemical business for $9.7 billion, further cementing its commitment to the energy sector.

In a somewhat contradictory move that highlights the complexity of Berkshire's strategy, the conglomerate also built a $5.6 billion position in Google (Alphabet). This suggests that while Buffett is reducing exposure to some tech giants, he still sees value in others, particularly those with dominant market positions and strong cash flows.

These moves appear to be part of a broader defensive positioning strategy. By shifting capital from high-growth tech stocks to more traditional businesses and sectors, Buffett seems to be preparing for potential economic headwinds. The emphasis on insurance, energy, and established media companies reflects a preference for businesses with predictable cash flows and strong competitive moats.

The Amazon sale is particularly noteworthy given Berkshire's history with the company. Buffett first invested in Amazon in 2019, meaning this reduction comes after seven years of holding the position. The decision to reduce such a significant stake suggests that even after Amazon's impressive growth and market dominance, Buffett sees better opportunities elsewhere or believes the company's best growth days may be behind it.

This strategic shift raises questions about Buffett's outlook for the broader economy. The move away from high-flying tech stocks toward more traditional sectors often signals concern about market valuations or economic conditions. Insurance companies, energy businesses, and established media properties tend to perform more consistently across economic cycles, making them attractive defensive positions.

Buffett's investment philosophy has always emphasized buying businesses with durable competitive advantages at reasonable prices. The current portfolio adjustments suggest he sees these qualities more readily in traditional sectors than in the technology space, at least at current valuations. The New York Times investment, in particular, represents a bet on the enduring value of quality journalism and brand strength, even in the digital age.

The timing of these moves is also significant. Coming in early 2026, they may reflect Buffett's assessment of the current market cycle and his expectations for the coming years. Whether this represents a temporary tactical adjustment or a more fundamental shift in Berkshire's investment approach remains to be seen, but the scale and scope of the changes suggest careful consideration rather than impulsive decision-making.

For individual investors, Buffett's moves offer valuable insights into how one of the world's most successful investors is positioning for the future. While not everyone has the resources to make billion-dollar portfolio adjustments, the underlying principles—focusing on businesses with strong competitive positions, predictable cash flows, and the ability to weather economic storms—remain applicable regardless of portfolio size.

The contrast between trimming tech positions while maintaining exposure to companies like Google also highlights the nuance in Buffett's approach. It's not a wholesale rejection of technology, but rather a selective approach based on specific company characteristics and valuations.

As markets digest these changes, the reaction to Berkshire's moves will likely influence other investors' decisions. Buffett's stamp of approval on traditional media through the NYT investment could spark renewed interest in the sector, while the tech reductions might prompt others to reassess their own exposure to high-flying technology stocks.

The coming months will reveal whether these strategic shifts prove prescient or premature, but they undoubtedly represent one of the most significant portfolio overhauls in recent Berkshire Hathaway history.

Comments

Please log in or register to join the discussion