Soaring investments in AI labs and data centers are colliding with rapid hardware depreciation and risky financing models, threatening a market correction. While long-term AI potential remains intact, short-term valuations ignore critical risks like GPU obsolescence and capital scarcity, putting developers and hyperscalers in a precarious position.

In late 2025, the AI industry is racing toward a financial precipice. Venture capitalists and tech giants have poured billions into artificial intelligence, driven by visions of societal transformation. Yet, beneath the surface, unsustainable capital demands, underestimated hardware depreciation, and inflated valuations are creating a powder keg. As one investor from UncoverAlpha puts it: "My conviction in AI in the long term has not changed one bit... but the stock market expectations in the short term have gotten ahead of the reality." This disconnect isn't just a Wall Street concern—it signals turbulence for developers building on these platforms and engineers designing the next generation of AI infrastructure.

The Capital Crunch: When $1.5 Trillion Isn't Enough

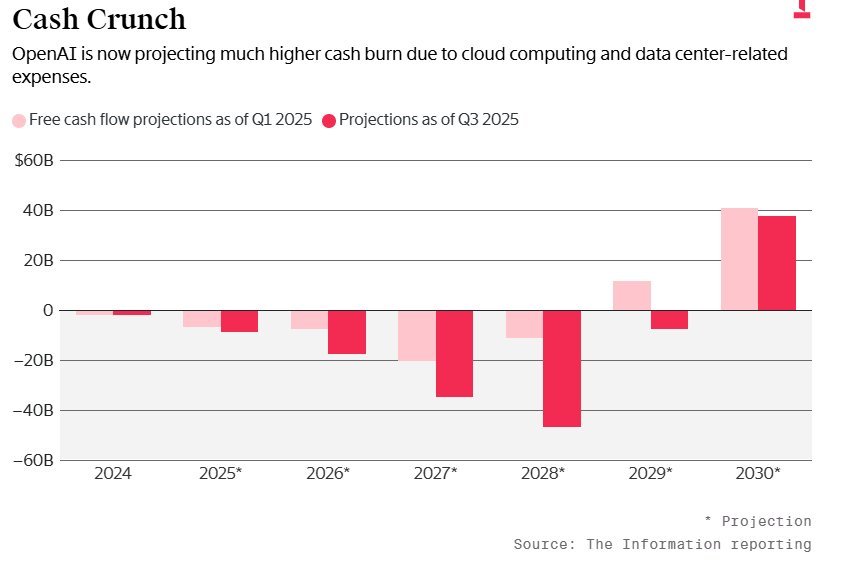

AI labs like OpenAI and Anthropic are abandoning traditional IPO routes to avoid scrutiny of their economics, opting instead for colossal private funding rounds. OpenAI's plan to build 26GW of data centers—costing over $1.5 trillion—exceeds the combined free cash flow of Amazon, Google, Meta, Microsoft, and Apple over the past five years. With OpenAI projected to lose $47 billion by 2028 and xAI burning $1 billion monthly, financing has turned creative—and desperate. Nvidia now acts as a lender of last resort, structuring deals like its $100 billion commitment to OpenAI, where $10 billion flows per gigawatt of power brought online. Debt-laden special purpose vehicles (SPVs) are proliferating, using GPUs as collateral, as seen in xAI's $20 billion raise and Meta's $26 billion debt-backed data center. An industry insider notes: "We have entered a market stage where debt and Nvidia... act as the lender of last resort." For developers, this means potential instability in cloud resources and unpredictable pricing as providers scramble to cover losses.

The GPU Depreciation Time Bomb

AI's hardware lifecycle is shortening dramatically, yet amortization models haven't caught up. Nvidia's shift to a one-year upgrade cycle—exemplified by the 10-20x cost reduction in tokens between Hopper and Blackwell GPUs—means chips depreciate far faster than the 3-6 years assumed by hyperscalers like Microsoft or neoclouds like CoreWeave. As Groq CEO Jonathan Ross warns: "People using 3-5 year amortization cycles are wrong." Running older GPUs like the H100 incurs soaring operational costs from electricity and water, while newer generations like Blackwell and Rubin offer exponential efficiency gains. This misalignment artificially inflates profits today but will pressure margins industry-wide. Worse, Nvidia's buyback agreements for older chips (e.g., $6.3 billion pledged to CoreWeave for unsold capacity) hint at a looming surplus of obsolete hardware. For engineers, this underscores the urgency of optimizing for energy efficiency and token-per-watt metrics in software design.

Valuation Realities and the Disruption Domino Effect

Market valuations assume near-perfect execution, ignoring AI's razor-thin moats and customer concentration. Just 35 companies drive 99% of AI token spending, with OpenAI and Anthropic alone consuming one-third of Nvidia's GPUs. Their success hinges on raising capital at $500 billion+ valuations—a tall order given $100 billion+ annual funding gaps. Microsoft's reluctance to meet OpenAI's compute demands, despite first-refusal rights, signals deeper skepticism. Meanwhile, AI labs are evolving into competitors: xAI aims to "become a compute provider" (per Nvidia sources), while OpenAI's direct deals with chipmakers bypass traditional clouds. This erodes the hyperscaler oligopoly, forcing players like Amazon and Google into defensive capex spirals. Meta's Mark Zuckerberg concedes: "The risk of overspending a few hundred billion is smaller than the risk of being left out." For tech leaders, this translates to diverted resources from innovation to moat defense, potentially stifling tools and APIs relied on by developers.

The AI revolution isn't ending—it's entering a necessary consolidation. Capital markets will soon force a reckoning, cooling the frenzy and revealing which business models can withstand hardware churn and financial scrutiny. As efficiency in software and hardware improves, developers who prioritize sustainable inference costs will lead the next phase. But until then, the industry's trillion-dollar gamble serves as a stark reminder: even transformative tech can't outrun economics. Source: UncoverAlpha, October 2025.

Comments

Please log in or register to join the discussion