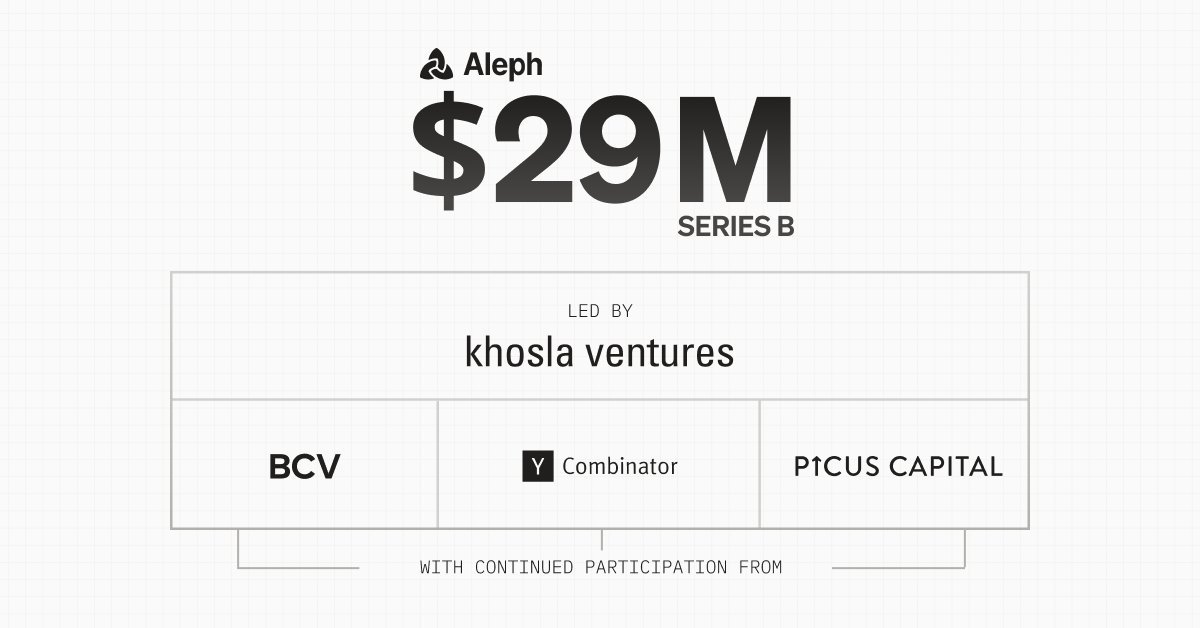

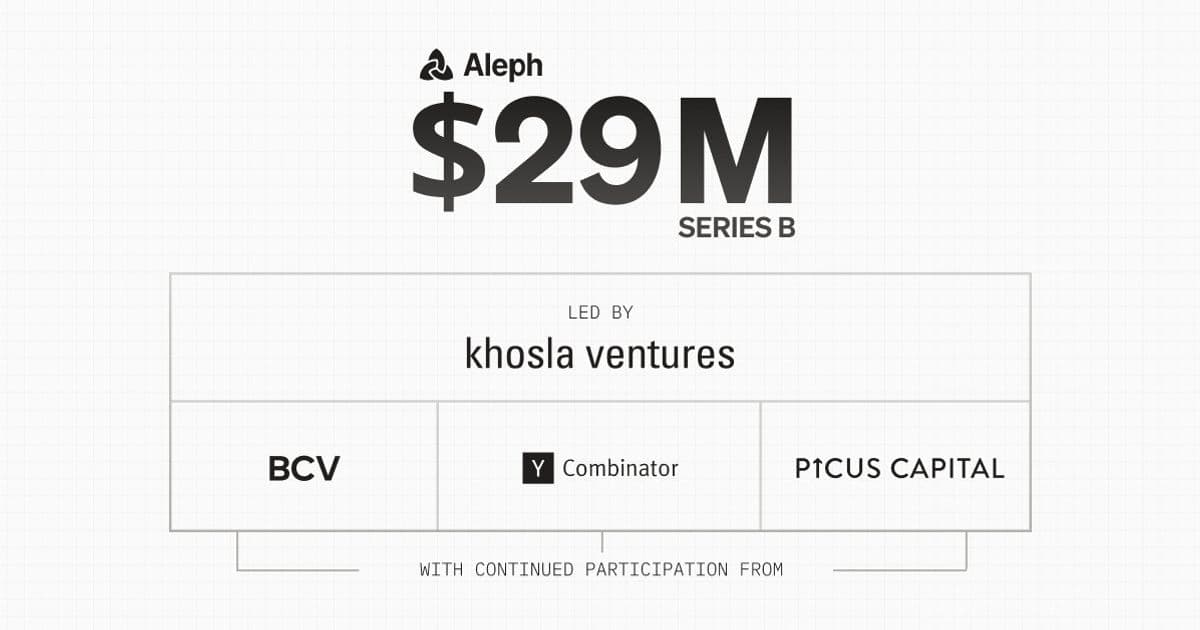

AI-powered FP&A platform Aleph has raised $29 million in Series B funding led by Khosla Ventures, bringing its total funding to $46 million. The investment fuels Aleph's mission to transform financial planning with an AI-native approach built on a unified data foundation, aiming to automate workflows and empower lean finance teams with unprecedented productivity gains.

Finance teams drowning in spreadsheets and fragmented data systems are getting a significant AI-powered lifeline. Aleph, a startup building an AI-native financial planning and analysis (FP&A) platform, today announced a $29 million Series B funding round led by Khosla Ventures. Existing investors Picus Capital, Bain Capital Ventures, and Y Combinator also participated, bringing Aleph's total funding to $46 million. This substantial vote of confidence underscores the growing demand for intelligent solutions that move beyond traditional, cumbersome FP&A tools.

The funding follows explosive growth for Aleph, which claims a 10X increase since its Series A. It now powers FP&A for companies like Zapier, Turo, Harvey, and Chess.com. Crucially, Aleph positions its success not just in user numbers, but in creating "10X finance professionals" – teams shifting from data hunting and spreadsheet consolidation to rapid, confident decision-making powered by a single source of truth.

"Finance teams spend too much time pulling data from different systems and double-checking numbers that should be at their fingertips," stated Kanu Gulati of Khosla Ventures. "Aleph fixes that with a single source of truth that delivers fast, accurate AI-powered insights. As Aleph identifies valuable patterns and trends, it keeps getting smarter, creating a flywheel where AI isn't just a tool but a true team member generating real insights that drive better business decisions."

Building the Foundation: More Than Just Another FP&A Tool

Aleph's journey began with a mission to disrupt the stagnant, multi-billion-dollar FP&A software market. Its core differentiators, established before its AI push, laid the groundwork for its current momentum:

- Speed to Value: Implementing Aleph takes hours, contrasting sharply with legacy tools requiring months of onboarding before usable reports emerge.

- Comprehensive Data Foundation: Aleph emphasizes enterprise-grade data warehousing, giving finance teams no-code control to sync, structure, and access data across systems without needing engineering or data science resources.

- Flexibility & Familiarity: Instead of forcing teams away from spreadsheets, Aleph supercharges them with bi-directional Excel and Google Sheets integrations.

- Scalability: Designed to meet teams at their current stage and scale with them, delivering immediate value that compounds as more workflows are automated.

"We’ve successfully executed against what we originally set out to do," the company stated, citing exceptional win rates against established vendors, near-perfect customer retention, and vocal user advocacy.

The AI-Native Future: Beyond Features to Foundational Intelligence

While the funding validates Aleph's current trajectory, the company is unequivocally betting on AI as the core of FP&A's future. They argue that finance has been slow to adopt AI due to the high stakes involved, where inaccuracies can cost millions. Aleph contends that its robust, unified data foundation uniquely positions it to build the trust required for AI at scale.

Existing features like AI-powered variance analysis demonstrate the practical benefits, saving customers "thousands of hours" by instantly pinpointing financial changes and their root causes. However, Aleph's vision extends far beyond discrete features.

"The real value unlock of AI-native FP&A isn’t a feature; it’s a seamless intelligence layer that automates workflows, surfaces suggestions, provides instant answers, and so much more," the announcement explains. The goal is transformative efficiency: "lean finance teams of one or two now doing that same work that used to take five or six—and these productivity gains continue to multiply as the data gets smarter and smarter."

The $29 million injection is earmarked to accelerate this vision. Aleph plans to double down on its best-of-breed platform and the infusion of intelligence throughout the FP&A workflow. For developers and finance technologists, Aleph's rise signals a significant shift towards platforms where deep data integration and trustworthy, evolving AI become the bedrock of financial operations, fundamentally reshaping team structures and capabilities. The race to build the intelligent finance stack just got hotter.

Source: Aleph Series B Announcement

Comments

Please log in or register to join the discussion