As competitors invest hundreds of billions in AI infrastructure, Apple holds $157B in reserve while betting large language models will become commoditized commodities. The company's strategy leverages its distribution advantage across 2.3B devices and strategic partnerships like Google's Gemini-powered Siri.

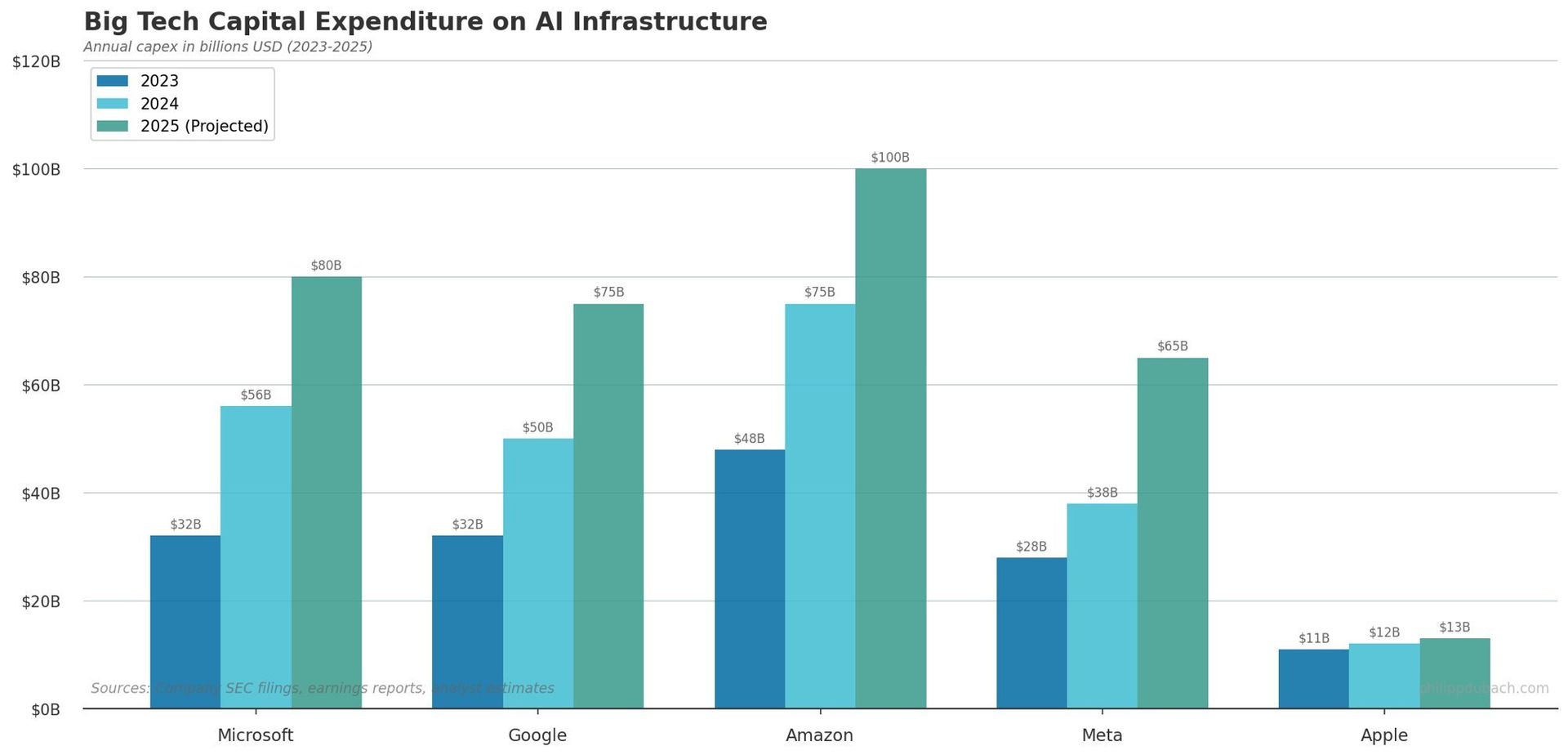

While OpenAI, Google, and Meta collectively pour hundreds of billions into AI infrastructure—with hyperscalers projected to spend $400 billion in 2025 alone—Apple maintains a strikingly different posture. Sitting on $157 billion in cash reserves as of Q4 2025, the Cupertino giant appears to be executing a contrarian strategy: betting that large language models (LLMs) will commoditize, shifting competitive advantage from model superiority to distribution and user experience.

The Commoditization Thesis

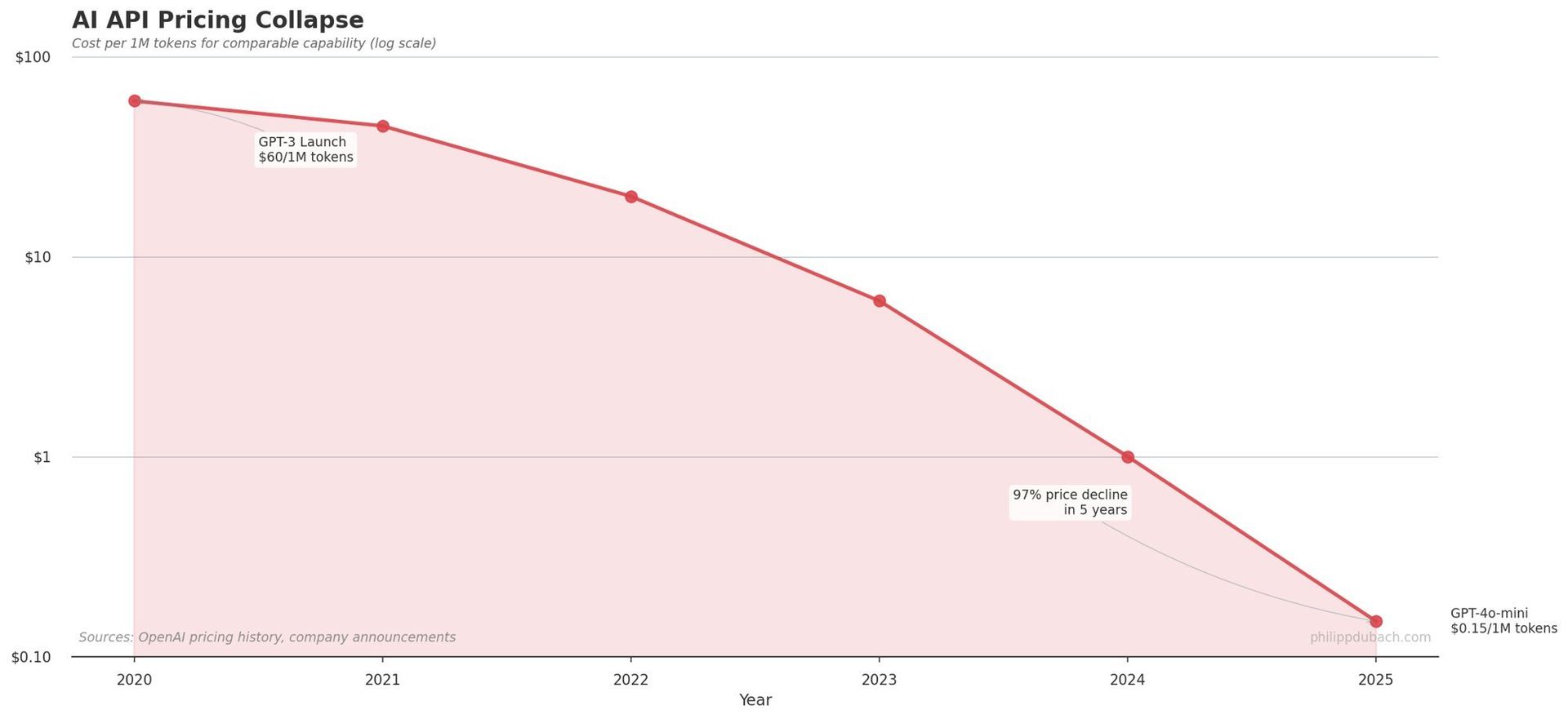

Recent market dynamics lend credence to Apple's position. Since GPT-3's 2020 debut, API pricing has plummeted 97%. Competitors like Anthropic's Claude and Google's Gemini rapidly closed gaps with OpenAI's models, while projects like DeepSeek demonstrated frontier-level capabilities at radically lower costs.

AI API pricing collapse since 2020 (Source: Philipp Dubach)

AI API pricing collapse since 2020 (Source: Philipp Dubach)

"The hyperscaler spending spree resembles historical cycles where capital floods sectors with falling barriers," observes industry analyst Philipp Dubach. "Winners typically emerge through distribution and customer relationships—not R&D budgets."

Apple's Distribution Moats

Apple's playbook mirrors its historical approach:

- Partnerships over ownership: Rather than building its own search engine, Apple took Google's payments for Safari defaults. The Spring 2026 Siri revamp will reportedly run on a custom Google Gemini model via a $1B annual deal.

- Instant deployment: Apple Intelligence features can reach over 2.3 billion active devices overnight via software updates—a scaling advantage that propelled Apple Music past Spotify despite late entry.

- Organizational shifts: John Giannandrea's retirement and Siri's transfer to hardware chief Mike Rockwell signal strategic realignment toward integrated implementation rather than foundational model development.

Risks and Optionality

The strategy isn't without peril. Should a competitor achieve discontinuous capability leaps—making current models appear "toy-like"—Apple could face integration lag. Early reports of performance issues in iOS 26.4 builds underscore execution challenges.

Big Tech AI capital expenditure comparison (Source: Philipp Dubach)

Big Tech AI capital expenditure comparison (Source: Philipp Dubach)

Yet Apple's war chest provides unique flexibility: If startups falter during an AI funding crunch, acquisition opportunities emerge. If breakthroughs occur, resources exist for rapid response. As one enterprise architect noted: "They've preserved optionality while others gamble on technological moats that may prove transient."

The 2026 Siri launch becomes a critical test case—not just for feature performance, but for validating whether value in the AI stack truly migrates toward the consumer touchpoint. Apple's bet hinges on history repeating: that in platform wars, distribution trumps raw technology.

Source: Analysis based on reporting from The Information and Philipp Dubach's technical strategy assessment.

Comments

Please log in or register to join the discussion