Semiconductor equipment giant Applied Materials will pay $252 million for illegally exporting ion implanter systems to SMIC after the Chinese foundry was added to the U.S. Entity List, revealing complex supply chain circumvention tactics.

The U.S. Department of Commerce has imposed a $252 million civil penalty against Applied Materials for exporting advanced semiconductor manufacturing equipment to China's Semiconductor Manufacturing International Corp (SMIC) despite export restrictions. According to the Bureau of Industry and Security (BIS), Applied Materials shipped 56 ion implanter systems and related modules valued at $126 million to SMIC subsidiaries between November 2020 and July 2022—after SMIC's Entity List designation over military end-use concerns.

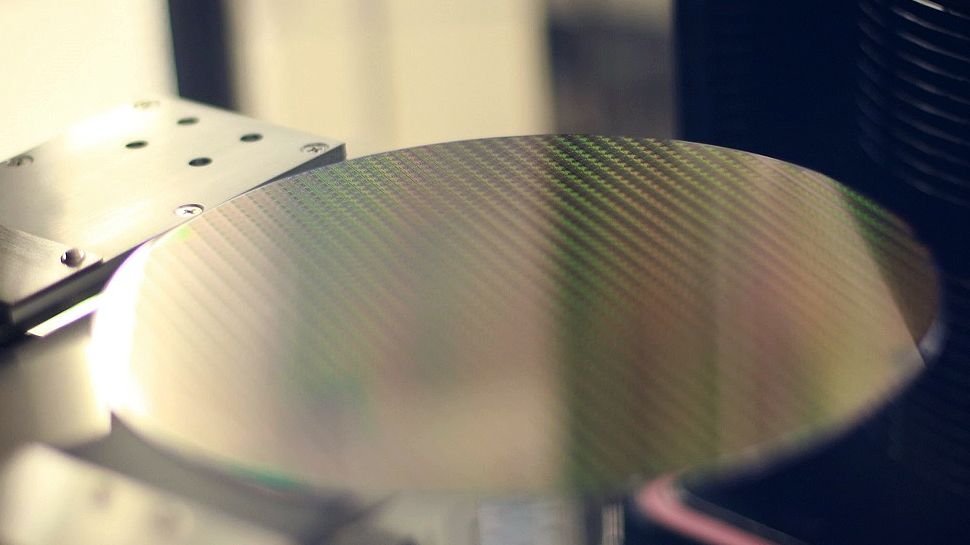

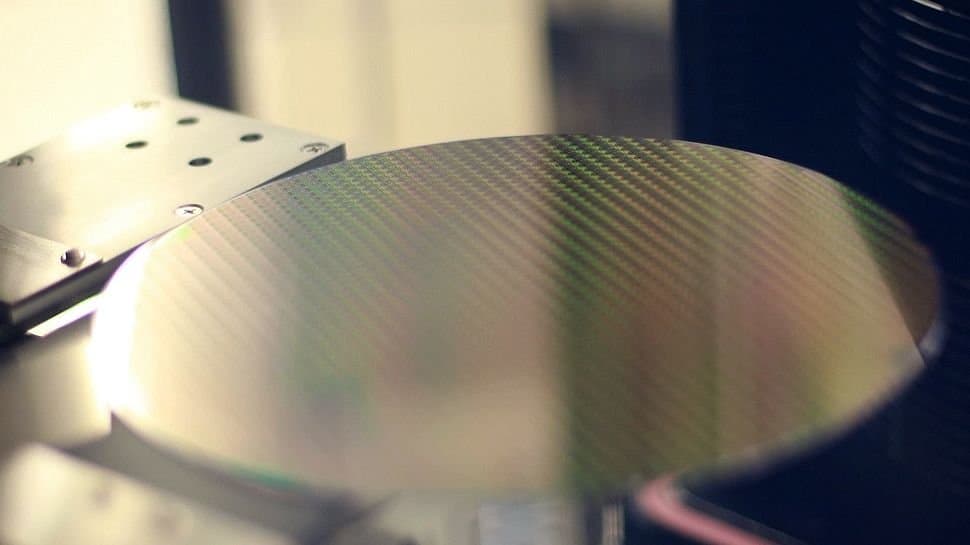

Ion implanters perform critical doping processes during transistor formation by bombarding silicon wafers with charged atoms. These tools operate across mature nodes (28nm+) to advanced nodes (5nm and below), controlling electrical properties in semiconductor materials. While less publicized than extreme ultraviolet (EUV) lithography systems, ion implanters determine transistor performance characteristics including threshold voltage, leakage current, and switching speed. Their precision directly impacts power efficiency and clock frequency in processors.

Image credit: SMIC

Image credit: SMIC

BIS documents reveal Applied Materials implemented a "dual-build" strategy to circumvent restrictions: Systems were partially manufactured in Gloucester, Massachusetts, shipped to South Korea for assembly and testing at Applied Materials Korea facilities, then exported to SMIC's Chinese fabs. Factory interface enclosures were separately routed through Singapore. Internal communications cited by BIS show executives describing urgent efforts to maintain SMIC shipments, with one senior leader directing teams into "hyper drive" immediately after receiving Commerce's September 2020 "is-informed" notice requiring export licenses.

The penalty represents twice the transaction value, the statutory maximum under export control regulations. Commerce also imposed a three-year suspended denial of export privileges, requiring Applied Materials to undergo external audits and annual compliance certifications. While the Department of Justice and Securities and Exchange Commission closed related investigations without action, this settlement ranks among BIS's largest standalone penalties.

For SMIC—China's largest foundry—this enforcement action exacerbates tool acquisition challenges. The company relies on foreign equipment for its 28nm to 7nm production lines, and ion implanters are irreplaceable for establishing doping profiles at any process node. Applied Materials supplies approximately 20% of global ion implantation equipment, competing with Axcelis Technologies and Advanced Ion Beam Technology.

This case highlights escalating semiconductor supply chain tensions. Since 2020, U.S. export controls have progressively restricted Chinese access to sub-14nm logic, 128-layer NAND, and 18nm DRAM technologies. Equipment manufacturers now face heightened compliance burdens when routing components through intermediary countries. With China accelerating domestic equipment development—including ion implantation systems from manufacturers like CETC—the penalty underscores how geopolitical factors increasingly dictate semiconductor manufacturing capabilities worldwide.

For context: Bureau of Industry and Security | Applied Materials | Entity List regulations

Comments

Please log in or register to join the discussion