An exploration of how Bitcoin's mining difficulty adjusts to maintain network stability, and what this reveals about the competitive nature of cryptocurrency mining.

The Bitcoin network operates at an astonishing scale, currently processing approximately one zettahash per second—that's 10^21 hashes every single second. This mind-boggling computational power serves a critical purpose: securing the blockchain by making it prohibitively expensive to attack while simultaneously regulating the rate at which new blocks are added to the chain.

At the heart of this system lies a clever feedback mechanism that adjusts mining difficulty to maintain equilibrium. The network aims to produce a new block approximately every 10 minutes, regardless of how much total computing power is devoted to mining. To achieve this, the difficulty of the proof-of-work puzzle changes every 2,016 blocks—roughly every two weeks. This interval wasn't chosen arbitrarily; 2,016 represents the number of 10-minute blocks that would be produced in exactly two weeks if the network operated perfectly.

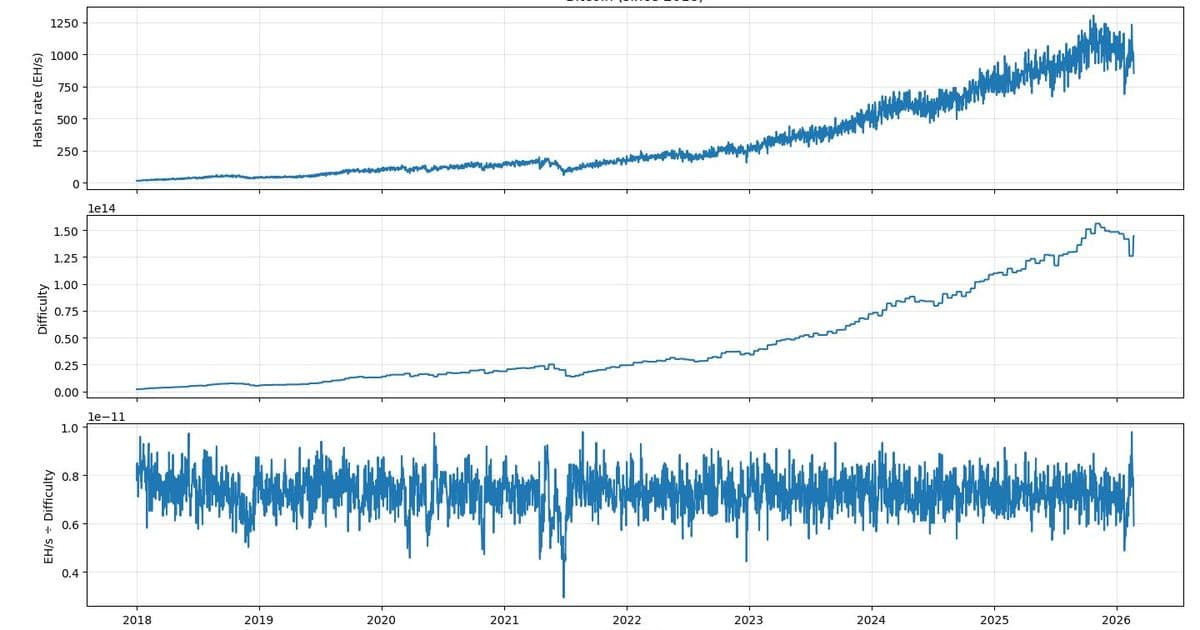

The relationship between hash rate and difficulty reveals fascinating insights about Bitcoin's competitive mining landscape. When we examine the ratio of total network hash rate to mining difficulty, we find it remains remarkably stable over time, with only minor fluctuations that appear as noise in the data. This stability demonstrates the effectiveness of Bitcoin's difficulty adjustment algorithm in maintaining consistent block production rates despite dramatic changes in total network computing power.

However, this stability was dramatically disrupted in mid-2021 when China implemented a sweeping crackdown on Bitcoin mining. The impact was immediate and severe: the network's hash rate plummeted as miners in China were forced to shut down operations. What makes this event particularly instructive is that the difficulty adjustment algorithm couldn't respond instantly. Since difficulty only changes every 2,016 blocks, the network continued operating at the previous, higher difficulty level even though there was significantly less computing power available. This mismatch caused block production to slow considerably until the next difficulty adjustment could occur.

To understand what these numbers mean in practical terms, consider the current mining difficulty of approximately 10^14. This figure represents a multiplier applied to the original mining difficulty, which required finding a hash with 32 leading zeros. At the original difficulty level, this would require an average of 2^32 attempts. With today's difficulty multiplier, the expected number of hashes needed to mine a block rises to approximately 10^14 × 2^32 = 4.3 × 10^23.

During a typical 10-minute block interval, the entire Bitcoin network computes roughly 10^21 × 60 × 10 = 6 × 10^23 hashes. This means that the total computational effort expended by all miners combined is only about 40% greater than what would be required for a single miner to successfully mine a block in isolation. This relatively small margin reveals the intense competition among miners—they're collectively expending enormous resources, but the actual work required to secure the network is surprisingly modest in comparison.

The cryptographic foundation of this system relies on double SHA-256 hashing. Each "Bitcoin hash" consists of applying the SHA-256 function twice in succession: SHA-256(SHA-256(x)). This double hashing provides additional security against certain types of cryptographic attacks and ensures that the proof-of-work puzzle remains computationally intensive enough to deter malicious actors.

This delicate balance between hash rate and difficulty illustrates a fundamental principle of Bitcoin's design: the network must be difficult enough to secure against attacks but efficient enough to remain economically viable for honest participants. The 40% excess computational power represents the margin that ensures network security while accounting for the reality that mining is a competitive, profit-driven activity. Miners race against each other, and only one succeeds every 10 minutes, but their collective efforts provide the security that makes Bitcoin valuable in the first place.

The system's resilience was tested during the Chinese mining ban, yet it adapted and recovered. Hash rate gradually redistributed globally as miners relocated to more favorable jurisdictions, and the difficulty adjustment algorithm eventually restored equilibrium. This episode demonstrated that while Bitcoin's mining ecosystem can experience significant shocks, its fundamental mechanisms for self-regulation remain robust.

Understanding these dynamics provides crucial insight into Bitcoin's security model. The network doesn't require an infinite amount of computational power—just enough to make attacks economically irrational while maintaining steady block production. The competition among miners, while intense, serves a purpose: it ensures that the network remains secure without requiring centralized coordination or trust in any single entity. In this way, the relationship between hash rate and difficulty embodies Bitcoin's core innovation: creating trust through mathematics and economics rather than through institutional authority.

Comments

Please log in or register to join the discussion