Compact camera sales surged 29.6% in 2025 while smartphone growth slowed to just 2%, marking a reversal of the decade-long decline in dedicated photography devices.

For years, the conventional wisdom held that smartphones would completely eliminate the need for compact cameras. The data seemed to support this narrative – after peaking at 29.6 million units sold in 2014, compact camera sales plummeted to a mere 1.7 million by 2023. But according to the latest figures from the Camera & Imaging Products Association (CIPA), this downward spiral has finally reversed.

In 2025, compact camera sales reached 2.3 million units, representing a remarkable 29.6% year-over-year increase. This growth occurred even as the smartphone market managed only a modest 2% expansion during the same period. The resurgence of dedicated cameras suggests that despite the incredible convenience of smartphones, many consumers still value the unique capabilities that purpose-built photography equipment provides.

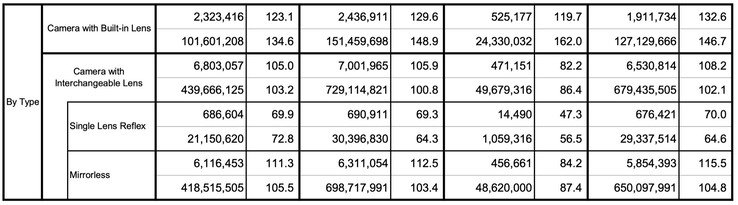

The broader camera market also showed signs of recovery. Mirrorless camera sales reached 6.1 million units in 2025, while DSLR sales totaled 690,000 units. The latter figure continues a long-term decline that shouldn't surprise anyone – major manufacturers like Canon and Nikon have been aggressively shifting their focus to mirrorless systems for years. Nikon's Z6 III, for example, starts at $2,097 on Amazon and represents the company's commitment to mirrorless technology.

However, even with this recent growth, the camera industry remains far from its glory days. The 9.44 million total camera units sold in 2025 pale in comparison to the 121 million units shipped during the market's peak year of 2010. This represents a market that has shrunk to less than 8% of its former size, though the recent positive momentum offers hope for stabilization.

Full-frame camera shipments showed modest growth of 1.9% year-over-year, while interchangeable-lens cameras with smaller sensors recorded a more substantial 8.4% increase. This suggests that both professional and enthusiast segments of the market are finding reasons to invest in dedicated camera equipment again.

Geographically, the United States led the market with 2.34 million camera sales, followed closely by China at 2.26 million and Europe at 2.11 million. Importantly, sales increased across all regions, indicating a genuinely global trend rather than isolated market recoveries.

This marks the first time since 2007 that global camera sales have experienced two consecutive years of growth. Whether this trend will continue into 2026 remains uncertain, particularly given the challenging economic climate and the ongoing DRAM crisis affecting various technology sectors.

The comeback of compact cameras raises interesting questions about consumer preferences in an age of ubiquitous smartphone photography. While smartphones offer unparalleled convenience and have made photography accessible to billions, dedicated cameras still provide superior image quality, better ergonomics, and more creative control. The 29.6% growth in compact camera sales suggests that many consumers are willing to carry a second device when the photographic results justify the inconvenience.

This trend could accelerate if camera manufacturers continue to innovate with features that smartphones struggle to replicate, such as optical zoom ranges, larger sensors, and specialized shooting modes. The camera industry's ability to carve out a sustainable niche in the smartphone era will depend on its success in emphasizing these unique advantages while maintaining competitive pricing.

The data from CIPA provides a fascinating counterpoint to the dominant narrative about smartphone dominance in photography. While smartphones remain the primary camera for most people, the resurgence of compact cameras demonstrates that there's still a significant market for dedicated photography equipment among enthusiasts and professionals who demand higher quality and more creative possibilities than smartphones can currently deliver.

Comments

Please log in or register to join the discussion