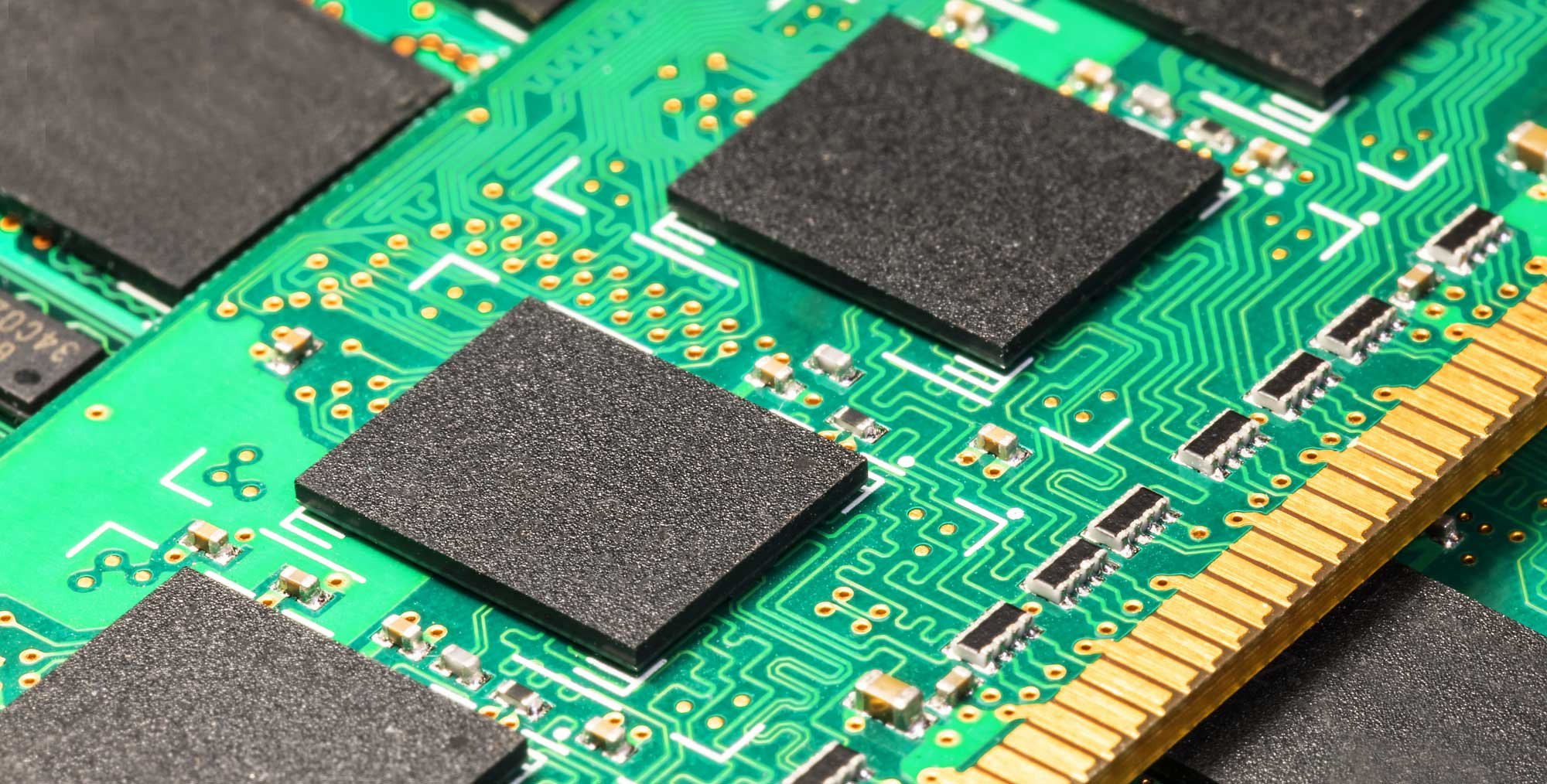

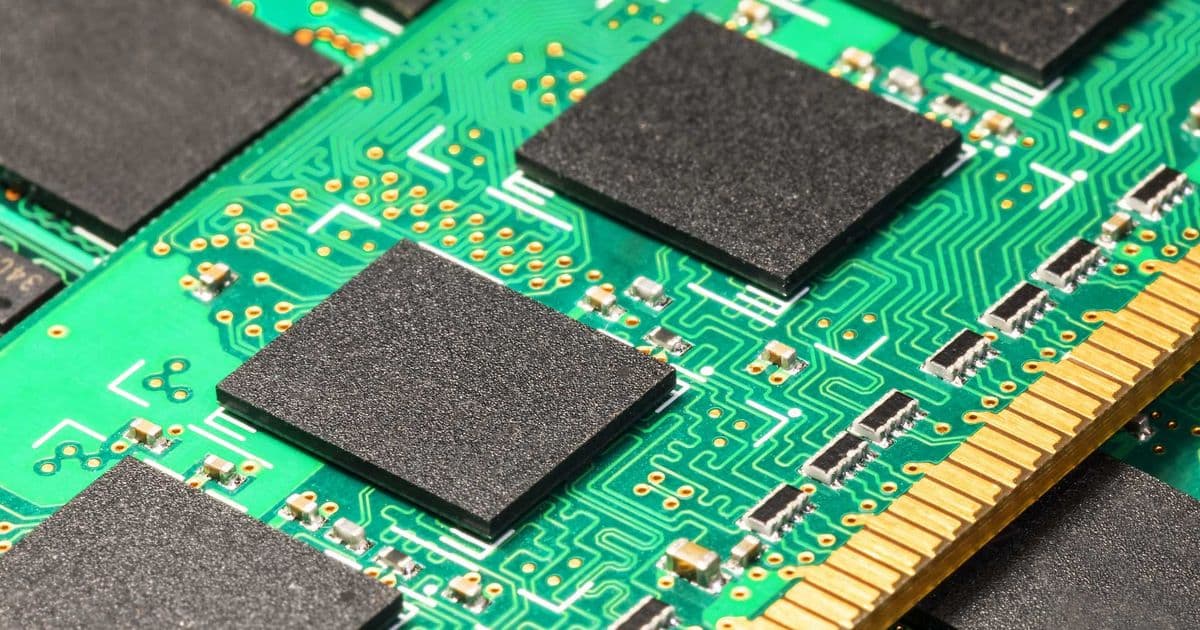

A global memory shortage is forcing cybersecurity vendors to confront rising component costs, with analysts predicting higher prices for next-generation firewall hardware in 2026.

The cybersecurity hardware market is facing a significant supply chain challenge as a global DRAM shortage drives up the cost of memory components used in network security appliances. According to research from Wedbush, this shortage is expected to push prices higher for firewalls and other security hardware throughout 2026, affecting both vendors and their customers.

Market Impact and Vendor Exposure

Wedbush analysts, following a channel-check conversation with Jim Gruzlewski of consultancy SecureX, identified Fortinet, Check Point, and Palo Alto Networks as the vendors most likely to face challenges mitigating memory costs in their best-selling products. These companies dominate the security hardware appliance market, with Palo Alto Networks and Fortinet leading in market share and revenue according to IDC data. Check Point ranks fourth globally, trailing Cisco.

The financial impact is already visible in recent earnings reports. Fortinet reported gross margins of 81.6 percent in its most recent November quarter, down from 83.2 percent during the same period last year. The company issued guidance expecting margins to fall further to 79-80 percent in the next quarter. Palo Alto Networks reported product gross margins of 76.9 percent in November, compared to 78 percent a year earlier, though the company does not provide forward guidance on margins.

Inventory Strategy and Price Adjustments

Different vendors are taking varied approaches to managing the DRAM cost pressure. Wedbush analysts noted that Palo Alto Networks may be in the strongest position to weather the storm due to its larger DRAM inventory holdings. The company reportedly front-loaded its inventory purchases, which could lessen the immediate impact of rising memory prices.

Check Point has taken a more direct approach by raising prices to offset costs. According to Wedbush, the company implemented a 5 percent price increase across its quantum business, which successfully offset DRAM-related cost pressures in that segment. However, analysts warn that the pricing issue is expected to have a larger impact moving into 2026 rather than in the final quarter of 2025, as more next-generation firewall buildouts continue.

Component Cost Trajectory

The DRAM market has experienced extreme price volatility recently. Reports from the Korea Economic Daily indicate that two major South Korean DRAM producers plan to raise prices by up to 70 percent this quarter. This follows a 50 percent increase during 2025, potentially doubling memory costs year-over-year by mid-2026.

Market watcher TrendForce reports that conventional DRAM prices already jumped 55 to 60 percent in a single quarter, reflecting the severity of the supply crunch. The shortage stems from multiple factors including increased demand from AI chip manufacturing, PC and datacenter production, and constrained supply capacity.

What This Means for Network Security Infrastructure

For organizations planning network security upgrades or building next-generation firewall systems, the Wedbush analysis suggests budgeting for higher hardware costs. The bill of materials for security appliances is rising, and vendors will likely pass these costs through to customers. The impact may be most pronounced for organizations deploying large-scale firewall deployments or those requiring high-memory configurations for advanced threat detection and processing capabilities.

The memory shortage also highlights the broader dependency of cybersecurity hardware on commodity component markets. Just as PC and datacenter manufacturers have struggled with DRAM pricing, security appliance vendors face similar supply chain constraints that directly affect their product costs and margins.

Organizations may need to consider timing their hardware purchases strategically or exploring alternative deployment models, such as virtual firewalls or cloud-based security services, which may be less affected by physical component costs. However, the transition to alternative deployment models involves its own considerations around performance, compliance requirements, and operational complexity.

The DRAM shortage appears to be a structural market issue rather than a temporary disruption, meaning elevated memory prices and their impact on security hardware costs are likely to persist through 2026 and potentially beyond.

Comments

Please log in or register to join the discussion