GlobalFoundries' acquisition of Synopsys's ARC and RISC-V IP portfolio marks its second CPU IP purchase in under a year, transforming the pure-play foundry into a platform provider with integrated design-to-manufacturing capabilities.

GlobalFoundries has finalized a definitive agreement to acquire Synopsys's Processor IP Solutions business, a move that adds ARC and RISC-V processor cores to its growing portfolio and solidifies its strategy of moving beyond pure-play manufacturing. This is the company's fifth major acquisition in eighteen months, following its purchase of MIPS last year, and signals a deliberate shift toward offering a vertically integrated solution for custom silicon development.

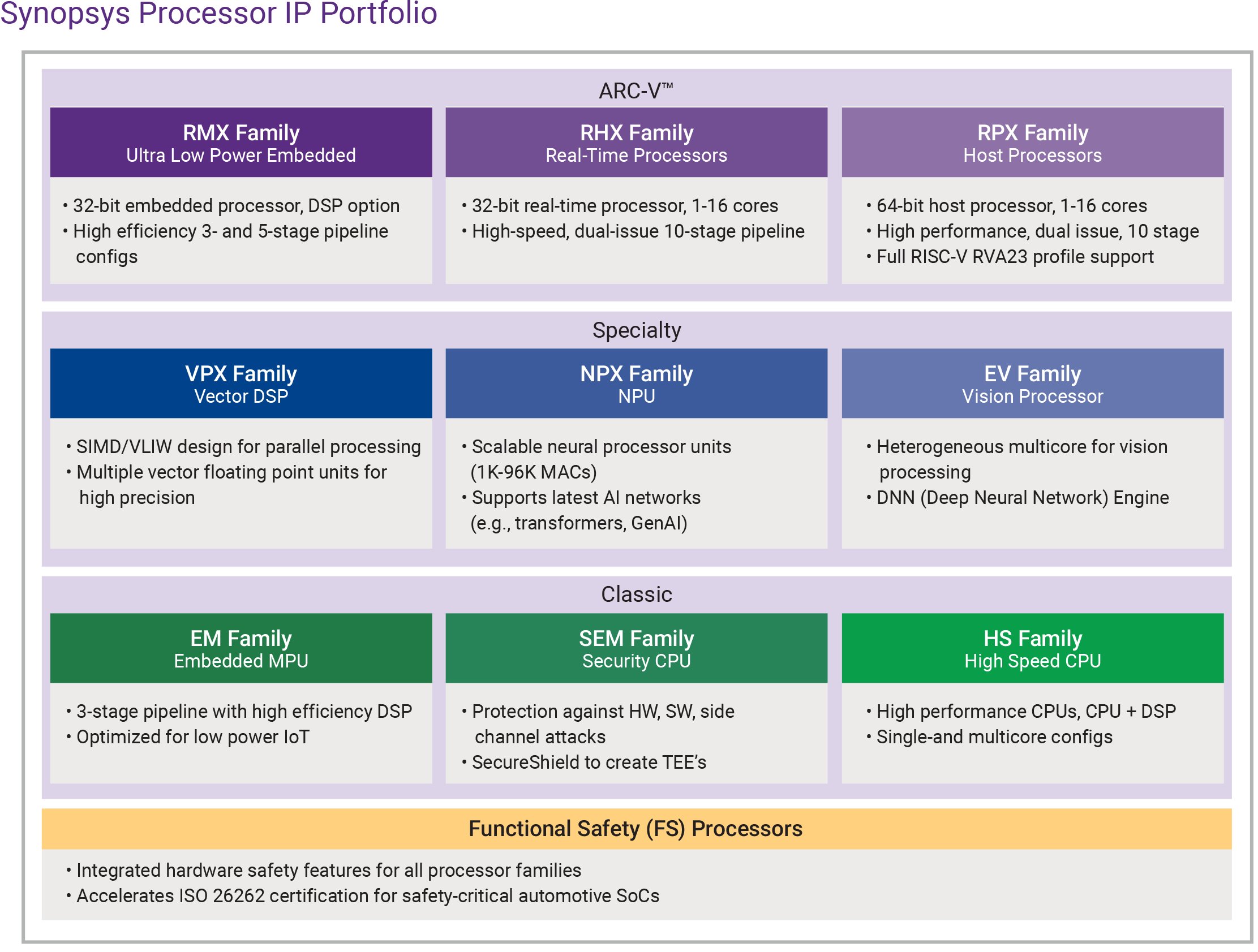

The deal brings a comprehensive suite of processor IP under the GlobalFoundries umbrella, including ARC-V (RISC-V) cores, classic ARC CPU cores, DSPs, and NPU IP built on the ARC framework. Critically, it also includes the associated software ecosystem, such as the ARC MetaWare development toolkits and Synopsys's ASIP Designer and ASIP Programmer toolchains. These tools automate the creation of Application-Specific Instruction-Set Processors (ASIPs), allowing designers to integrate base CPU cores with custom instructions, pipelines, or accelerators that are immediately supported by a compiler.

The acquisition is expected to close in the second half of the year, with both companies committing to a coordinated transition plan to ensure existing Synopsys IP customers experience no disruption. Upon closing, all assets and expert teams will be integrated into MIPS, which operates as a separate entity within GlobalFoundries. This structure allows MIPS to license IP to companies that do not use GlobalFoundries' manufacturing services, maintaining the IP's market reach.

The Strategic Value of ARC and RISC-V

The combination of RISC-V and ARC addresses two distinct but complementary needs in the embedded and specialized computing markets. RISC-V provides an open, extensible instruction set architecture (ISA) with a growing ecosystem of open-source software, offering customers freedom from proprietary licensing models. ARC, on the other hand, is renowned for its configurability. Unlike fixed-architecture CPUs, ARC allows designers to modify the datapath and add custom instructions tailored to specific workloads, making it ideal for ASIPs.

This configurability is key to ARC's value proposition. By building an ASIP around a specific workload, developers can achieve higher performance-per-watt efficiency and more predictable performance compared to using off-the-shelf CPU cores. For applications in automotive, embedded systems, industrial IoT, and wearables—where specialization often trumps peak performance—this capability is a significant advantage.

GlobalFoundries' goal is to deliver a comprehensive processor IP suite that spans from general-purpose RISC-V cores to specialized DSPs and NPUs. By bundling these IPs with its manufacturing and packaging services, the company aims to reduce adoption barriers and accelerate time-to-market for its customers. This is particularly valuable for fabless companies that lack the internal resources to assemble a full compute stack from scratch, traditionally licensing IP from multiple vendors before mapping designs onto a foundry's process technology.

Building a Cohesive Ecosystem

The integration of ARC and MIPS IP with GlobalFoundries' process technologies, packaging options, and verification flows is a critical step in the company's strategy. This alignment reduces incompatibilities between architectural intent and physical implementation, a common challenge when IP and manufacturing are sourced from different entities. For customers, this means access to silicon-proven IP blocks that are optimized for GlobalFoundries' fabrication processes, leading to more predictable yields and faster development cycles.

This approach mirrors the ecosystems offered by competitors like TSMC's Open Innovation Platform (OIP) and Arm's extensive IP portfolio. However, GlobalFoundries differentiates itself by offering a tightly integrated path from architecture to silicon, with the added flexibility of RISC-V and the customization capabilities of ARC. For customers operating under export controls or seeking sovereign chip designs, this integrated model provides a policy-resilient alternative to proprietary architectures like Arm.

Reshaping the Foundry Model

GlobalFoundries' acquisition spree reflects a broader trend in the semiconductor industry: the blurring of lines between pure-play foundries and integrated device manufacturers (IDMs). By combining manufacturing capability with in-house processor IP, GlobalFoundries is positioning itself as a platform partner rather than just a fabricator. This strategy targets emerging applications in automotive, physical AI, and industrial markets, where the demand for custom silicon is growing.

The company's location of fabs in Asia, Europe, and the U.S. further strengthens this value proposition, offering geographic diversity that can be attractive to customers with supply chain security concerns. The integration of ARC and RISC-V IP also opens opportunities with newly established fabless designers with limited budgets, as well as clients requiring customized accelerators without the overhead of negotiating with proprietary IP vendors.

What Comes Next?

With two CPU IP acquisitions in less than a year, the logical next steps for GlobalFoundries would be to deepen its platform with adjacent technologies. Potential targets could include controller, connectivity, and security IP to further simplify chip development for clients. Another possibility is acquiring IP focused on advanced packaging, which is becoming increasingly critical for performance and power efficiency in modern designs.

A less likely but plausible move would be to acquire domain-specific accelerator IP for particular applications, though the company has so far focused on general-purpose IP with broad applicability. Alternatively, GlobalFoundries could pursue software or middleware assets for automotive, embedded, or industrial applications, offering customers a complete solution that includes both silicon-proven hardware and functionally safe software.

Implications for the Market

GlobalFoundries' transformation from a pure-play foundry to a platform provider has significant implications for the semiconductor industry. By offering an integrated suite of IP, manufacturing, and packaging, the company reduces the complexity and time required for customers to bring custom silicon to market. This could attract a new segment of customers who previously found the process too daunting or expensive.

Moreover, the emphasis on RISC-V and configurable IP aligns with the industry's move toward open standards and customization. As more applications demand specialized processing, the ability to tailor hardware to specific workloads becomes a competitive advantage. GlobalFoundries' strategy positions it to capitalize on this trend, potentially capturing market share from both traditional foundries and IP vendors.

In summary, GlobalFoundries' acquisition of Synopsys's processor IP is a calculated expansion of its value proposition. By integrating IP, software tools, and manufacturing under one roof, the company is creating a platform that could accelerate the development of custom silicon for a wide range of emerging applications. As the semiconductor industry continues to evolve, this move may well redefine the role of the pure-play foundry.

Comments

Please log in or register to join the discussion