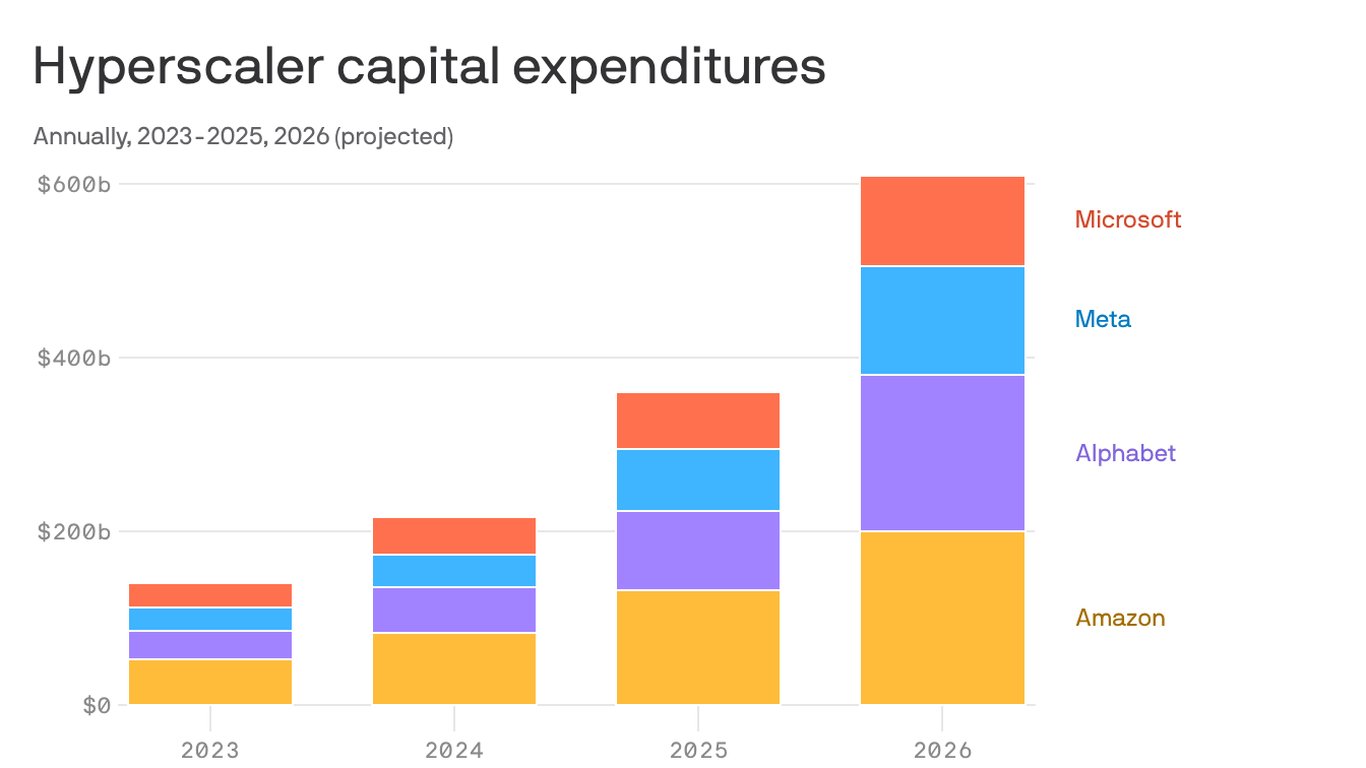

Driven by massive investments in AI and cloud infrastructure, the four largest tech companies are set to collectively spend over $600 billion this year, reshaping the competitive landscape of the tech industry.

The collective capital expenditure of tech giants Google, Meta, Microsoft, and Amazon is projected to surpass $600 billion in the current fiscal year, according to industry analysis. This unprecedented level of investment underscores the intensifying race to dominate cloud computing and artificial intelligence infrastructure.

Hyperscalers, the dominant providers of cloud infrastructure, are expanding their global data center footprint at a rapid pace. The $600 billion spending mark represents a 20% year-over-year increase from 2023's estimated $500 billion collective expenditure. This acceleration is primarily fueled by generative AI development, which requires specialized hardware like NVIDIA's H100 GPUs and custom AI accelerators. Amazon leads in absolute spending due to AWS's market dominance, followed by Microsoft Azure, Google Cloud Platform, and Meta's AI research initiatives.

Three strategic drivers underpin this spending surge:

- AI Infrastructure Arms Race: Each company is deploying capital to secure scarce AI chips and develop proprietary silicon. Microsoft's Maia AI chips and Amazon's Trainium processors represent efforts to reduce reliance on third-party suppliers.

- Cloud Region Expansion: 78 new cloud regions are planned globally through 2025, with particular focus on secondary markets like Ohio, Arizona, and international hubs in Southeast Asia.

- Energy Infrastructure: Data center power requirements have increased 300% since 2020, prompting investments in nuclear-powered facilities and renewable energy projects to manage operational costs.

The capital allocation carries significant market implications. Hyperscalers' scale creates nearly insurmountable barriers for competitors, potentially consolidating 85% of the cloud infrastructure market among these four players. Meanwhile, semiconductor manufacturers like TSMC and Samsung benefit from sustained demand, with advanced packaging orders increasing 40% quarter-over-quarter. However, smaller cloud providers face margin pressure, forcing strategic pivots toward specialized services.

Investors monitor these expenditures for signals about future revenue streams. Each dollar invested in AI infrastructure typically generates $3-4 in cloud services revenue within 18 months, according to recent analyst models. The spending surge also signals confidence in sustained enterprise cloud adoption, particularly as AI workloads transition from experimentation to production environments.

This investment cycle presents both opportunities and challenges. While accelerating AI capabilities and cloud service innovation, the concentration of infrastructure ownership raises regulatory concerns. The European Union's Digital Markets Act now designates all four companies as "gatekeepers," subjecting their operations to increased scrutiny. Additionally, the environmental impact of data center expansion remains contentious, though all four companies maintain carbon-neutral commitments through renewable energy investments.

As hyperscaler spending eclipses the GDP of medium-sized economies, the tech industry's center of gravity shifts decisively toward infrastructure ownership. The companies controlling these assets will likely dictate the pace of AI adoption and cloud innovation through the remainder of the decade.

Comments

Please log in or register to join the discussion