India's home services market is projected to expand 60% to $95 billion by 2030, driven by app-based platforms like Urban Company and Insta Help that are transforming how millions access domestic help.

India's home services market is experiencing explosive growth, with app-based housekeeping platforms rapidly transforming how millions of urban households access domestic help. The sector, projected to expand 60% to 8.58 trillion rupees ($95 billion) by 2030, represents one of the fastest-growing segments in India's digital economy.

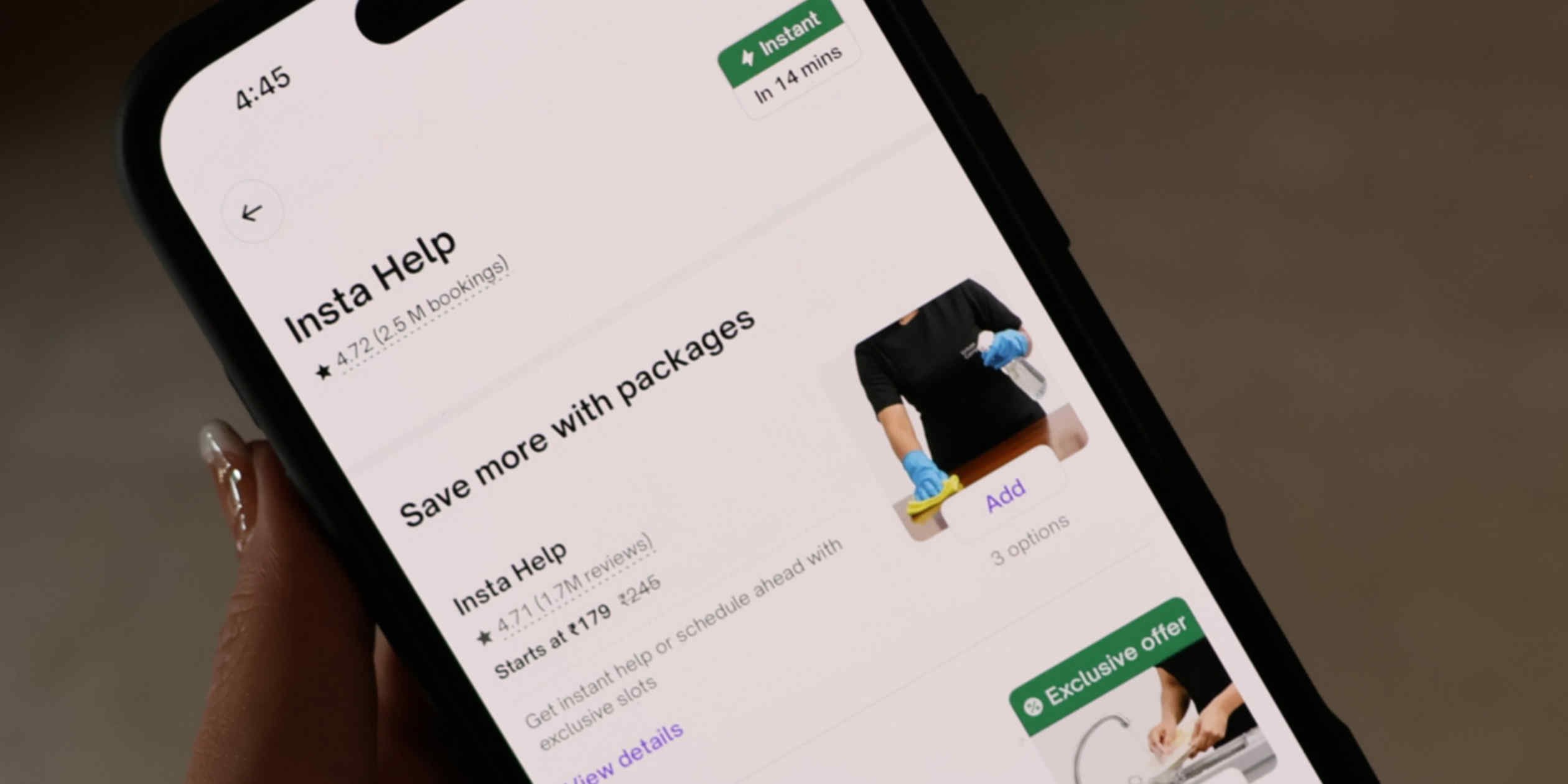

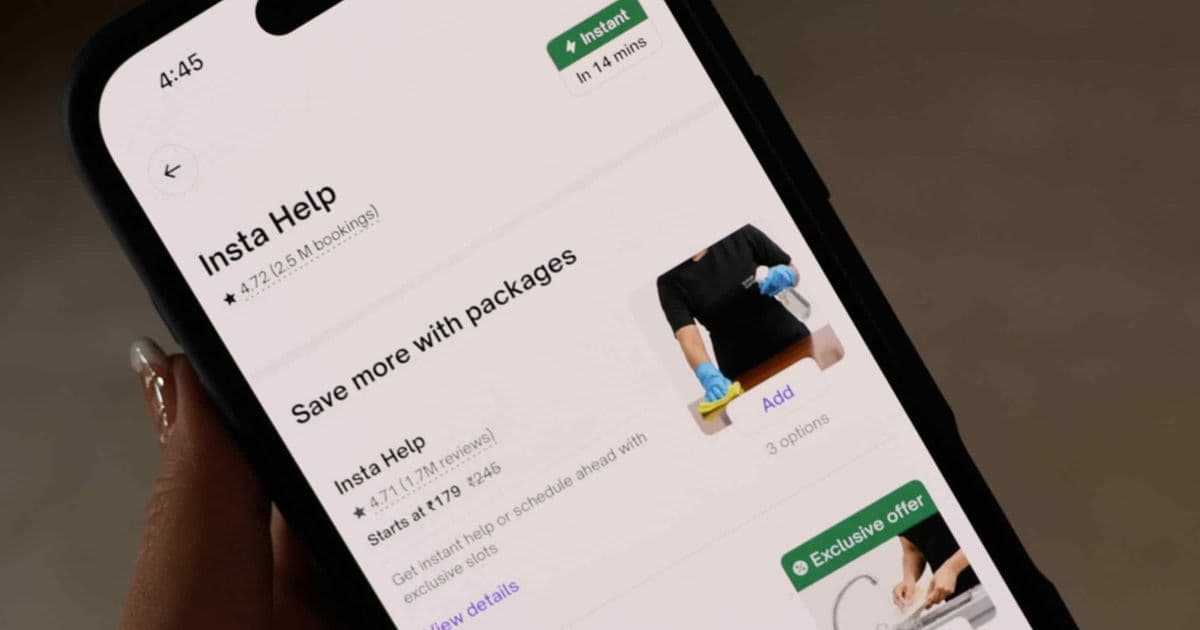

Leading platforms like Urban Company and Insta Help are at the forefront of this transformation. During the October-December quarter alone, Insta Help recorded 1.61 million orders, demonstrating the massive scale of demand for on-demand home services. These platforms have successfully tapped into urban India's growing appetite for convenience and reliability in domestic help.

The Digital Transformation of Domestic Work

The rise of housekeeping apps addresses several longstanding challenges in India's informal domestic worker sector. Traditional hiring methods often involved unreliable referrals, inconsistent quality, and lack of accountability. Digital platforms have introduced standardization, background verification, and customer ratings that were previously absent from this market.

Urban Company, one of the pioneers in this space, has expanded beyond basic cleaning to offer a comprehensive suite of home services including plumbing, electrical work, beauty services, and appliance repair. This diversification strategy has helped the company build deeper relationships with customers while creating more earning opportunities for service professionals.

Market Dynamics and Competition

The competitive landscape is intensifying as new players enter the market. While established platforms like Urban Company have first-mover advantage, newer entrants are focusing on specific niches or geographic regions to gain market share. The success of these platforms has attracted significant investor interest, with several companies raising substantial funding rounds to fuel expansion.

This growth comes amid broader trends in India's digital economy. The country's world-leading mobile payment network and increasing smartphone penetration have created ideal conditions for app-based service delivery. Urban consumers, particularly millennials and Gen Z, show strong preference for digital solutions that save time and offer convenience.

Economic and Social Implications

The formalization of domestic work through digital platforms has significant economic implications. By bringing informal workers into a structured system with ratings, payments, and professional development opportunities, these platforms are creating new pathways for economic mobility. Service professionals can build reputations, access steady work, and potentially earn higher incomes than through traditional arrangements.

However, this transformation also raises questions about worker rights and protections. As India pushes forward with gig economy reforms, the home services sector faces scrutiny over issues like minimum wages, insurance coverage, and job security for platform workers. The balance between flexibility and worker protections remains a key challenge for the industry.

Future Growth Drivers

Several factors will drive continued expansion of India's home services market. Rapid urbanization is creating new demand as nuclear families in cities seek convenient solutions for household chores. Rising disposable incomes, particularly in tier-2 and tier-3 cities, are expanding the addressable market beyond major metropolitan areas.

The integration of advanced technologies like AI for matching services, IoT for smart home integration, and data analytics for personalized offerings will further enhance platform capabilities. Some companies are already experimenting with subscription models and bundled services to increase customer lifetime value.

Challenges and Opportunities

Despite the positive outlook, the sector faces several challenges. Building trust remains crucial, as customers entrust platforms with access to their homes. Quality control across a distributed workforce requires sophisticated training and monitoring systems. Competition for both customers and service professionals is intensifying, potentially leading to price pressures.

Geographic expansion presents both opportunities and challenges. While tier-1 cities offer dense markets with high purchasing power, expanding to smaller cities requires different approaches to pricing, service offerings, and customer acquisition. Some platforms are developing hybrid models that combine digital booking with local partnerships to serve diverse markets effectively.

The Path Forward

As India's home services market approaches the $100 billion mark, the next phase of growth will likely focus on deepening penetration in existing markets while expanding to new geographies. The most successful platforms will be those that can balance scale with quality, technology with human touch, and growth with sustainability.

The transformation of India's domestic help sector through digital platforms represents a broader shift in how services are delivered and consumed in emerging markets. By addressing fundamental pain points in traditional service delivery while leveraging technology for scale and efficiency, housekeeping apps are creating a new paradigm for home services that could serve as a model for other developing economies.

Featured image: The rapid growth of India's home services market is being driven by app-based platforms that are transforming how millions access domestic help.

Comments

Please log in or register to join the discussion