Intel and SoftBank subsidiary Saimemory have partnered to develop Z-Angle Memory (ZAM), a vertically-stacked memory technology designed to compete with HBM by offering 2-3x more capacity, greater bandwidth, and half the power consumption.

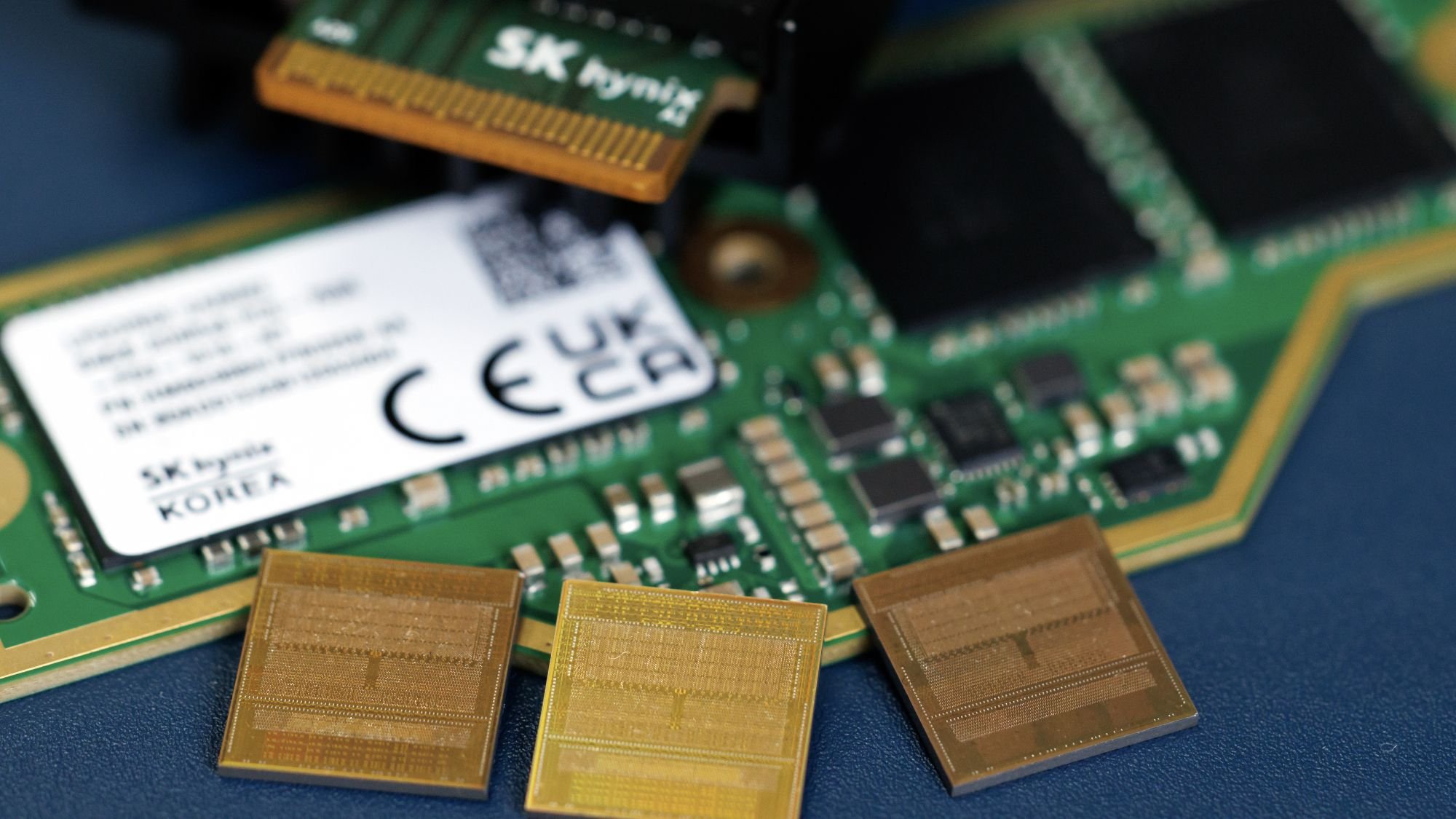

Intel and SoftBank subsidiary Saimemory have signed a collaborative agreement to develop Z-Angle Memory (ZAM), a next-generation vertically-stacked memory technology designed to compete with High Bandwidth Memory (HBM) in AI data centers. This partnership marks Intel's return to the memory market for the first time since the 1980s and represents Japan's first attempt at cutting-edge memory production in decades.

What is Z-Angle Memory?

ZAM is engineered to deliver two to three times the capacity of HBM while operating at as little as half the power consumption and being up to 60% cheaper to produce, according to Nikkei. The technology achieves these improvements through innovative vertical stacking of DRAM chips combined with Intel's Embedded Multi-Die Interconnect Bridge (EMIB) to reduce latency between individual chips.

The development builds on Intel's Next Generation DRAM Bonding (NGDB) initiative, which was part of the Advanced Memory Technology R&D program managed by the U.S. Department of Energy and National Nuclear Security Administration through Sandia National Laboratory. This program recognized that while HBM offers impressive bandwidth, it trades that advantage for lower capacity and weaker power efficiency.

Dr. Joshua Fryman, Intel Fellow and CTO of Intel Government Technologies, explained the motivation behind ZAM: "Standard memory architectures aren't meeting AI needs, so NGDB defined a whole new approach to accelerate us through the next decade."

Technical Innovation

The development of ZAM required designing a new stacking approach and a different way of organizing DRAM chips. Early prototypes confirmed that capacity could be increased through these new stacking techniques, while recent developments have demonstrated that the necessary high performance is achievable.

Gwen Voskuilen, principal member of technical staff at Sandia, highlighted the significance of this advancement: "This is an exciting technology that we anticipate will lead to a wider adoption of higher bandwidth memories in systems that are currently unable to take advantage of high bandwidth memory due to its limited capacity and power constraints."

Strategic Partnership and Timeline

Saimemory, though owned by SoftBank, was originally a joint development between Intel and SoftBank. The two companies began building a prototype of this new memory standard in mid-2025, leveraging Intel's packaging technologies and key Japanese patents.

The partnership has already attracted additional industry support. Companies cooperating on ZAM's design, development, and manufacture include Japanese IT hardware and services firm Fujitsu, PowerChip Semiconductor Manufacturing (the recent Micron acquisition), Shinko Electric Industries, and the University of Tokyo.

Saimemory plans to produce its first ZAM prototype in 2027, with mass production line development targeted for 2029. This timeline reflects the long-term strategic nature of the project rather than an immediate market disruption.

Market Implications

This venture represents more than just a technical advancement in memory technology. It signals Intel's strategic return to the memory market and Japan's re-emergence as a potential player in cutting-edge memory manufacturing. Japan was a major memory manufacturing region in the 1980s but lost prominence as Korean and Taiwanese manufacturers gained dominance.

SoftBank views this initiative as part of its strategy to support next-generation social infrastructure. In its release, the company stated that "SAIMEMORY's development of next-generation memory technologies represents one of SoftBank's key initiatives to support next-generation social infrastructure."

By collaborating with Intel and other technology partners and research institutions in Japan and abroad, SoftBank aims to contribute to the creation of advanced, homegrown semiconductor technologies and strengthen Japan's global competitiveness.

The Broader Context

The development of ZAM reflects the growing recognition that access to advanced memory technologies is becoming a strategic asset, similar to how access to silicon, rare earth materials, and other critical components are increasingly viewed as important for strategic defense. There's an argument that these technologies are also keystones in developing the components for social change in the coming decades and the partnerships that will enable it.

For Intel, this partnership represents a diversification strategy beyond its traditional CPU and GPU markets. For SoftBank, it's an opportunity to rebuild Japan's semiconductor industry and position the country as a key player in the next generation of memory technology. For the broader industry, ZAM could potentially reshape the competitive landscape of high-performance memory solutions for AI data centers.

As the world scrambles for more memory to power increasingly complex AI workloads, both SoftBank and Intel see a clear opportunity to provide solutions that address the limitations of current HBM technology while offering significant improvements in capacity, power efficiency, and cost-effectiveness.

Comments

Please log in or register to join the discussion