A severe memory shortage is poised to stunt PC shipments in 2026 as chip manufacturers reallocate production capacity toward high-margin AI server components, driving mainstream memory costs up 40-70% and forcing PC vendors to either raise prices significantly or ship underpowered configurations.

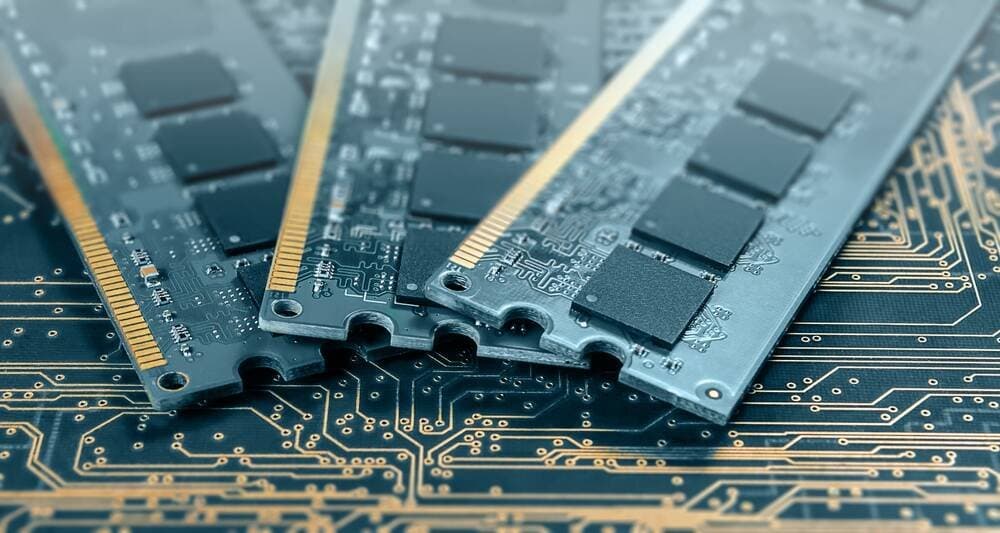

The PC industry faces a critical supply constraint in 2026 as memory manufacturers shift production capacity away from mainstream DDR memory toward high-bandwidth memory (HBM) and server DRAM required for AI infrastructure. This reallocation is creating a severe shortage that will impact consumer and business PC availability throughout the year.

The Memory Supply Crisis

Memory and storage costs for mainstream PCs rose between 40 and 70 percent during 2025, according to Omdia Principal Analyst Ben Yeh. This dramatic price increase occurred as memory chip manufacturers deliberately reduced production of standard desktop and laptop memory in favor of components that deliver higher profit margins.

The primary driver is the explosive demand for AI servers and accelerators. These systems require specialized memory types—specifically High Bandwidth Memory (HBM) and server-grade DRAM—that command premium pricing. Manufacturers like Samsung, Micron, and SK Hynix are responding to market incentives by converting production lines to meet this demand, effectively starving the PC market of essential components.

PC vendors including Dell and Lenovo issued warnings in December about "unprecedented cost increases" that will force them to raise product prices. The alternative—shipping systems with reduced memory—risks disappointing customers whose performance expectations won't be met by underpowered machines.

Industry Response and Market Impact

The shortage is forcing PC manufacturers into difficult strategic decisions. According to Omdia's analysis, the industry is emphasizing high-end SKUs while reducing memory configurations in mid- and low-tier systems to protect profit margins. This approach means budget-conscious buyers will either pay significantly more for the same specifications or accept reduced performance.

The competitive dynamics are intensifying. With memory supplies fundamentally constrained, PC makers with stronger supplier relationships and greater purchasing scale will secure preferential access. This creates a tiered market where major players like Lenovo, HP, and Dell can leverage their volume to maintain supply, while smaller manufacturers face steeper challenges. The result is likely further price consolidation across the market.

TrendForce, a Taiwanese market watcher, has already adjusted its projections downward, forecasting a 5.4 percent decrease in laptop shipments for 2026 compared to 2025. This translates to approximately 173 million units—millions fewer than the market would otherwise absorb at normal pricing.

Broader Market Consequences

The memory shortage extends beyond immediate pricing concerns. Windows 11 adoption may suffer as the higher cost of replacement systems discourages users from upgrading from Windows 10. Microsoft's newer operating system has not significantly increased its market share since Windows 10 support ended in October 2025, and this memory crunch provides another barrier to migration.

Historically, memory shortages resolve through the industry's boom-bust cycle: prices rise, manufacturers expand production, supply eventually exceeds demand, and prices fall. However, analysts believe this cycle won't repeat in 2026. The structural shift toward AI infrastructure represents sustained, long-term demand that won't dissipate quickly. Memory manufacturers have little incentive to return to lower-margin PC memory production when HBM and server DRAM remain in such high demand.

Despite these headwinds, B2B channel vendors remain surprisingly optimistic. An Omdia poll from November 2025 found that 57 percent of channel vendors still forecast growth during 2026, suggesting confidence in their ability to navigate the supply constraints through pricing strategies and inventory management.

Market Leadership Implications

The current market dynamics favor established scale players. Lenovo currently leads with just over 25 percent market share, followed by HP at just over 20 percent, Dell at 15 percent, Apple at nearly 10 percent, and Asus at 7.2 percent. These major vendors have the supplier relationships and purchasing power to weather the shortage, though they'll pass costs to customers.

The shortage also highlights the interconnected nature of the semiconductor ecosystem. The same manufacturing capacity that produces PC memory can produce AI memory, but not both simultaneously. As the AI boom accelerates, other sectors must compete for finite resources, fundamentally altering the economics of PC manufacturing.

For consumers and businesses planning PC purchases in 2026, the message is clear: expect higher prices, potentially reduced memory configurations, and limited availability of budget options. The AI revolution is transforming not just what we compute with, but what we pay for the privilege of computing at all.

Comments

Please log in or register to join the discussion