Tesla CEO Elon Musk asserts that Optimus will surpass Chinese competitors in capability, while Figure AI demonstrates impressive dexterity with its Helix 02 platform that can open bottle caps and handle delicate objects.

Tesla is making a dramatic pivot toward what Elon Musk calls "physical AI," with the company discontinuing its premium Model X and Model S vehicles to focus on producing Optimus humanoid robots. During Tesla's Q4 investor call, Musk made bold claims about Optimus's competitive position, stating that while Chinese robots currently lead the industry, Tesla's offering will ultimately prove superior.

When pressed about whether Optimus could compete with established Chinese manufacturers like Ubtech and XPeng—companies already mass-producing robots with impressive design and dexterity—Musk was unequivocal. "Optimus will be much more capable than any robot that we are aware of under development in China," he declared. The Tesla CEO cited two key advantages: superior cognition and hand design. However, he acknowledged that Chinese companies have mastered two critical pillars of humanoid robot feasibility that Tesla is still developing—AI-powered awareness and mass production scalability.

The Chinese humanoid robot industry is currently dominant, with over $400 million in sales and an installed base of 18,000 units shipped last year alone. These robots have already demonstrated sophisticated factory manipulation capabilities, performing tasks that require precision and adaptability in industrial settings.

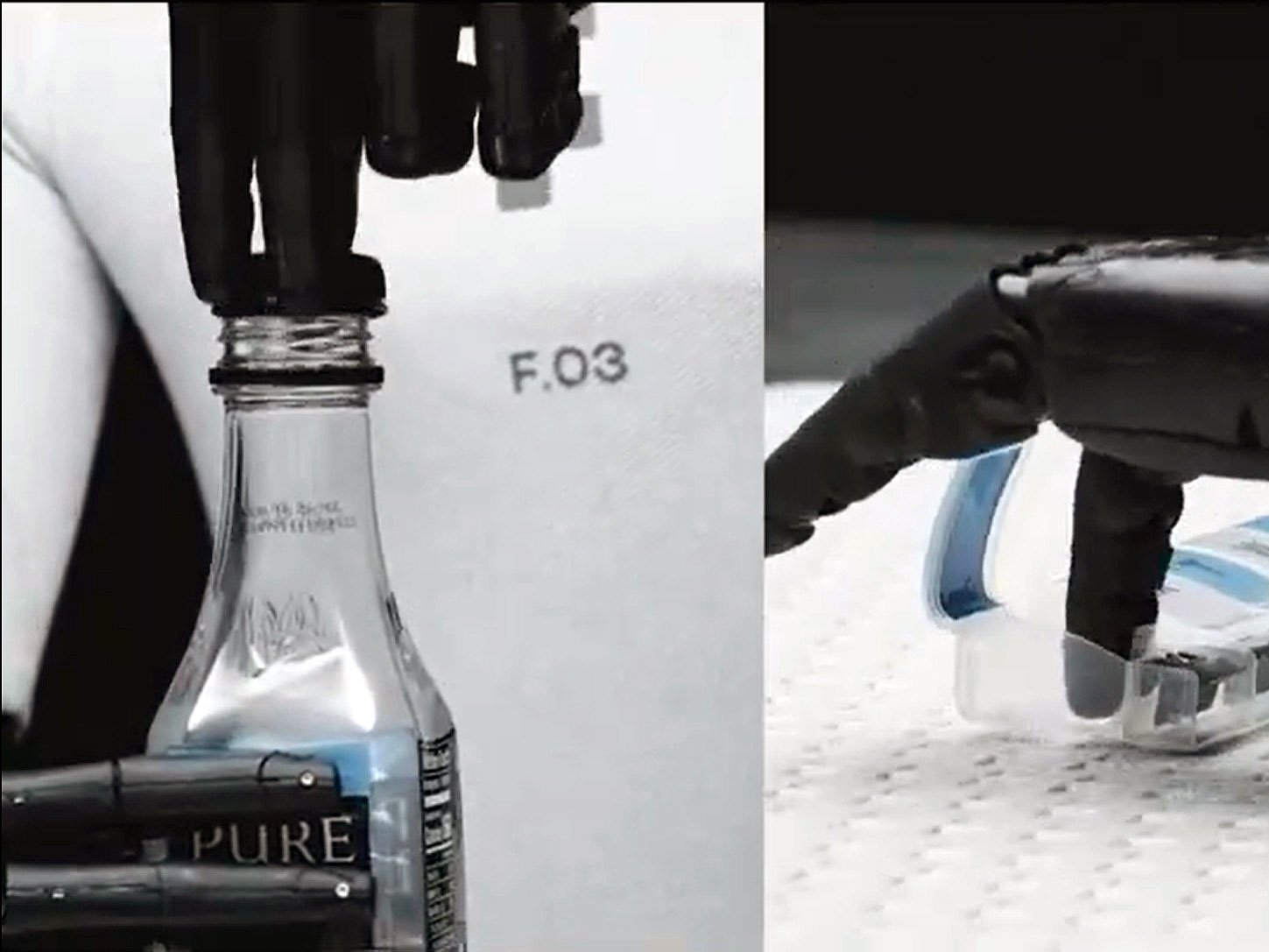

Meanwhile, Tesla has yet to release its Optimus robot to the public, despite Musk's repeated promises of "amazing" capabilities. This delay has allowed competitors to showcase their own advancements. Figure AI, for instance, has developed the Helix 02 full-body autonomy platform that demonstrates remarkable dexterity. Their robots can perform delicate tasks like opening bottle caps without struggle and extracting tiny stickies from boxes—tasks that require fine motor control and tactile sensitivity.

The Helix 02 platform incorporates tactile sensors and cameras embedded in the robot's palm, enabling it to "extract individual pills, dispense precise syringe volumes, and separate small, irregular objects from clutter despite self-occlusion," according to Figure AI. This level of precision suggests that Tesla may face stiff competition not just from Chinese manufacturers but from innovative companies worldwide.

Musk's vision for Optimus extends beyond mere capability. He has repeatedly stated a goal of producing one million humanoid robots annually, which he believes would enable Tesla to reduce the price to approximately $30,000 per unit. This ambitious target faces significant challenges, as evidenced by Boston Dynamics' experience with its Atlas humanoid robots. Even with plans to reduce costs from $300,000 to $130,000 per unit by 2030, Boston Dynamics is finding that its robots may still be too expensive to replace skilled Hyundai factory workers.

The humanoid robot race is intensifying, with multiple players developing increasingly sophisticated platforms. While Musk positions Tesla as the eventual leader, the current landscape shows a diverse ecosystem of competitors pushing the boundaries of what's possible in physical AI. The question remains whether Tesla's late entry and ambitious production targets will allow it to capture market share from established players who already have working prototypes and manufacturing pipelines in place.

The competition extends beyond just technical capability to include practical considerations like cost, reliability, and ease of integration into existing workflows. As companies like Figure AI demonstrate increasingly refined manipulation skills and Chinese manufacturers scale their production, Tesla's Optimus will need to deliver on Musk's promises to justify its position as the future of Tesla's business model.

Comments

Please log in or register to join the discussion