Senate Republicans moved to block a War Powers Resolution on Venezuela after Trump's intervention, signaling continuity in U.S. sanctions policy that maintains pressure on Venezuelan oil exports and global energy markets.

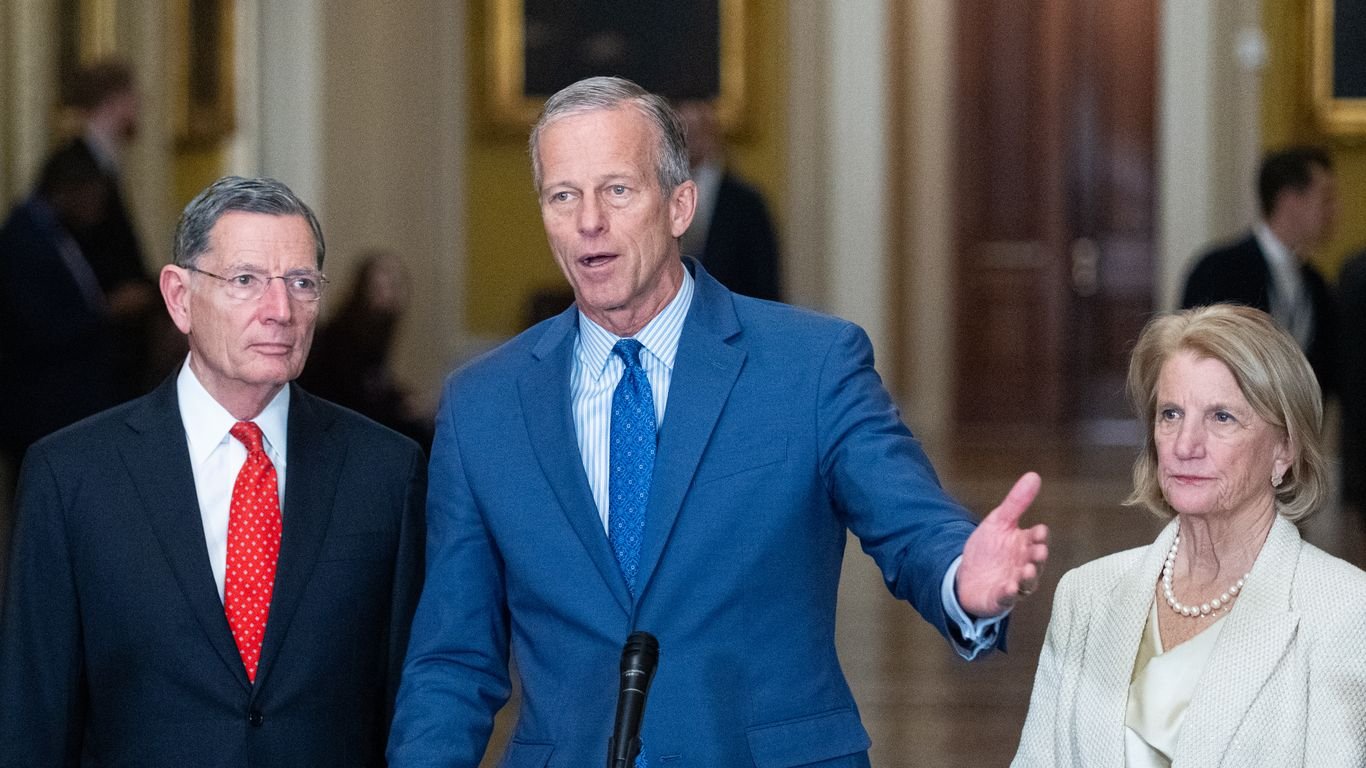

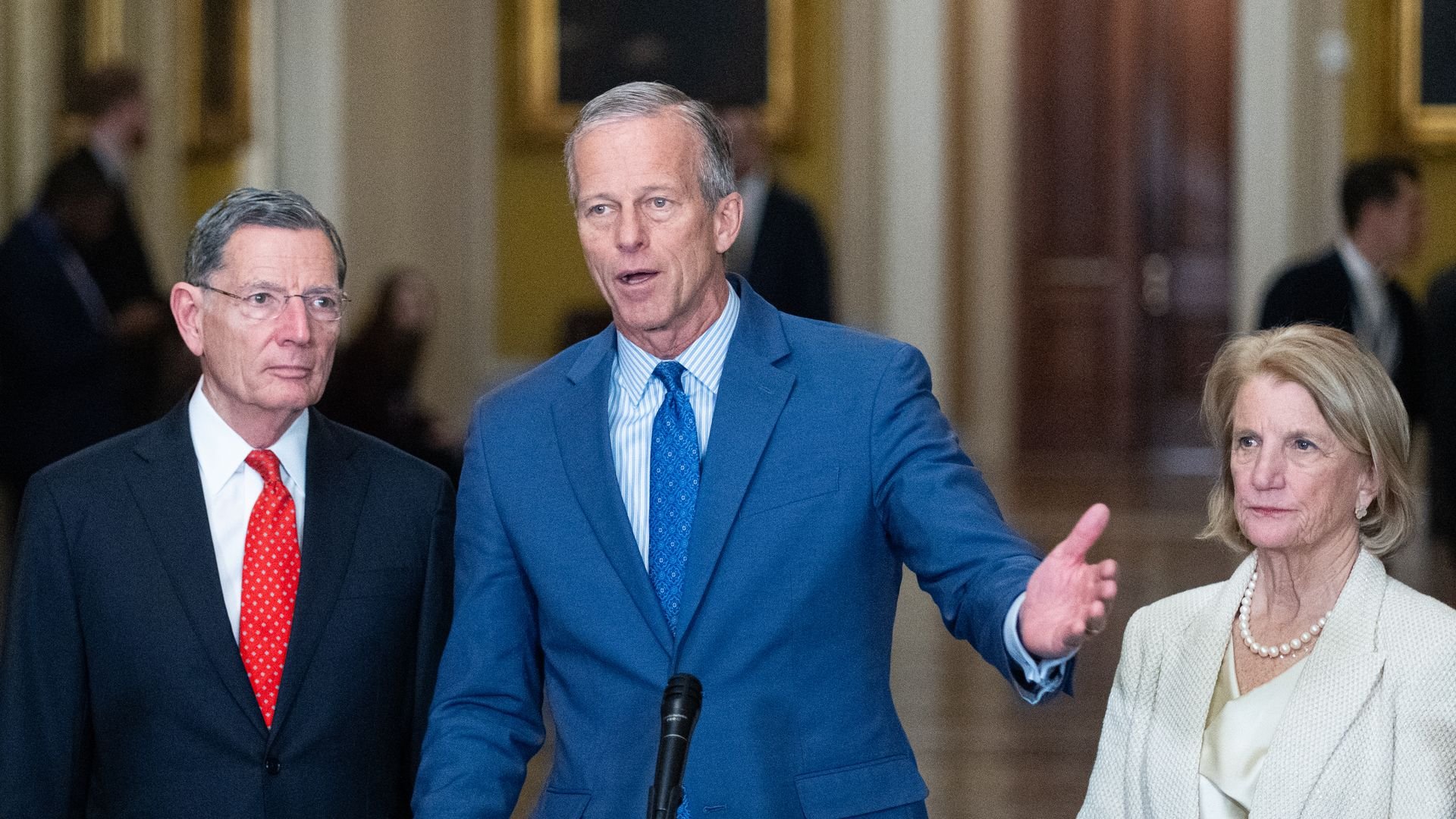

Senate Republicans abruptly halted plans to vote on a War Powers Resolution regarding Venezuela this week, following direct opposition from former President Trump. The resolution would have forced congressional debate on U.S. military engagement policies toward Venezuela. Senate Majority Leader John Thune (R-S.D.) confirmed the reversal after Trump conveyed objections to GOP senators, arguing the measure could undermine his potential Venezuela policy if reelected.

This political maneuver maintains the status quo of U.S. sanctions against Venezuela's oil sector, which have reduced the country's crude exports by approximately 40% since 2019. Venezuela holds the world's largest proven oil reserves at 304 billion barrels, yet production remains constrained at roughly 800,000 barrels per day - less than half of pre-sanction levels. These constraints continue influencing global energy markets, particularly heavy crude supplies that refineries in Texas and Louisiana depend on.

The frozen policy landscape preserves current exemptions for U.S. companies like Chevron, which operates under Treasury Department license in Venezuela. Energy analysts note ongoing sanctions contribute to global heavy crude shortages, maintaining a $3-$5 per barrel premium for similar grades. This premium directly impacts refiners' operating margins, with Valero and Phillips 66 reporting Venezuelan crude substitution costs adding $0.5-$0.8 per barrel to processing expenses in Q1 earnings.

Market implications extend beyond immediate pricing effects. Continued sanctions delay potential production recovery investments in Venezuela's oil infrastructure, requiring $200-$300 billion to restore pre-2000s capacity according to OPEC estimates. The Congressional blockade signals reduced regulatory risk for U.S. energy firms operating under existing licenses but delays potential market rebalancing that could lower global heavy crude premiums by 15-20% if sanctions eased.

For investors, the political intervention maintains current exposure calculations: energy sector allocations remain weighted toward companies with Venezuelan operation licenses while broader market impacts include sustained support for Canadian and Middle Eastern heavy crude suppliers. The Venezuela policy stalemate exemplifies how geopolitical decisions continue shaping commodity risk premiums, with energy equities showing 30-day volatility correlations of 0.85 to State Department sanction announcements since 2022.

Comments

Please log in or register to join the discussion