A Turkish wedding's unconventional gifts of Nvidia RTX 5090 GPUs, DDR5 memory kits, and Intel processors highlight the soaring value of advanced semiconductors amid global shortages.

A recent wedding tradition in Turkey has unexpectedly highlighted the shifting valuation of high-performance semiconductors in consumer markets. Video documentation shows bridal gifts transitioning from conventional gold jewelry to cutting-edge computing components, including an MSI Suprim GeForce RTX 5090 GPU, quad-channel DDR5 memory modules, and an Intel Core Ultra Unlocked processor.

Component Specifications and Market Positioning

The gifted components represent current high-end consumer technology:

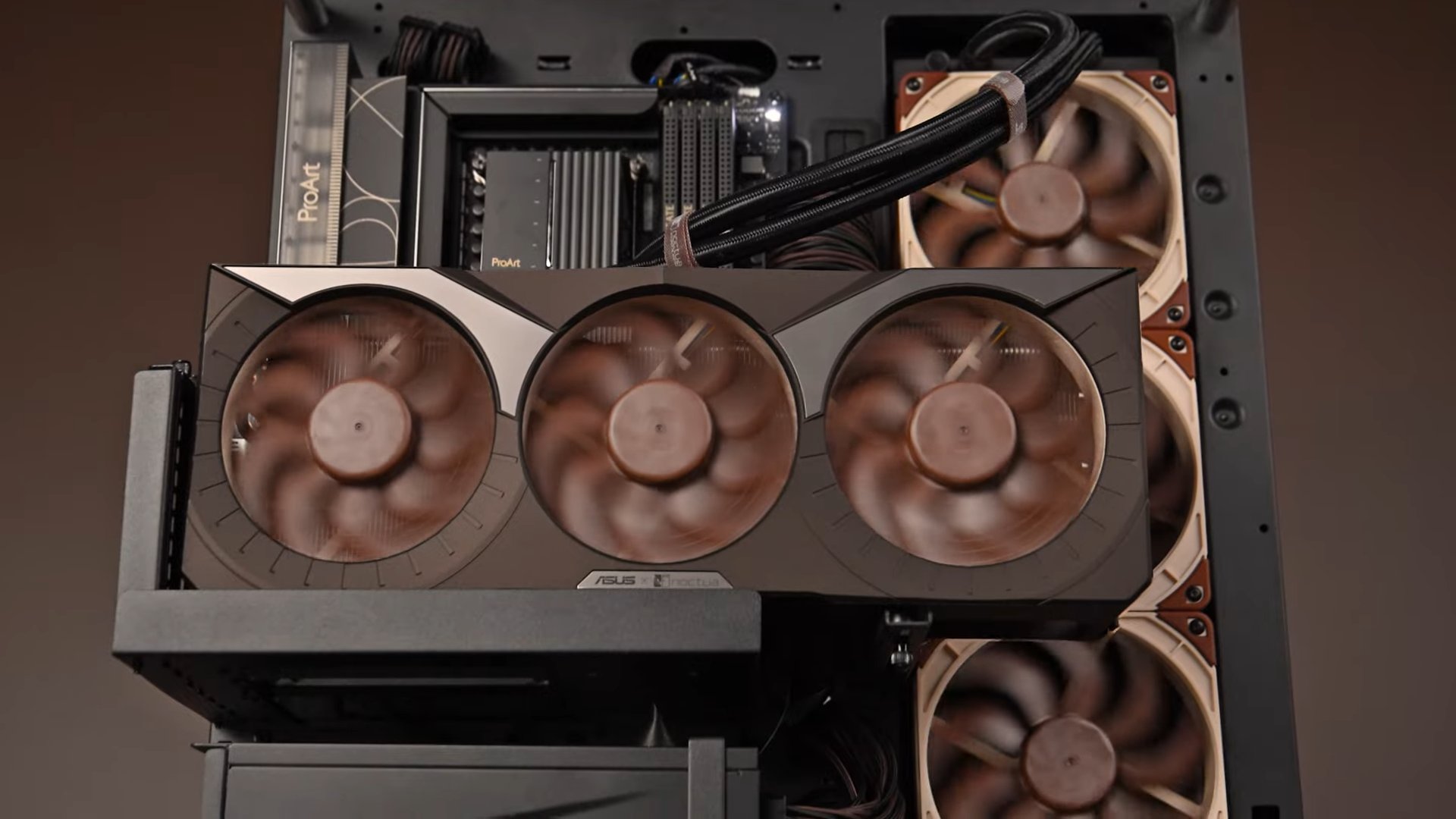

- Nvidia RTX 5090: Based on Blackwell architecture, this flagship GPU features 24,576 CUDA cores and GDDR7 memory delivering 1.5 TB/s bandwidth. Current retail pricing exceeds $2,500 due to constrained TSMC 4N wafer allocations.

- Quad-Channel DDR5-8000 Kit: 64GB configuration operating at 1.1V latency (CL32), manufactured using SK Hynix's 1β (1-beta) 10nm process. Spot prices for such kits have increased 18% quarterly.

- Intel Core Ultra 9 2895K: 24-core Raptor Lake Refresh processor built on Intel 7 process node, with unlocked multipliers for overclocking. Represents Intel's consumer desktop leadership amid foundry transitions.

Supply Chain Implications

The ceremonial substitution of gold for semiconductors coincides with measurable market shifts. DRAM spot prices surpassed gold's value-per-gram in Q4 2025 ($65.20/gram vs $63.50/gram), while NAND flash reached parity at $58.40/gram. This inversion stems from:

- AI-driven demand expanding beyond datacenters to consumer applications

- Yield challenges at sub-3nm nodes reducing leading-edge wafer output

- Geopolitical factors restricting equipment access to Chinese fabs

Memory market analysts project 12-18 months before supply normalization, with TrendForce forecasting DDR5 contract prices rising another 8-13% in Q3 2026. GPU availability remains particularly constrained, with distributors reporting allocation fulfillment rates below 40% for RTX 50-series parts.

Longevity vs Volatility Considerations

While gold maintains perpetual value stability, semiconductor gifts carry inherent obsolescence risks:

- GPU architectures typically depreciate after 3-5 generations

- DDR5 standards face displacement by LPDDR6/X in 2028

- Lithography advances may accelerate performance gaps

However, the components' current scarcity creates unusual short-term value retention. The RTX 5090's secondary market premium exceeds 60% above MSRP, outperforming traditional hedges like precious metals during the documented period.

This cultural phenomenon underscores semiconductors' transition from utilitarian components to prestige assets during supply-constrained market phases. Industry observers note similar assetification patterns emerging in Southeast Asian dowry practices, suggesting broader re-evaluation of technology's tangible worth.

Comments

Please log in or register to join the discussion