SoftBank has reportedly halted talks to acquire US data center operator Switch for approximately $50 billion, a significant setback for CEO Masayoshi Son's ambitious Stargate infrastructure project aimed at building a global network of AI-ready data centers. The move highlights the immense capital requirements and strategic complexities of scaling physical AI infrastructure, even for a well-funded conglomerate.

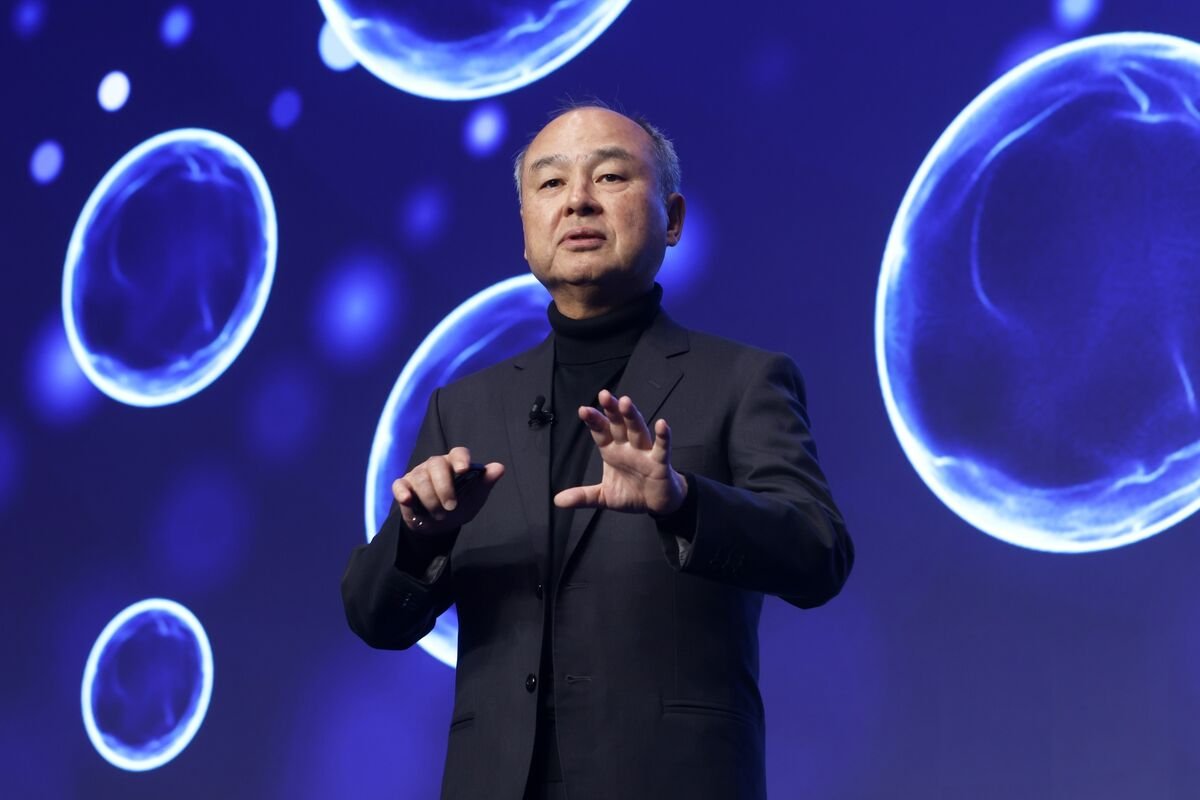

SoftBank Group Corp. has halted talks to acquire US data center operator Switch Inc., a move that represents a major setback for CEO Masayoshi Son's long-term vision of building a global network of AI-ready data centers. The potential deal, valued at around $50 billion, was seen as a cornerstone for Son's Stargate infrastructure project, which aims to provide the massive computational power required for next-generation AI models.

The Stargate Ambition

Masayoshi Son's Stargate project is not a single facility but a conceptual framework for a globally distributed, ultra-scale data center network. The goal is to create a physical backbone for AI development and deployment, capable of supporting the training and inference of models that require unprecedented amounts of compute. This infrastructure is designed to be energy-efficient, highly connected, and strategically located to serve key markets.

Switch, a Nevada-based data center operator known for its high-density, efficient facilities and its flagship Las Vegas campus, was a logical target. Its expertise in building and operating large-scale, resilient data centers aligns with Stargate's requirements. Acquiring Switch would have given SoftBank immediate control over a substantial portfolio of existing infrastructure and a proven operational team, accelerating the Stargate timeline significantly.

Why the Deal Collapsed

While official reasons are not disclosed, the halt in talks likely stems from a combination of factors:

Valuation and Economics: A $50 billion price tag is enormous, even for SoftBank. Data centers are capital-intensive businesses with long payback periods. The economics of building and operating AI-specific data centers, which require specialized cooling and power delivery, are still being proven at this scale. SoftBank may have determined the financial returns were too uncertain or the cost of capital too high.

Regulatory Scrutiny: A transaction of this size, involving critical digital infrastructure, would face intense scrutiny from regulators in the US and potentially other jurisdictions. Concerns over foreign ownership of strategic assets and potential national security implications could have created significant hurdles.

Strategic Reassessment: SoftBank's investment strategy has been in flux. After the Vision Fund's turbulent period, the company has been more cautious with large-scale bets. The decision to walk away suggests a potential pivot in how SoftBank plans to execute its Stargate vision—perhaps opting for partnerships, joint ventures, or a more incremental build-out rather than a massive, single acquisition.

Technical and Operational Fit: While Switch is a strong operator, integrating a large, established company into a new, ambitious project like Stargate presents challenges. Aligning operational cultures, technology stacks, and strategic roadmaps can be complex and time-consuming.

Implications for the AI Infrastructure Landscape

The failure of this deal has ripple effects across the industry:

For SoftBank and Stargate: The project is now significantly delayed. Without a major acquisition, SoftBank must find another path to scale. This could involve building new data centers from the ground up—a slower and more complex process—or pursuing smaller, targeted acquisitions. The setback raises questions about the timeline and ultimate scope of Stargate.

For the Data Center Market: The news underscores the intense competition for quality data center assets. Companies like Switch, Digital Realty, Equinix, and a wave of new players are all vying for a share of the booming demand driven by AI. A $50 billion bid sets a high benchmark for valuations, but its collapse may also signal that the market is approaching a point of correction or recalibration.

For AI Developers: The delay of a major, dedicated AI infrastructure project like Stargate means that the supply of specialized compute capacity may grow more slowly than anticipated. This could keep cloud computing costs elevated for AI training and inference in the near term, potentially slowing the pace of innovation for some companies that rely on third-party cloud providers.

The Broader Context: Physical AI vs. Software AI

Son's Stargate project highlights a critical, often overlooked aspect of the AI boom: the physical infrastructure required to power it. While much of the focus is on model architectures (like transformers) and software breakthroughs, the underlying hardware and facilities are the true bottlenecks.

Training a single large language model can require thousands of GPUs running for weeks, consuming megawatts of power and generating immense heat. Inference—running the model for users—also demands substantial, always-on compute. Building data centers optimized for these workloads is a different challenge than building general-purpose cloud facilities.

The failed acquisition suggests that even the most well-capitalized players are finding the economics of this physical build-out challenging. It points to a future where AI infrastructure may be built through a combination of strategies: large corporate projects, government-backed initiatives, and decentralized networks of smaller facilities.

What Comes Next for SoftBank

SoftBank is not abandoning its AI ambitions. The company remains a major investor in the sector and continues to explore opportunities. The Stargate vision is likely still alive, but its execution will be different. Possible next steps include:

- Partnerships: Collaborating with existing data center operators or technology companies to co-develop facilities.

- Greenfield Development: Acquiring land and building new data centers tailored specifically for AI, though this is a slower and more capital-intensive path.

- Focus on Software and Services: Shifting some resources toward developing the software stack and services that run on top of the infrastructure, rather than owning the physical layer outright.

The halt in talks with Switch is a reminder that the path to building the future of AI is paved with concrete, steel, and silicon, not just code. For now, Masayoshi Son's grand Stargate plan faces a significant delay, forcing the industry to reassess how—and how quickly—the physical foundations of artificial intelligence will be laid.

Comments

Please log in or register to join the discussion