Tesla's pivot to humanoid robots faces major supply chain hurdles as China controls 50-70% of critical materials and components needed for Optimus production.

Tesla's ambitious pivot from electric vehicles to robotics and AI is hitting a major roadblock: its supply chain is deeply entangled with China, creating potential vulnerabilities as trade tensions persist between the two superpowers.

China's Grip on Critical Materials The scale of Tesla's production ambitions for humanoid robots means it must rely heavily on China for raw materials, components, and manufacturing expertise. According to consulting firm Bain & Co., Chinese companies account for 50-70% of manufacturing and core component production expertise globally, with Chinese players making up at least 55% of the global humanoid robot bill of materials (BOM).

China dominates the supply of numerous critical materials essential for robotics manufacturing:

- Gallium: 94% global supply

- Neodymium: Major supplier

- Molybdenum: Major supplier

- Indium: Major supplier

- Praseodymium: Major supplier

While the U.S. maintains strong supply chains for materials like Beryllium and Boron, China's control over these rare earth elements creates a significant dependency for companies like Tesla.

Beyond Raw Materials: The Complete Supply Chain The challenge extends beyond simply mining these materials. China controls the entire ecosystem: extraction expertise, processing facilities to make materials usable, and the logistical infrastructure to deliver them where needed. This comprehensive control gives China enormous leverage over Tesla's robotics ambitions.

Tesla's Existing China Dependencies Tesla already has deep ties to China through its Shanghai production facility, which employs 20,000 people and produces vehicles for the Chinese market. The company sources many batteries from Chinese suppliers and uses numerous raw materials from China in vehicle production. China represents over one-third of Tesla's sales in 2025, making it both a critical supplier and customer.

The Rare Earth Crisis Tesla has already experienced the consequences of China's supply control. In April 2024, CEO Elon Musk complained that a Chinese block on exporting "rare-earth magnets" had impacted Optimus robot production. He was forced to request a license to use these materials, highlighting the immediate vulnerability of Tesla's robotics plans.

China took all rare earth mineral resources within its borders under state ownership in fall 2024, giving its leadership top-down control over these critical materials. While China has issued limited export licenses to some companies following trade negotiations, the threat of supply disruption remains.

The Robotics Manufacturing Challenge Unlike semiconductor chips that require clean room fabrication and specialized design software, humanoid robots are decidedly more physical. They require:

- Iron, titanium, nickel, chromium, copper, and manganese

- Actuators, motors, bearings, and lubricants

- Complex assembly and manufacturing expertise

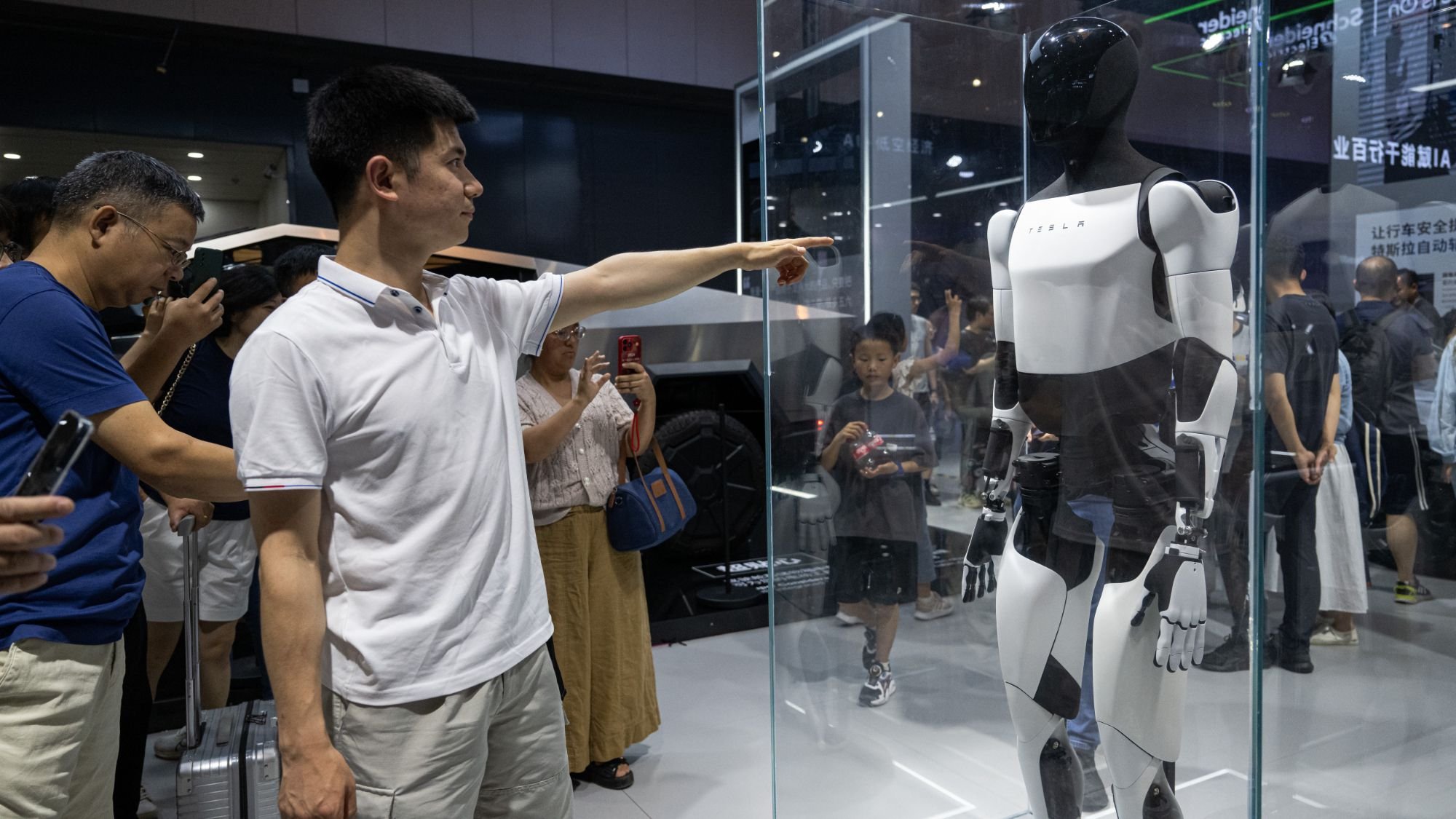

China's Robotics Advantage China's domestic humanoid robotics industry poses another challenge to Tesla's ambitions. With over 100 Chinese companies working on designs and Chinese officials centralizing development to accelerate progress, the country is already shipping consumer-grade robots. In 2025 alone, over 13,000 robots were deployed in China, compared to Tesla's several hundred prototype Optimus models.

The Pricing Paradox Tesla hopes to bring Optimus down to $30,000 per unit, but this pricing goal may depend more on China's willingness to maintain stable supply chains than on Tesla's manufacturing efficiency. If China restricts supply, it would affect not only production volumes but also pricing across the entire industry.

U.S. Response and Limitations The American government recognizes this supply chain vulnerability and is attempting to develop a new stockpile with a $12 billion investment. However, this would only provide a 60-day reserve focused on civilian needs. In a supply cutoff scenario, Tesla would compete with numerous other firms and organizations for the same limited materials.

The BYD Parallel Just as BYD has overtaken Tesla in the EV space through vertical integration and manufacturing efficiency, China appears positioned to gain a significant head start in humanoid robotics. Chinese companies benefit from:

- More deployed units

- Higher production volumes

- Better access to key technologies and raw materials

- Proximity and efficiency of supply chains

Tesla's robotics ambitions rest on a knife-edge, with China holding the cards to either enable or curtail its progress. The company's future in humanoid robotics may ultimately depend less on its technological innovations and more on the complex geopolitical relationship between the U.S. and China.

Comments

Please log in or register to join the discussion