The world's largest contract chipmaker projects capital spending between $52B and $56B for 2026, a 25%+ increase from 2025, and forecasts approximately 30% year-over-year revenue growth, both exceeding analyst estimates. The guidance underscores the industry's ongoing investment in advanced manufacturing capacity to meet demand for AI accelerators and high-performance computing chips.

Taiwan Semiconductor Manufacturing Company (TSMC) has issued financial projections for 2026 that point to continued aggressive investment in manufacturing capacity and strong revenue growth, driven largely by sustained demand for artificial intelligence hardware. The company's capital expenditure guidance for the coming year falls between $52 billion and $56 billion, representing an increase of more than 25% compared to its 2025 spending. Simultaneously, TSMC forecasts approximately 30% year-over-year revenue growth for 2026. Both figures surpass the consensus estimates from financial analysts, suggesting the chip industry's AI-driven expansion is accelerating rather than moderating.

The capital spending projection is particularly significant given the scale of investment required for leading-edge semiconductor manufacturing. Building and equipping a single advanced fabrication plant (fab) can cost upwards of $20 billion, with the most sophisticated nodes requiring even greater investment. TSMC's planned spending indicates it is continuing to expand its 3nm and 2nm production capabilities while also preparing for the next generation of process technologies. The company's 2025 capital expenditure was already substantial, and the projected increase for 2026 demonstrates its commitment to maintaining technological leadership and meeting the capacity needs of major customers like Apple, AMD, Nvidia, and Qualcomm.

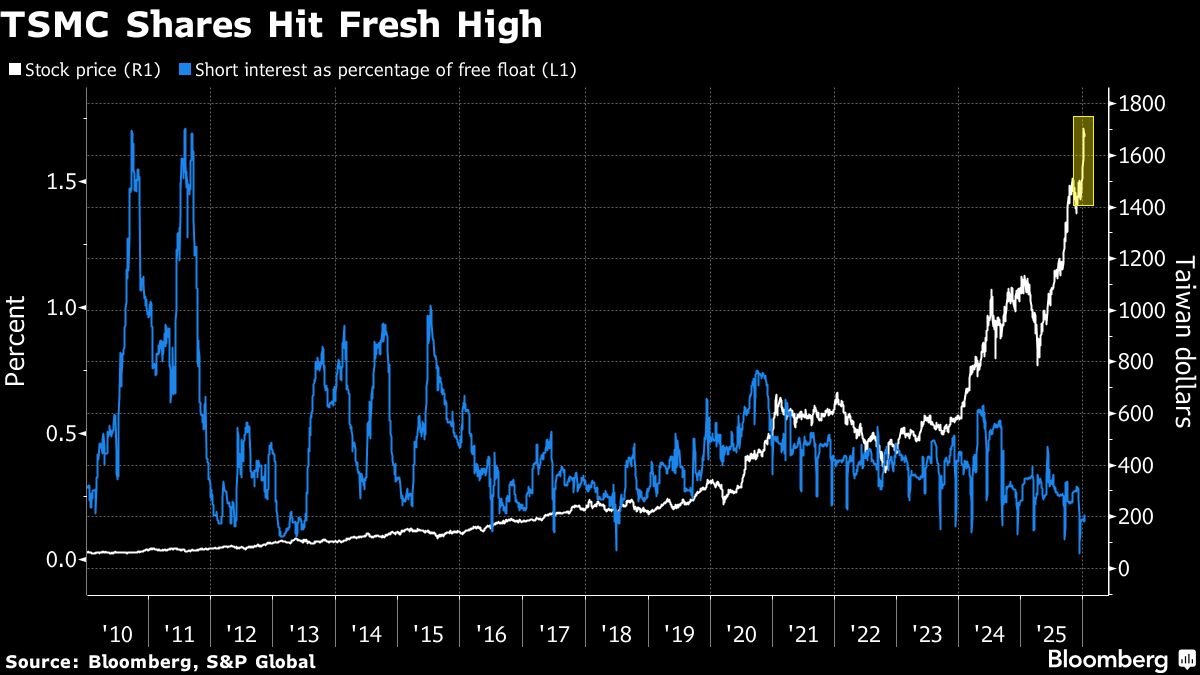

The revenue growth forecast of approximately 30% for 2026 aligns with the company's recent performance. TSMC reported a 35% year-over-year increase in fourth-quarter net profit to approximately $16 billion, exceeding market expectations of $15.17 billion. The company also achieved $100 billion in revenue for the full year 2025, a milestone driven by surging demand for AI chips. The 2026 revenue projection suggests this demand trajectory will continue, with AI accelerators, high-performance computing processors, and advanced smartphone chips remaining key growth drivers.

Several factors underpin TSMC's optimistic outlook. The AI hardware market continues to expand rapidly, with data center operators and cloud providers investing heavily in GPU clusters and specialized accelerators to support large language models and other AI workloads. Nvidia's H200 and upcoming Blackwell architecture chips, which rely on TSMC's advanced packaging and process technologies, represent a significant portion of this demand. Additionally, the transition to more sophisticated mobile processors, automotive chips, and high-performance computing components contributes to the company's growth.

However, TSMC's projections also reflect broader industry challenges and uncertainties. The company operates in a geopolitically sensitive environment, with ongoing tensions between the United States and China affecting semiconductor supply chains. Recent U.S. tariffs on chips transshipped through the country, as well as China's draft rules limiting purchases of certain Nvidia chips, highlight the complex regulatory landscape. TSMC must navigate these constraints while expanding its global manufacturing footprint, including its new fabs in Arizona, Japan, and Germany.

From a technical perspective, TSMC's capital spending is directed toward several key areas. The company is advancing its 2nm process node, which is expected to enter high-volume production in 2025 or early 2026. This node will offer improved performance and power efficiency, critical for next-generation AI chips and mobile processors. TSMC is also investing in advanced packaging technologies like CoWoS (Chip-on-Wafer-on-Substrate), which is essential for integrating multiple chiplets in high-performance AI accelerators. The company's capacity expansion includes both leading-edge and mature nodes, as demand for automotive, industrial, and IoT chips remains robust.

The financial implications of TSMC's spending are substantial. Capital expenditures typically represent a significant portion of a semiconductor company's revenue, and TSMC's projected spending of $52-56 billion for 2026 would likely exceed 25% of its expected revenue. This level of investment requires careful balance between growth and profitability. While the company's recent profit growth has been strong, sustained high capital spending could pressure margins if demand growth slows or if competitors like Samsung and Intel make significant technological advances.

TSMC's forecasts also have implications for its customers and the broader technology ecosystem. The company's ability to ramp up production of advanced nodes is critical for product launches from major tech firms. Apple's next-generation iPhones, AMD's data center CPUs and GPUs, and Nvidia's AI accelerators all depend on TSMC's manufacturing capabilities. The company's revenue growth projection suggests these customers are planning for significant volume increases in 2026, which could indicate anticipated product cycles or market expansion.

Looking ahead, TSMC's performance will be closely watched as an indicator of the semiconductor industry's health. The company's forecasts for capital spending and revenue growth exceed analyst estimates, which may prompt upward revisions for the broader sector. However, the industry remains subject to cyclical demand patterns, geopolitical risks, and technological disruptions. TSMC's ability to execute on its ambitious expansion plans while maintaining its technological edge will be crucial for sustaining its market leadership.

For more information on TSMC's financial results and outlook, refer to the company's official announcements and investor relations materials. The company's Q4 2025 results and 2026 guidance were detailed in its earnings release and subsequent analyst call, which provide additional context on the factors driving its projections.

Comments

Please log in or register to join the discussion