The second round of U.S.-Iran nuclear negotiations in Geneva signals potential recalibration of global energy flows, with sanctions relief scenarios carrying major implications for oil markets and nuclear technology sectors.

The United States and Iran will hold their second round of nuclear negotiations in Geneva this week, following preliminary talks mediated by Oman in early February. This diplomatic engagement marks the most sustained dialogue between the two nations since the collapse of the 2015 Joint Comprehensive Plan of Action (JCPOA).

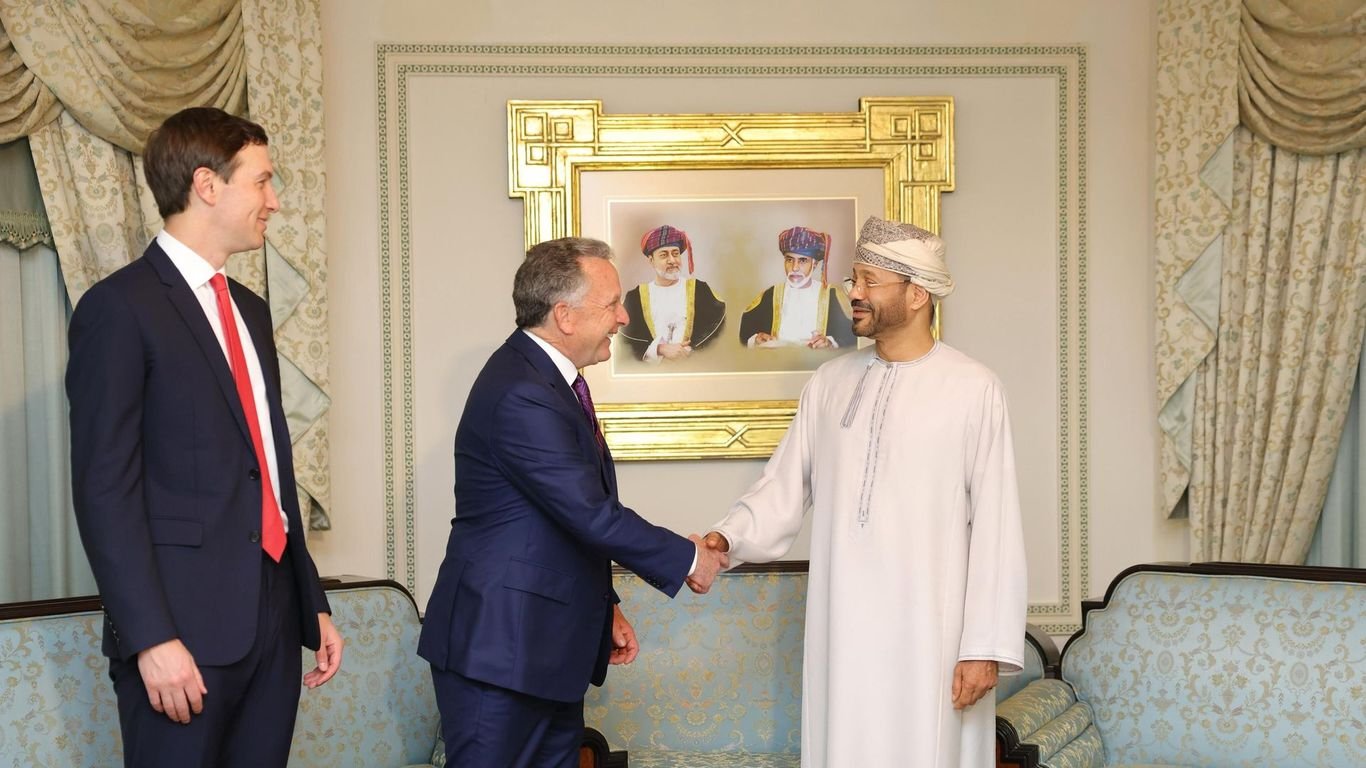

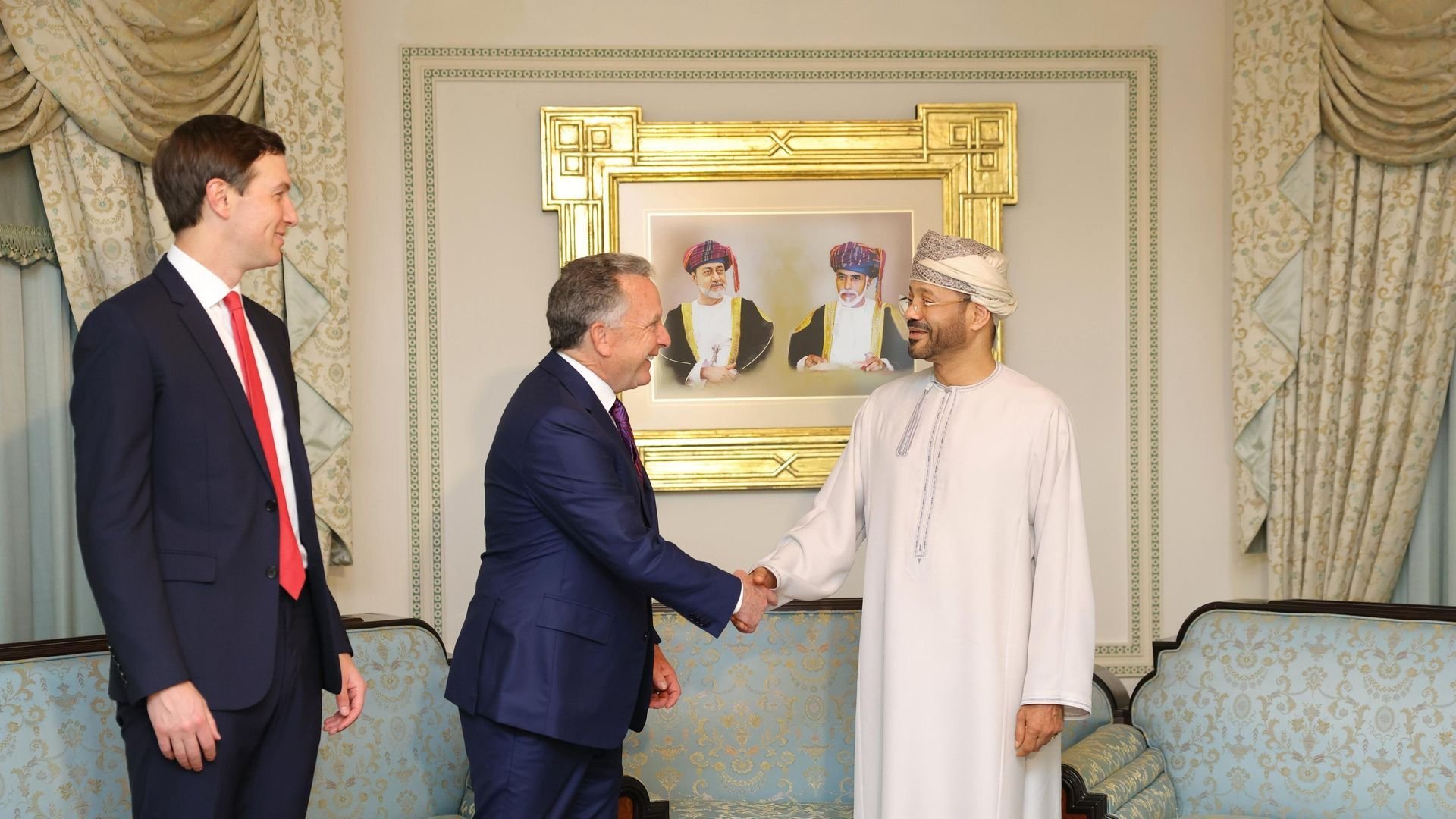

Omani Foreign Minister Sayyid Badr Hamad Al Busaidi meeting with U.S. negotiators in Muscat on February 6 (Photo: Oman Foreign Ministry/Anadolu via Getty Images)

Omani Foreign Minister Sayyid Badr Hamad Al Busaidi meeting with U.S. negotiators in Muscat on February 6 (Photo: Oman Foreign Ministry/Anadolu via Getty Images)

Energy Market Calculus

Current sanctions restrict Iran's oil exports to approximately 1 million barrels per day (bpd), down from pre-sanction peaks of 2.5 million bpd. Should negotiations yield sanctions relief, energy analysts project Iran could rapidly increase production by 600,000-800,000 bpd within six months, potentially reaching full capacity of 3.8 million bpd within three years. This supply influx could depress global oil prices by 5-8% according to International Energy Agency models, translating to $4-$6/barrel reductions based on current Brent crude benchmarks near $85.

Nuclear Technology Implications

Beyond energy markets, the talks carry significant consequences for nuclear technology transfer. Iran's nuclear infrastructure requires modernization, with its sole commercial reactor at Bushehr operating at reduced capacity due to maintenance limitations under sanctions. Sanctions relief would enable access to:

- Advanced centrifuge technology for uranium enrichment

- Western-designed safety systems for existing facilities

- International partnerships for next-generation reactor construction

Technology providers including France's Framatome and Russia's Rosatom stand to gain contracts worth an estimated $7-12 billion should sanctions ease. However, verification mechanisms for civilian versus military technology use remain a core negotiation point.

Strategic Business Impact

Energy-intensive industries globally face divergent scenarios:

| Outcome Scenario | Oil Price Impact | Nuclear Tech Market |

|---|---|---|

| Sanctions Maintained | +$8-$12/barrel | Limited growth (<2% CAGR) |

| Partial Relief | -$4-$6/barrel | Moderate growth (5-7% CAGR) |

| Full Sanctions Lift | -$7-$10/barrel | Accelerated growth (12-15% CAGR) |

Technology firms face parallel considerations. Cloud providers and data centers operating energy-intensive server farms could see operational cost reductions of 3-5% with lower oil prices. Conversely, renewable energy investments face competitive pressure if fossil fuel prices decline significantly.

Geopolitical Risk Factors

Middle Eastern stability remains pivotal to energy security. Oman's mediation role highlights regional efforts to balance Saudi and Iranian interests. Should talks stall, heightened tensions could trigger supply chain disruptions affecting 18% of global oil transit through the Strait of Hormuz. Contingency planning by energy majors already includes diversified shipping routes and increased LNG investments along alternative corridors.

The Geneva negotiations represent a critical inflection point for global energy economics and nuclear technology transfer. Market participants should model scenarios accounting for 10-15% volatility in energy prices and prepare supply chain adaptations across both fossil fuel and alternative energy sectors.

Comments

Please log in or register to join the discussion