Walmart is expanding its partnership with Wing, Alphabet's drone delivery service, to an additional 150 stores. This move will bring the total number of stores offering drone delivery to over 270, covering approximately 10% of the U.S. population.

The logistics of getting goods from a distribution center to a customer's doorstep is a notoriously expensive and complex problem. For decades, the industry has relied on a combination of large trucks, regional sorting hubs, and a final leg handled by services like UPS, FedEx, or increasingly, a growing army of gig-economy drivers. This final step, known as "last-mile delivery," can account for more than half of the total shipping cost. The promise of drone delivery has always been to bypass the traffic, the complex routing, and the human labor of that final mile, replacing it with a direct aerial route.

Walmart's latest announcement represents a significant step toward making that promise a practical reality. The company is expanding its partnership with Wing, an Alphabet-owned drone delivery service, to another 150 stores. This will bring the total number of Walmart locations offering on-demand drone delivery to over 270 across the United States. The expansion is notable not just for its scale, but for what it represents: a shift from experimental trials to a more established service that now covers roughly 10% of the U.S. population. For customers within the service radius, this means the ability to have groceries, over-the-counter medicine, and other household items delivered in as little as 15 minutes.

The Technology and Operational Model

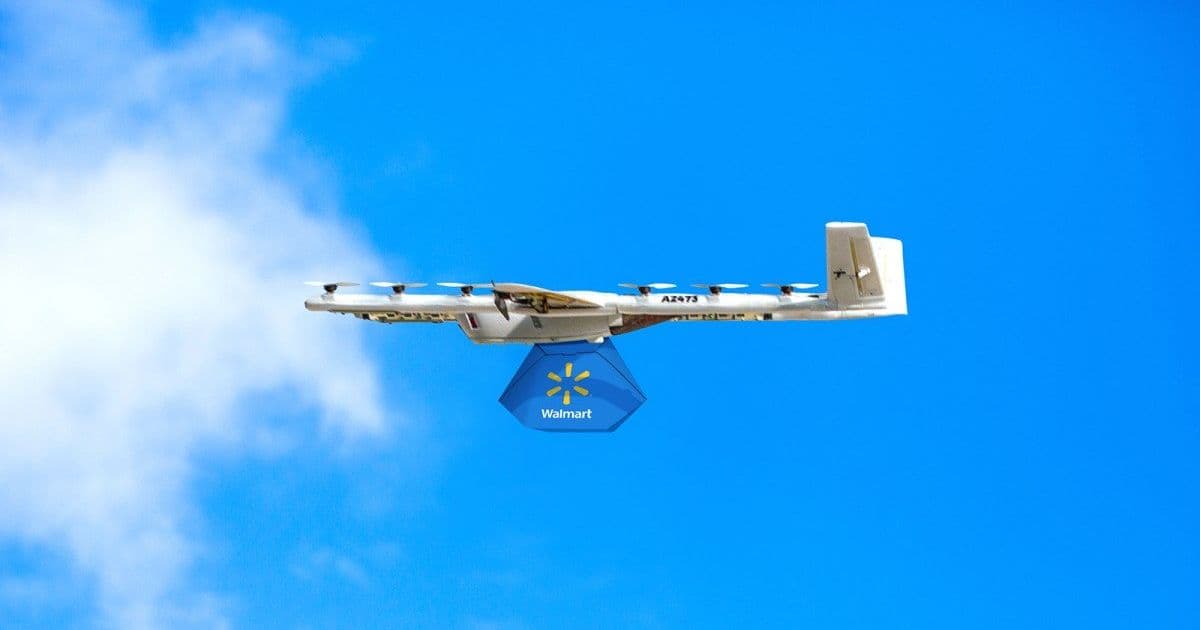

To understand the significance of this expansion, it is essential to look at the underlying technology and operational model. Wing, which spun out of Google's parent company's "Project Wing" in 2018, does not use the quadcopter design common among consumer drones. Instead, its aircraft use a tilt-rotor mechanism, allowing them to take off and land vertically like a helicopter but transition to horizontal flight for more efficient, longer-range travel.

The delivery process is highly automated. A customer places an order through the Wing app (or, increasingly, through a partner's platform). The order is sent to a local fulfillment center, which could be a dedicated facility or, in this case, a specific Walmart store. An employee (or in the future, a robot) packs the item into a small, aerodynamic box. This package is then attached to the drone. The drone launches, follows a pre-programmed flight path (often at altitudes between 150 and 400 feet), and navigates to the customer's location.

A key piece of Wing's technology is its automated delivery winch. The drone does not land. It hovers safely above the delivery spot and lowers the package to the ground on a thin cord. Once the package is detected as having reached the ground, the cord detaches, and the drone returns to the base. This method avoids the risks associated with a drone landing in an unfamiliar or cluttered area, such as a backyard with children or pets. It also significantly speeds up the delivery, as the drone spends only a moment hovering before returning to its next task.

The Business Case: Speed vs. Cost

Walmart's motivation is clear: compete on speed. Amazon has been working on its Prime Air drone delivery service for years, and while its progress has been slower than anticipated, the threat of a competitor dominating the high-speed delivery space is a powerful motivator. For Walmart, drone delivery is not just a novelty; it's a strategic tool to capture impulse purchases and urgent needs. If a customer runs out of diapers, coffee, or headache medicine, the 15-minute delivery window is a compelling alternative to driving to the store or waiting hours for a traditional delivery.

However, the economics of drone delivery remain a significant question. While drones reduce the need for a human driver per delivery, they come with their own high costs: the aircraft themselves, maintenance, battery charging infrastructure, and the sophisticated software required to manage a fleet safely. The cost of a single drone delivery is still likely higher than a standard ground delivery for a single item, especially when factoring in the initial capital expenditure.

Walmart's strategy appears to be one of calculated investment. By starting with specific, high-demand items and targeting dense suburban or semi-rural areas where the cost of traditional delivery is higher, they can refine the model. The expansion to 150 more stores suggests that the pilot programs have shown enough promise—in terms of customer adoption and operational feasibility—to justify a larger rollout. It's a long-term play, betting that as the technology matures and scales, the cost per delivery will fall below that of ground-based methods.

Counter-Perspectives and Hurdles

Despite the momentum, significant hurdles remain. Regulatory oversight from the Federal Aviation Administration (FAA) is the most prominent. Wing and other operators have received Part 135 air carrier certificates, which allow them to conduct commercial deliveries. However, scaling to hundreds of drones operating simultaneously in busy airspace requires complex deconfliction and safety protocols. The FAA must be convinced that these operations are not just safe for the customers receiving packages, but also for people and property on the ground, as well as other aircraft. Any incident, even a minor one, could trigger a regulatory pause or stricter rules that might hamper growth.

There is also the question of public acceptance. While many may welcome the convenience, others may have concerns about noise pollution from frequent drone flights over their neighborhoods. The whirring of drone propellers could become a new, persistent sound in the background of daily life. Furthermore, privacy concerns persist. Drones are equipped with cameras for navigation, and customers may be uneasy about aircraft flying over their properties, even if they are not the intended target of the delivery.

Finally, the scope of what can be delivered is limited. Drones have strict weight and size restrictions. They are ideal for small, lightweight items but cannot deliver a week's worth of groceries or a new television. This means drone delivery is likely to remain a supplement to, rather than a replacement for, traditional logistics. It serves a specific niche: urgent, small-item needs.

Walmart's expansion with Wing is one of the most visible signs that drone delivery is moving past the hype phase and into a period of methodical, scaled implementation. It demonstrates a major retailer's belief that the technology can solve a real business problem. The coming years will determine if the operational costs can be brought down and public acceptance can be secured, but for now, the sky above hundreds of Walmart stores is about to get a lot busier.

Comments

Please log in or register to join the discussion