Airbnb's 'Pay as a Local' initiative transformed its payment architecture, enabling support for 220+ markets through modular services, standardized payment flow archetypes, and configuration-driven onboarding that reduced integration time and improved the guest experience.

Airbnb has dramatically expanded its global payment capabilities, scaling support for local payment methods across more than 220 markets in just 14 months through its "Pay as a Local" initiative. This transformation addresses a critical challenge in the travel industry: reducing checkout friction for international guests while maintaining reliability and scalability at global scale.

The Payment Architecture Evolution

Previously, Airbnb relied primarily on card-based payments across its platform. To improve accessibility and adoption in international markets, the company undertook a comprehensive architectural transformation as part of its long-term Payments initiative.

The migration moved from a monolithic payment system to a domain-oriented services architecture. This new structure encompasses core domains including pay-ins, payouts, transaction fulfillment, processing, wallets, incentives, issuing, and settlement. The processing subdomain serves as a critical integration layer, connecting with third-party Payment Service Providers (PSPs) through a connector and plugin framework that supports both API and file-based integrations.

This modular approach has proven transformative for scaling. By standardizing integration patterns and creating reusable components, Airbnb significantly reduced the effort required to onboard new payment providers across different markets. The architecture enables rapid expansion while maintaining consistency and reliability.

Local Payment Method Support

The initiative supports a diverse range of locally preferred payment methods (LPMs) that vary by region:

- Digital wallets: Country-specific solutions like M-Pesa and MTN MoMo

- Online bank transfers: Regional systems such as Online Banking Czech and Online Banking Slovakia

- Real-time bank payments: Instant payment networks like Pix and UPI

- Local payment schemes: Regional card networks including EFTPOS and Cartes Bancaires

By offering these region-specific options, Airbnb aligns with local consumer preferences and reduces barriers to booking for international travelers.

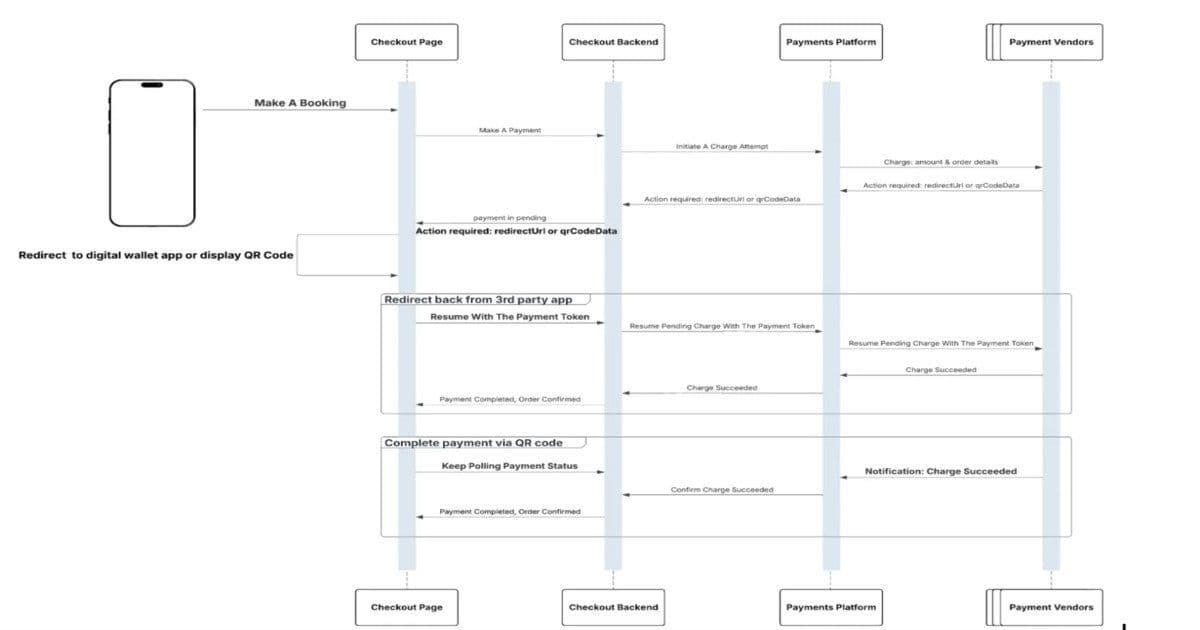

Standardized Payment Flow Archetypes

A key innovation in the initiative was the identification and standardization of three foundational payment flow archetypes based on analysis of 20+ global LPMs:

- Redirect flows: Guests are sent to a third-party app or website to complete payment, then return with a confirmation token

- Asynchronous flows: QR-based payments that notify Airbnb via webhooks after external transaction completion

- Direct flows: Guests enter credentials directly within Airbnb's interface for immediate processing

By standardizing these patterns into reusable archetypes, Airbnb reduced engineering complexity and simplified the onboarding of additional providers. This approach creates consistency across diverse payment methods while maintaining flexibility for regional variations.

Multi-Step Transaction Framework

To manage the complex, multi-step interactions required by different payment providers, Airbnb developed a processor-agnostic Multi-Step Transaction (MST) framework. This framework defines PSP-agnostic steps for authorizations, redirects, confirmations, and captures, providing a consistent orchestration layer that handles both internal and external payment interactions. The MST framework ensures reliability across flows involving app switching, session hand-offs, and asynchronous confirmations. This orchestration layer is critical for maintaining a seamless user experience despite the underlying complexity of different payment systems.

Configuration-Driven Onboarding

Airbnb streamlined integration and maintenance through a centralized YAML-based payment method configuration. This single source of truth defines:

- Eligibility rules for different markets and user segments

- Input validation requirements

- Refund policies

- UI rendering instructions

Backend services and the checkout widget reference this configuration dynamically, making new payment launches largely declarative. This approach significantly reduces errors and accelerates deployment of new payment methods.

Testing and Observability Infrastructure

The complexity of supporting diverse payment flows required substantial investments in testing and observability:

- PSP Emulator: An in-house tool that simulates redirect and asynchronous methods, enabling end-to-end testing without external sandboxes

- Centralized monitoring: A framework capturing metrics across clients, backend systems, PSPs, and webhooks

- Standardized alerts: Automated notifications for rapid issue detection

- Auto-enabled metrics: New payment methods automatically generate relevant metrics for monitoring

These capabilities enable engineers to trace problems end-to-end and maintain consistent reliability across diverse payment flows.

Business and Technical Impact

The Pay as a Local initiative delivered measurable results:

- Increased bookings: Markets with local payment methods saw higher booking volumes and engagement from new users

- Reduced integration time: Engineering teams significantly decreased the time required to onboard new providers

- Lower maintenance overhead: Configuration-driven approaches reduced ongoing maintenance burden

- Improved reliability: Enhanced observability and testing strengthened platform stability

- Faster scaling: The modular architecture enabled rapid expansion to 220+ markets

The combination of modular services, multi-step transaction orchestration, and centralized configuration created a foundation for continued growth while delivering a more consistent, localized checkout experience for guests worldwide.

Technical Architecture Insights

Several architectural patterns emerge from Airbnb's approach:

Domain-driven design: The decomposition into clear payment domains (pay-ins, payouts, processing, etc.) enables focused development and scaling

Plugin architecture: The connector and plugin framework for PSP integration provides extensibility without coupling

Configuration as code: YAML-based payment configurations enable declarative management of complex business rules

Observability-first design: Comprehensive monitoring and testing infrastructure built into the payment platform from the ground up

Archetype-based standardization: Identifying common patterns across diverse payment methods to reduce complexity

These patterns demonstrate how modern payment platforms can balance the need for global scale with local customization requirements.

Looking Forward

Airbnb's success with Pay as a Local demonstrates the viability of large-scale payment architecture transformation. The modular, configuration-driven approach provides a blueprint for other platforms seeking to expand globally while respecting local payment preferences.

The initiative's rapid scaling—220 markets in 14 months—highlights how proper architectural foundations can accelerate business expansion. As Airbnb continues to grow internationally, this payment infrastructure provides the flexibility and reliability needed to support diverse markets while maintaining a consistent user experience.

The combination of technical innovation and business impact makes this transformation a notable case study in modern payment platform architecture, showing how thoughtful design can solve complex global scaling challenges while improving the customer experience.

Comments

Please log in or register to join the discussion