Alphabet exceeded Wall Street expectations as its AI-powered advertising and cloud services drove a 15% revenue surge to $80.5 billion, demonstrating tangible returns on AI investments.

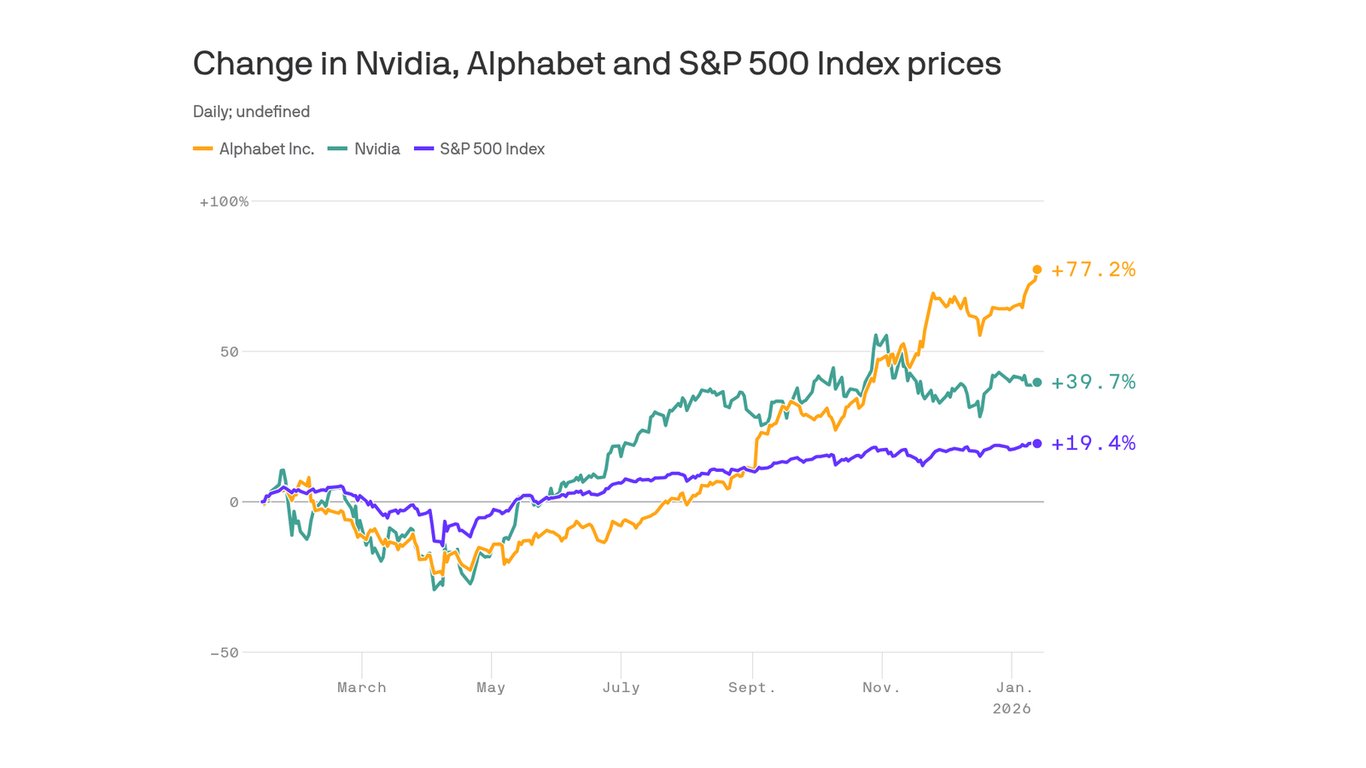

Alphabet's first-quarter earnings report delivered a decisive victory for AI-driven business models, with revenue climbing 15% year-over-year to $80.5 billion - significantly surpassing Wall Street's $78.9 billion forecast. The results validate investor confidence in CEO Sundar Pichai's aggressive AI strategy, sending Alphabet shares up 10% in after-hours trading.

Google's advertising business, powered by AI-optimized ad placements and performance tools, generated $61.7 billion - a 13% increase that outperformed digital advertising market growth rates. Meanwhile, Google Cloud revenue surged 28% to $9.2 billion, with AI infrastructure services becoming its fastest-growing segment. This positions Alphabet to capture more enterprise cloud market share from rivals Microsoft Azure and AWS, both of which saw cloud growth decelerate last quarter.

Three strategic AI advantages emerged:

- Search Dominance: Integration of generative AI features into Google Search increased user engagement by 6% while maintaining ad relevance scores

- Cloud Monetization: Enterprises adopted Vertex AI platform at triple last year's rate, with 60% of new cloud customers purchasing AI-specific services

- Efficiency Gains: AI-powered data center optimizations reduced operational costs by $1.2 billion quarterly

Financial analysts note Alphabet traded at a 15% discount to Microsoft before earnings, reflecting skepticism about AI monetization. "These numbers prove Google can convert AI research into revenue," said Morgan Stanley analyst Brian Nowak. "Their dual engine of search monetization and cloud AI services creates a sustainable competitive moat."

The results intensify pressure on competitors as Alphabet plans to increase AI infrastructure spending to $50 billion this year. With operating margins expanding to 32% and free cash flow hitting $16.9 billion, Alphabet now has both the financial resources and technical capability to accelerate its AI lead. As Pichai noted: "We're now seeing the multiplier effect of seven years of AI investment across our entire product ecosystem."

Comments

Please log in or register to join the discussion