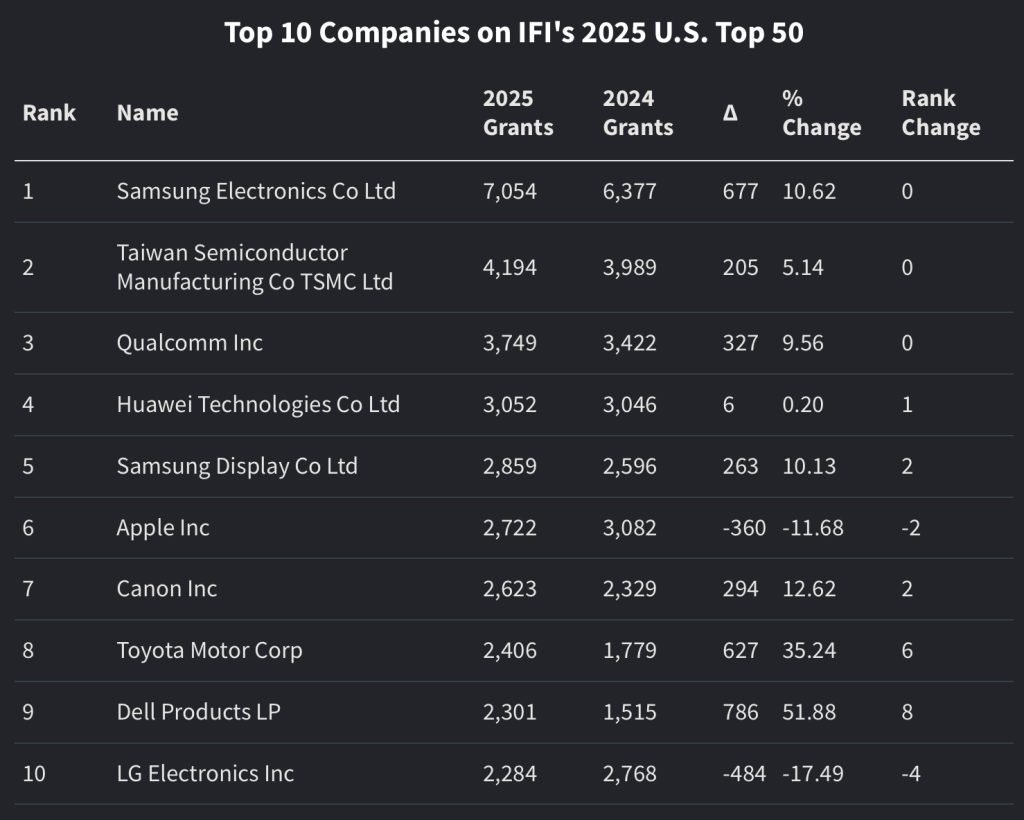

Apple's U.S. patent grants declined 11.6% to 2,722 in 2025, dropping the company to seventh place overall as Samsung maintains the top spot with 7,054 patents. The broader trend shows U.S. patent activity continuing its multi-year decline, with AI investment becoming the primary focus for corporate innovation.

Apple's position in U.S. patent rankings fell to seventh place in 2025, with the company receiving 2,722 patent grants—a 11.6% decrease from the 3,082 grants it received in 2024. This decline mirrors broader trends in U.S. patent activity, which continued its multi-year contraction according to the latest report from patent analytics firm IFI CLAIMS.

The Numbers Behind Apple's Decline

The raw data shows Apple's patent trajectory has been steadily weakening. While 2,722 patents still represents significant innovation output, the double-digit percentage drop places Apple behind several competitors for the first time in recent memory. Samsung Electronics led the field with 7,054 patent grants, marking a 10.6% year-over-year increase that widened the gap between the two tech giants.

The complete top 10 for 2025 reads: Samsung Electronics, TSMC, Qualcomm, Huawei, Samsung Display, Apple, Canon, Toyota, Dell, and LG Electronics. This ranking puts Apple behind not just Samsung, but also major semiconductor and display manufacturers, highlighting how the patent landscape has shifted toward specialized hardware innovation.

Broader Patent Market Decline

Apple's individual decline reflects wider industry patterns. U.S. patent grants overall slipped 0.2% to 323,272 in 2025, while applications dropped 8.6% to 393,344. This marks the sixth consecutive year of declining patent filings and grants in the United States.

IFI CLAIMS characterizes the current environment as dominated by "the dash to invest in artificial intelligence." This AI-focused strategy appears to be reshaping how companies approach intellectual property. Rather than pursuing broad patent portfolios, many corporations are concentrating their IP efforts on specific strategic areas.

IBM's position illustrates this shift dramatically. The company fell out of the top 10 for the first time in over three decades, landing in 11th place. However, IFI CLAIMS notes this doesn't necessarily indicate declining innovation. Instead, IBM has deliberately shifted strategy, moving away from maximizing patent volume to focusing specifically on cloud computing and AI technologies.

Patent Classification Shifts Signal Technology Evolution

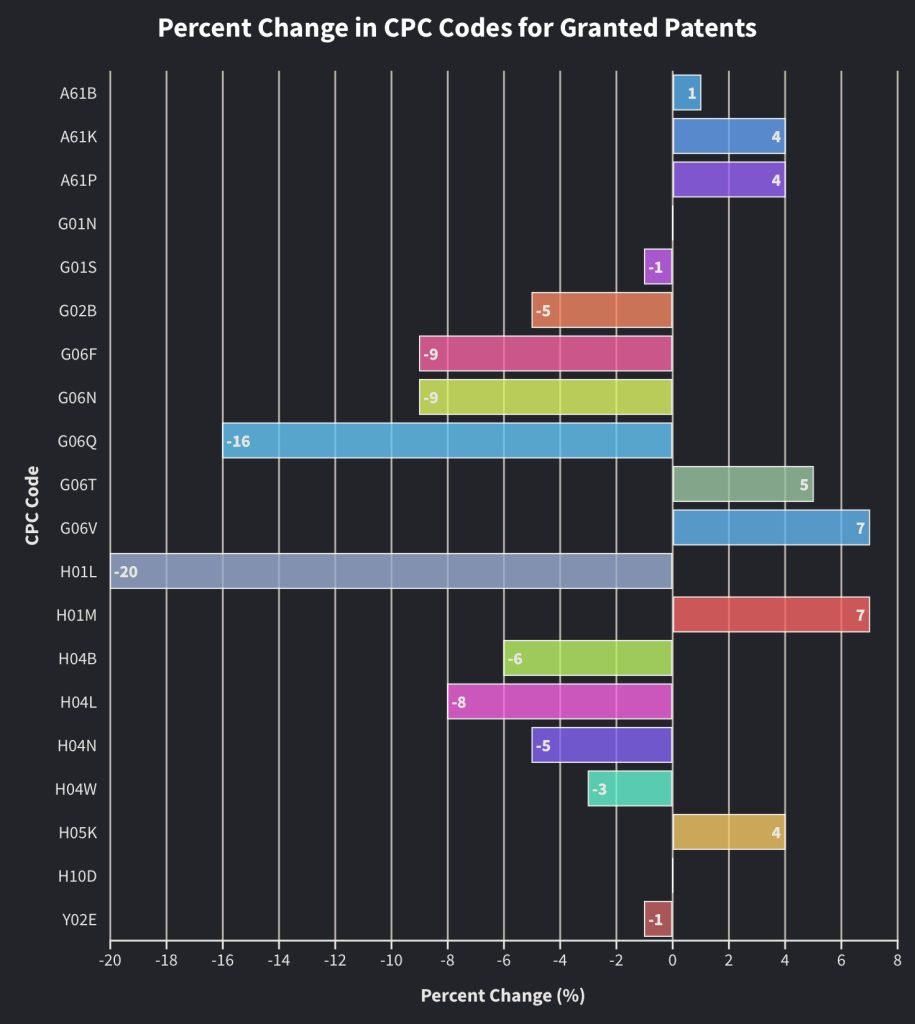

One of the most interesting findings in the report involves semiconductor patent classifications. Despite AI's massive computational demands driving chip innovation, traditional chip patents (H01L classification) declined 20% year-over-year.

At the same time, the H10D classification—which covers inorganic semiconductor devices like transistors, diodes, and integrated devices—appeared on the top 20 lists for both patent grants and applications. This suggests a fundamental shift toward next-generation chip technologies that go beyond conventional approaches.

TSMC, Samsung, IBM, and Intel emerged as the principal filers in the H10D space, indicating these companies are positioning themselves for the next wave of semiconductor innovation. For mobile developers, this classification shift matters because it signals where chip technology is heading, which directly impacts future device capabilities and development requirements.

What This Means for Apple's Development Strategy

For iOS developers and those building cross-platform applications, Apple's patent decline raises questions about the company's long-term innovation pipeline. Patents often serve as leading indicators of future product features and platform capabilities. A sustained decline could mean slower introduction of new APIs, hardware features, or development tools.

However, the IBM example provides important context. Patent quantity doesn't necessarily correlate with innovation quality or strategic focus. Apple may be following a similar path—reducing broad patent filings while concentrating resources on specific areas that align with product development priorities.

The company's recent focus areas suggest this might be the case. Apple has invested heavily in custom silicon, AR/VR technologies, health monitoring features, and privacy-preserving computation. These specialized areas require deep, focused innovation rather than broad patent portfolios.

Cross-Platform Development Implications

The patent landscape shift toward AI and advanced semiconductors has direct implications for cross-platform development. As chip manufacturers file more patents in next-generation categories, mobile developers should expect:

New hardware acceleration capabilities - The H10D classification growth suggests new types of processors and specialized compute units that will require platform-specific optimization.

AI integration requirements - With AI driving patent activity across all major players, on-device machine learning will become a standard expectation rather than a premium feature.

Platform fragmentation challenges - Different manufacturers pursuing different semiconductor approaches could lead to more varied hardware capabilities across Android and iOS devices.

The Competitive Landscape

Samsung's lead in patent grants—more than double Apple's total—reflects its dual role as both device manufacturer and component supplier. The company's patent strategy covers display technology, memory chips, processors, and device designs, giving it a broader IP base than Apple's more focused approach.

TSMC's second-place ranking underscores the foundry's critical role in advanced chip manufacturing. As Apple continues to design its own silicon but relies on TSMC for fabrication, the patent relationship between these companies becomes increasingly important for understanding future product timelines.

Looking Ahead

The patent data suggests 2026 may see continued emphasis on AI and next-generation semiconductors. For mobile developers, this means:

Stay informed about patent classifications - Tracking H10D and related categories can provide early insight into coming hardware capabilities.

Plan for AI-first development - The patent dash toward AI indicates this technology will be table stakes for competitive apps.

Expect hardware diversity - With multiple companies filing different semiconductor patents, cross-platform developers need to design for varied capabilities.

Apple's patent decline doesn't necessarily signal reduced innovation, but it does reflect a changing competitive environment where focused strategic IP matters more than volume. For developers, the key is monitoring these trends to anticipate platform evolution and plan development roadmaps accordingly.

The full IFI CLAIMS 2025 patent report provides additional detail on specific technology areas and company strategies. Read the complete report here.

Comments

Please log in or register to join the discussion