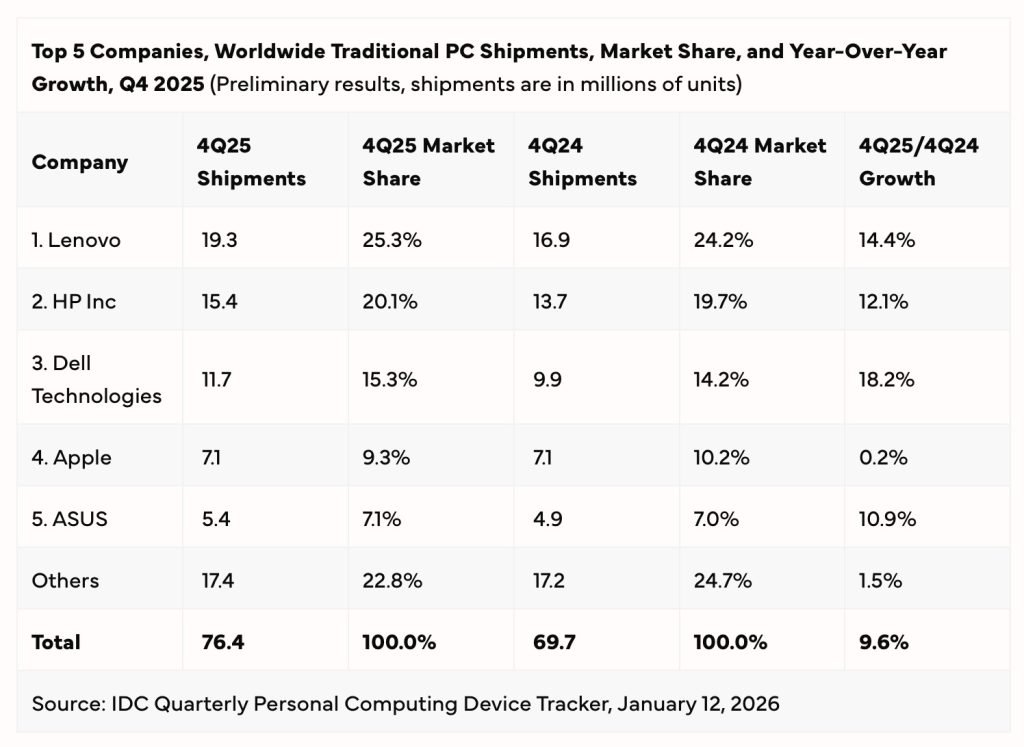

While the broader PC market expanded 9.6% year-over-year during the holiday quarter, shipping 76.4 million units, Apple's shipments remained flat at 7.1 million units, causing its market share to decline from 10.2% to 9.3%. However, the company still outpaced the industry for the full year with 11.1% growth.

The PC market posted strong growth during Q4 2025, but Apple couldn't keep pace. According to IDC's preliminary report, the industry shipped 76.4 million units, representing a 9.6% year-over-year increase. Apple's shipments, however, remained unchanged from Q4 2024 at 7.1 million units, causing the company's market share to slip from 10.2% to 9.3%.

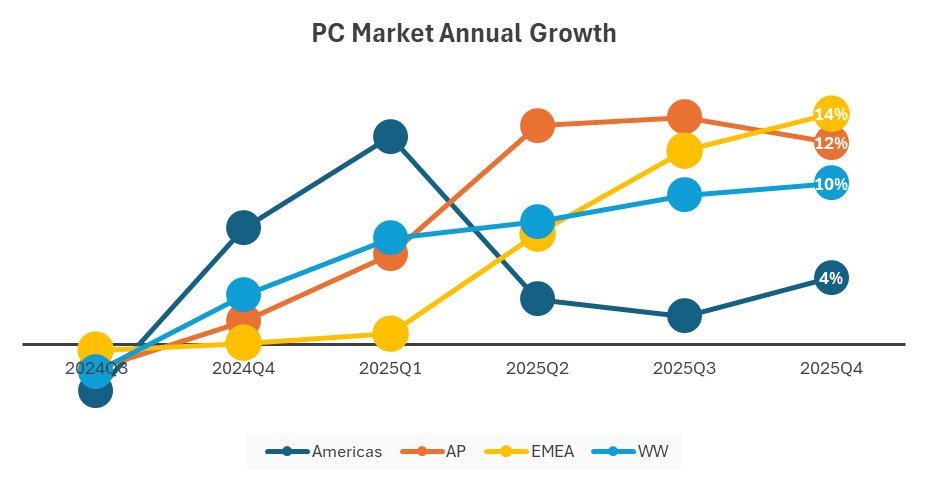

Regional Performance Diverges

The growth wasn't evenly distributed across the globe. Europe, the Middle East, and Africa (EMEA) led with 14% year-over-year growth, marking the first time since Q3 2024 that this region topped the charts. The Asia-Pacific region followed with 12% growth, while the Americas trailed significantly at just 4%. This marks the third consecutive quarter where the Americas have lagged behind all other regions.

The memory shortage that has been affecting the industry played a significant role in these results. IDC notes that the shortage "led buyers and brands to secure inventory ahead of anticipated price increases in 2026." This preemptive buying behavior likely boosted shipment numbers across the board.

Memory Shortages Reshape Industry Dynamics

Jitesh Ubrani, research manager with IDC's Worldwide Mobile Device Trackers, explained that the memory shortage will have lasting effects: "Large consumer electronics brands are well positioned to leverage their scale and memory allocations to capture shares from smaller and regional vendors. However, the severity of the shortage raises the risk that smaller brands may not survive, and consumers, particularly DIY enthusiasts, may delay purchases or shift their spending to other devices or experiences."

This dynamic creates a challenging environment for smaller PC manufacturers who lack the purchasing power of industry giants. Apple, with its massive scale and vertical integration, is better positioned to weather these supply constraints compared to many competitors.

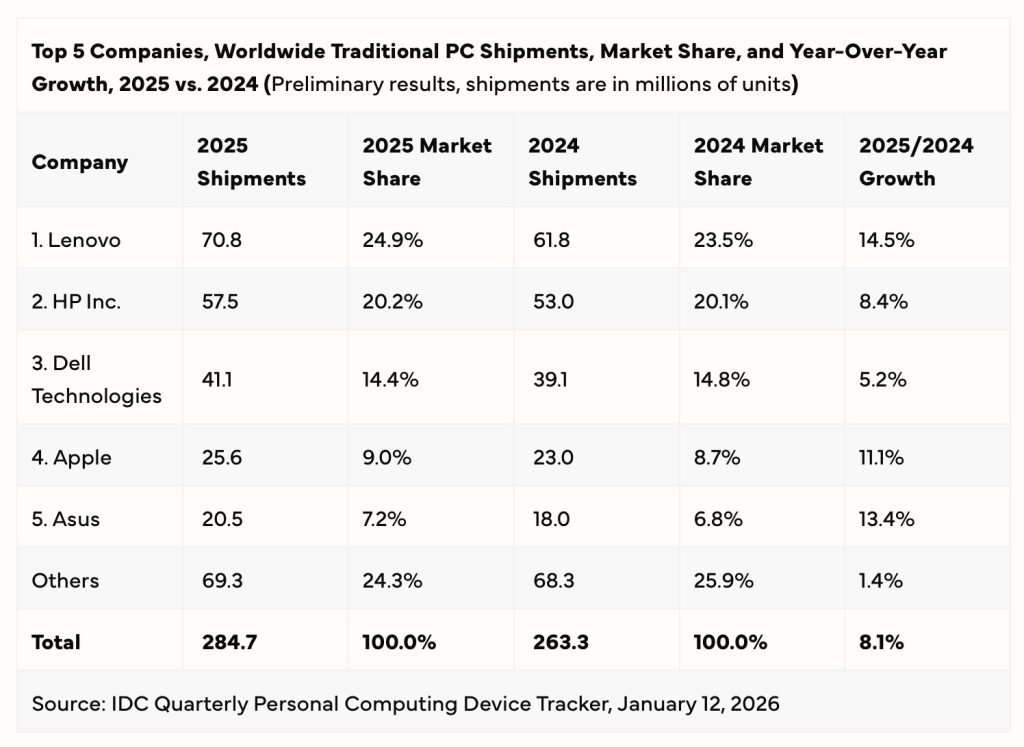

Full-Year 2025: Apple Outpaces Market

Despite the Q4 stumble, Apple performed well throughout 2025. The company achieved 11.1% shipment growth for the full year, exceeding the industry's 8.1% growth rate. Apple shipped 25.6 million units across all four quarters.

Lenovo and ASUS still outpaced Apple with 14.5% and 13.4% growth respectively, but Apple's performance demonstrates resilience in a competitive market. IDC attributed part of the overall demand to the end of Windows 10 support and early-year tariff concerns, which drove both consumer and enterprise upgrades.

What to Expect in 2026

Looking ahead, IDC predicts significant volatility. Jean Philippe Bouchard, research vice-president with IDC's Worldwide Mobile Device Trackers, stated: "IDC expects that the PC market will be far different in 12 months given how quickly the memory situation is evolving. […] Beyond the obvious pressure on prices of systems, already announced by certain manufacturers, we might also see PC memory specifications be lowered on average to preserve memory inventory on hand. The year ahead is shaping up to be extremely volatile."

This volatility could affect Apple's pricing strategy and product specifications. The company may need to balance maintaining performance standards with managing component costs, particularly for memory-intensive features like AI processing and high-resolution displays.

Developer Implications

For iOS and macOS developers, these market dynamics matter. A growing PC market with memory constraints could influence hardware upgrade cycles among users. Developers building memory-intensive applications may need to optimize further, while those targeting professional users should consider how pricing pressures might affect their customer base's hardware purchasing decisions.

The shift toward larger brands dominating memory allocations also suggests that Apple's vertical integration and supply chain control will remain key advantages, potentially leading to more consistent hardware availability for users within the Apple ecosystem compared to fragmented Windows PC manufacturers.

IDC's full Q4 2025 report will provide more detailed breakdowns when released, including specific performance by product category and vendor.

Comments

Please log in or register to join the discussion