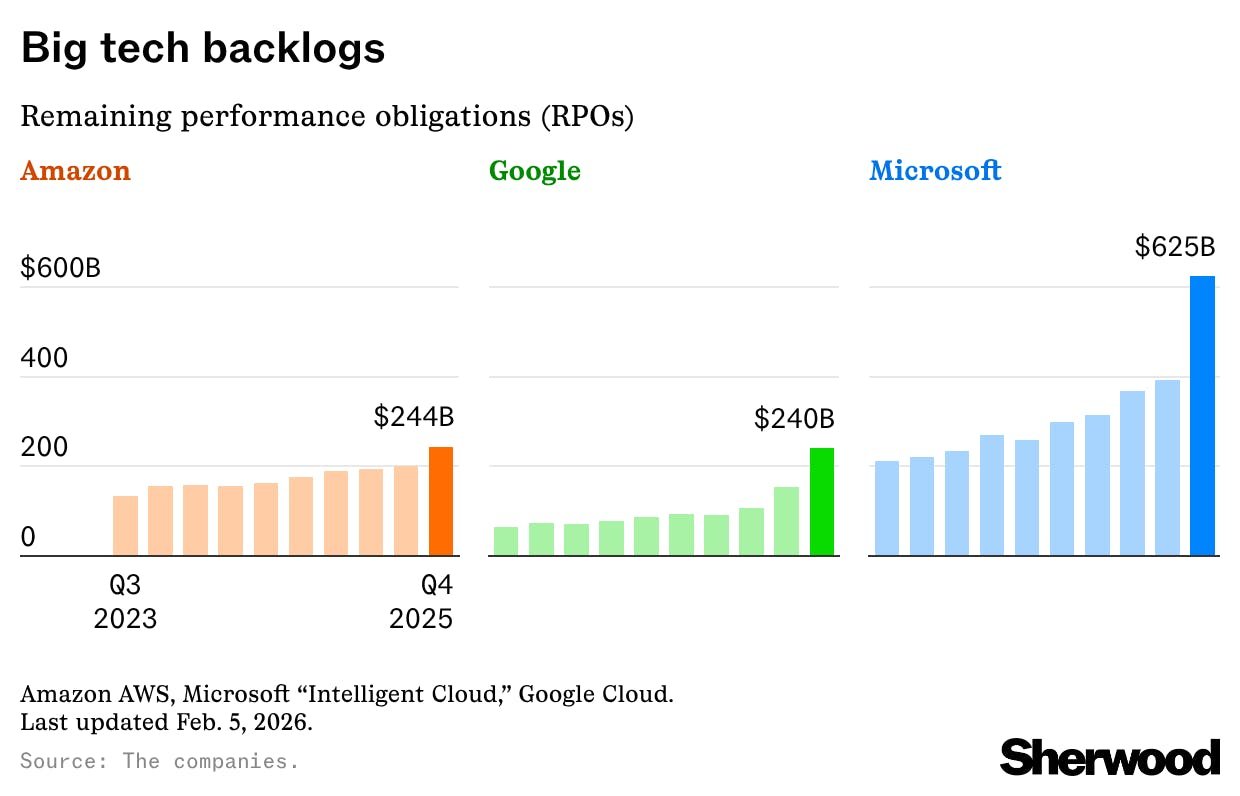

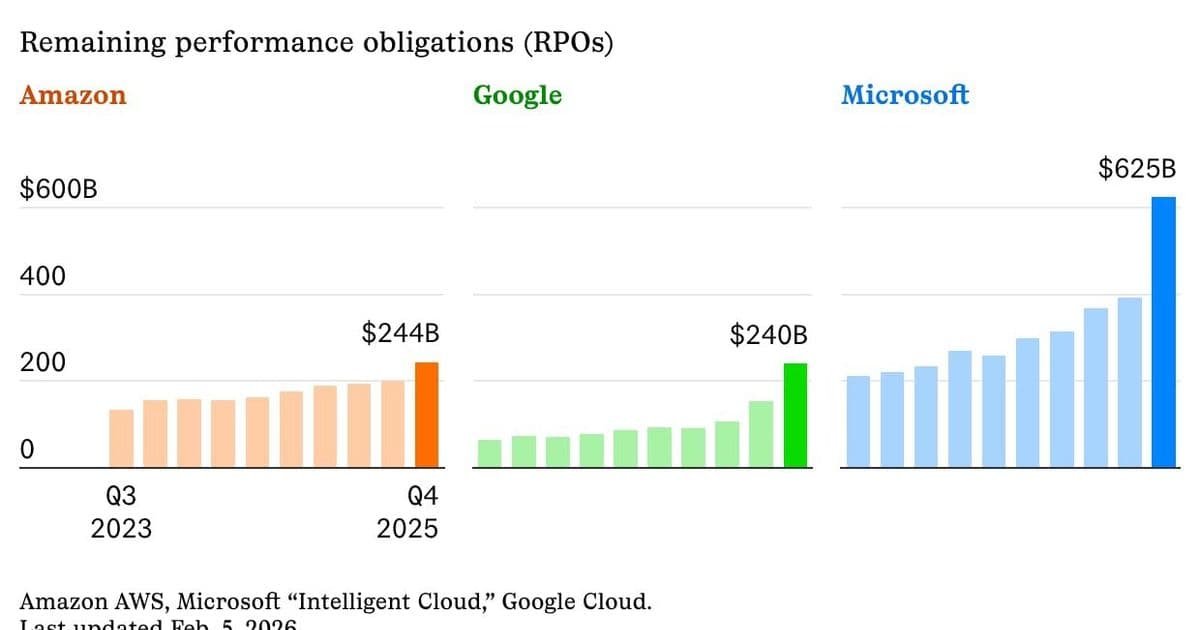

Amazon, Google, and Microsoft report a staggering $1.1 trillion backlog of cloud computing revenue, driven by massive AI infrastructure investments and unprecedented capital expenditure forecasts.

The cloud computing giants are sitting on an unprecedented $1.1 trillion backlog of contracted revenue, according to recent quarterly earnings reports from Amazon, Google, and Microsoft. This massive figure, which includes Microsoft's $625 billion portion alone, signals both the explosive demand for AI infrastructure and the enormous capital investments required to meet it.

The Scale of the Backlog

The $1.1 trillion backlog represents contracted but not yet delivered cloud services, primarily driven by AI workloads. Microsoft's $625 billion backlog alone exceeds the GDP of many countries, highlighting how AI has transformed cloud computing from a steady-growth business into a capital-intensive race for infrastructure dominance.

This backlog isn't just a revenue pipeline—it's a commitment. These companies have promised customers massive computing capacity that doesn't yet exist, forcing them to accelerate data center construction and GPU procurement at unprecedented rates.

Capital Expenditure Explosion

Four major US tech companies—Alphabet, Amazon, Meta, and Microsoft—have forecast a combined $650 billion in capital expenditures for 2026, representing a staggering 60% year-over-year increase. This spending surge is almost entirely focused on AI infrastructure:

- Data centers: Massive construction projects to house AI training clusters

- GPUs and accelerators: Nvidia, AMD, and Intel chips for AI workloads

- Networking equipment: High-bandwidth interconnects for AI clusters

- Power infrastructure: Meeting the enormous energy demands of AI training

The Infrastructure Bottleneck

Intel and AMD have notified Chinese customers of severe server CPU shortages, with Intel warning of delivery lead times up to six months. This shortage extends across the entire AI hardware stack, from processors to networking equipment.

The semiconductor industry is racing to meet demand, with global chip sales hitting $791.7 billion in 2025—a 25.6% year-over-year increase. Advanced AI chips from Nvidia, AMD, and Intel alone accounted for $301.9 billion, up 40% from the previous year. The Semiconductor Industry Association expects $1 trillion in chip sales in 2026.

The AI Training Arms Race

Companies are using increasingly sophisticated methods to train AI models. Waymo, Alphabet's autonomous driving unit, is using DeepMind's Genie 3 to create realistic digital worlds for training edge-case scenarios. This approach allows companies to simulate rare but critical situations without the risks and costs of real-world testing.

Meanwhile, Goldman Sachs has partnered with Anthropic to develop AI agents that automate roles across the bank, from trades and transactions to client vetting and onboarding. This represents a broader trend of financial institutions investing heavily in AI automation.

The GitHub Commit Revolution

Perhaps most surprisingly, Anthropic's Claude Code is now responsible for 4% of all public GitHub commits and is on track to cross 20% of all daily commits by the end of 2026. This represents a fundamental shift in how software is developed, with AI agents becoming primary contributors to open-source projects.

Regional Challenges and Opportunities

OpenAI is working with UAE-based G42 to build a ChatGPT version tuned for local language, political outlook, and speech restrictions. This highlights how AI deployment is becoming increasingly regionalized, with companies adapting models to local regulations and cultural norms.

However, only 35 countries signed a declaration affirming "human responsibility over AI-powered weapons," with the US and China opting out. This lack of international consensus on AI governance could create fragmented markets and regulatory challenges.

The Market Response

Amazon's shares plunged 8% after the company posted mixed fourth-quarter earnings but boosted its 2026 spending forecast to $200 billion. This reaction underscores Wall Street's concerns about the profitability of massive AI infrastructure investments.

Microsoft, meanwhile, is scaling back plans for a virtual health coach, according to people with knowledge of the matter. This suggests that even tech giants are struggling to find profitable AI applications beyond infrastructure.

The Bottom Line

The $1.1 trillion cloud backlog represents both an opportunity and a challenge. It confirms that demand for AI infrastructure is real and massive, but it also reveals the enormous capital requirements and execution risks involved.

Companies that can efficiently build and operate AI infrastructure will capture enormous value. Those that can't may find themselves with billion-dollar commitments they can't fulfill. As one industry analyst put it, "The AI gold rush is real, but you need to build the mines before you can extract the gold."

The race is on, and the stakes have never been higher. With $650 billion in planned spending and a $1.1 trillion backlog of commitments, the next few years will determine which companies can turn AI infrastructure into sustainable competitive advantages—and which will be left holding the bag when the AI bubble inevitably faces its first major correction.

Comments

Please log in or register to join the discussion