Chinese authorities are preparing new regulations that would restrict how many Nvidia H200 chips local companies can purchase and require them to justify their need, according to sources familiar with the matter. The move represents the latest escalation in the ongoing semiconductor trade tensions between the U.S. and China, and could significantly impact the AI development landscape in the world's second-largest economy.

Chinese authorities are drafting new rules that would limit how many Nvidia H200 chips local companies can purchase and require them to justify their need, according to multiple sources familiar with the matter. The regulations, which are still being finalized, represent the latest escalation in the ongoing semiconductor trade tensions between the U.S. and China and could significantly impact AI development in the world's second-largest economy.

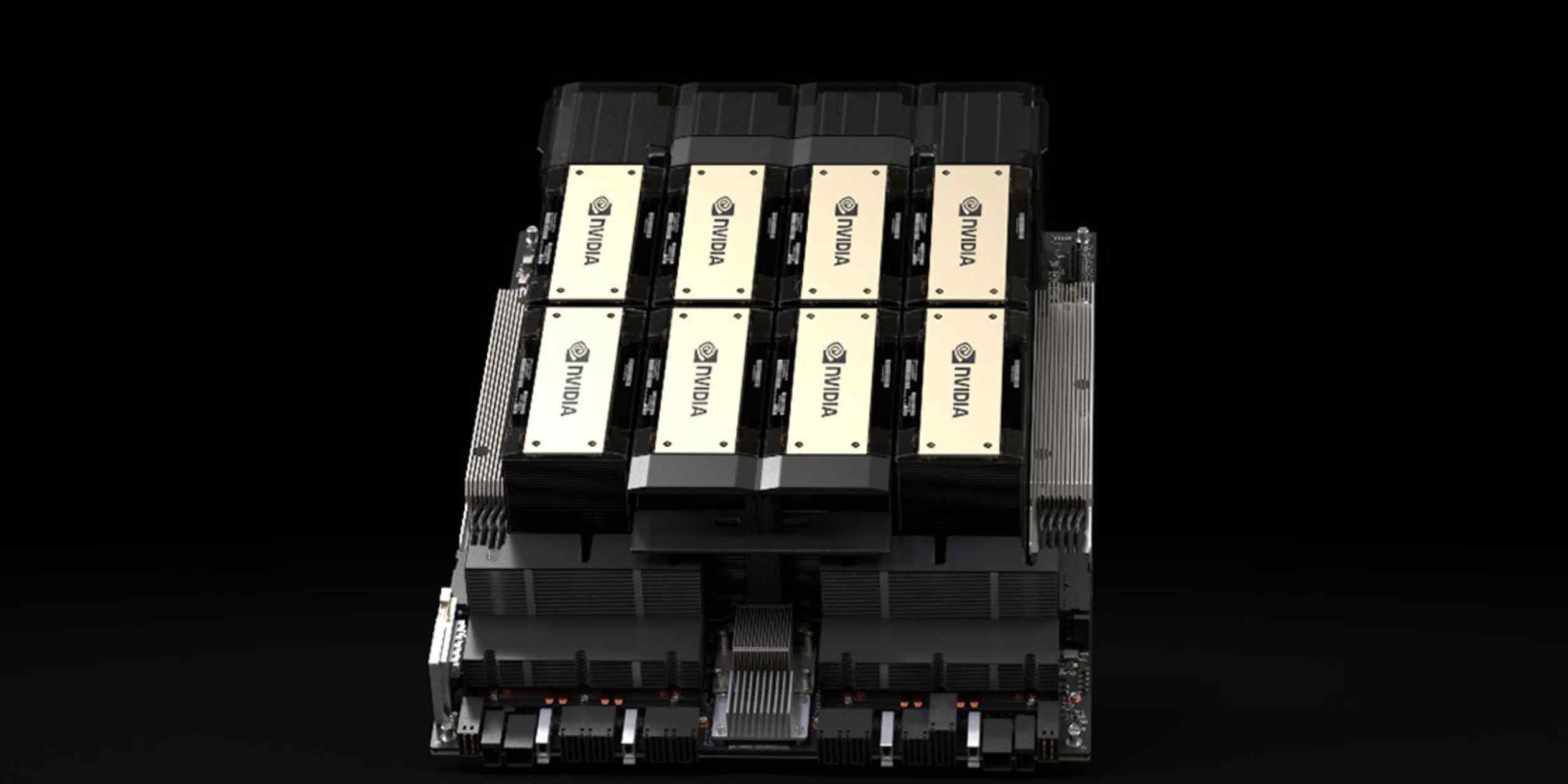

The proposed rules come as Chinese tech companies have been aggressively stockpiling high-end AI chips in anticipation of further restrictions. Nvidia's H200, which features 141GB of HBM3e memory and delivers up to 1.8x the inference performance of the previous H100 generation, has become a critical component for training and deploying large language models. Chinese firms have been racing to acquire these chips despite U.S. export controls that already restrict the sale of Nvidia's most advanced data center GPUs to China.

Sources indicate that Chinese customs officials were told this week that H200s are effectively barred from the country, with local tech companies instructed not to purchase them unless absolutely necessary. The new rules would formalize this approach by creating a permit system where companies must demonstrate a specific, legitimate business need for each chip acquisition.

This development follows a pattern of increasingly stringent controls on both sides. The U.S. has progressively tightened export restrictions on advanced semiconductors to China, most recently with the 25% tariff on chips "transshipped through the United States to other foreign countries" that President Trump signed earlier this week. China has responded with its own measures, including restrictions on the use of cybersecurity software from U.S. and Israeli companies and now targeted controls on specific high-end chips.

For Chinese AI companies, the implications are substantial. Many have been building their infrastructure around Nvidia's CUDA ecosystem, which remains the dominant platform for AI development globally. While Chinese firms like Biren and Moore Threads are developing domestic alternatives, they currently lag significantly behind Nvidia in performance and software support. The H200 restrictions could force Chinese companies to either work with less powerful domestic chips or develop more efficient algorithms that can achieve comparable results with fewer resources.

The rules also create a complex compliance challenge. Companies will need to carefully document their chip requirements and justify why domestic alternatives or less powerful imported chips won't suffice. This could slow down AI development projects and add administrative overhead, particularly for smaller startups that lack the resources to navigate complex regulatory processes.

International companies operating in China face their own challenges. While foreign firms aren't subject to the same justification requirements, they may still find it difficult to secure sufficient chip supplies for their Chinese operations. This could lead to a bifurcation of AI development, with Chinese operations becoming increasingly isolated from global AI infrastructure trends.

The timing of these regulations is particularly significant given the current AI boom. Chinese companies have been making notable progress in AI development, with models like Baidu's Ernie Bot and Alibaba's Tongyi Qianwen showing competitive performance. However, access to cutting-edge hardware remains a critical bottleneck. The H200 restrictions could slow this progress, potentially widening the gap between Chinese and Western AI capabilities.

Industry analysts note that these restrictions might accelerate China's push toward technological self-sufficiency. The Chinese government has already invested billions in domestic semiconductor manufacturing through initiatives like the National Integrated Circuit Industry Investment Fund. While catching up to leading-edge chip manufacturing remains a formidable challenge, the pressure from export restrictions could spur additional investment and innovation in domestic alternatives.

The rules also highlight the growing complexity of global semiconductor supply chains. Companies must now navigate not just technical specifications and pricing, but also an increasingly complex web of geopolitical considerations. This adds another layer of uncertainty for investors and could influence where AI companies choose to locate their data centers and development teams.

For the broader AI ecosystem, these developments underscore the fragmentation of global technology infrastructure. While the internet has historically been a global network, semiconductor supply chains and AI development are becoming increasingly regionalized. This could lead to parallel AI ecosystems developing in different parts of the world, with different hardware preferences, software frameworks, and regulatory requirements.

The proposed rules are still being finalized, and their exact implementation timeline remains unclear. However, they signal that both the U.S. and China are prepared to use semiconductor controls as a tool of economic and technological policy. For companies operating in the AI space, this means that geopolitical considerations will remain a critical factor in strategic planning for the foreseeable future.

The impact will likely be most pronounced in the short term, as Chinese companies scramble to secure remaining H200 inventory before the rules take effect. In the longer term, the restrictions could accelerate the development of domestic alternatives and force a rethinking of AI hardware strategies. Either way, the era of freely accessible global semiconductor supply chains appears to be ending, replaced by a more fragmented and politically charged landscape.

Comments

Please log in or register to join the discussion