Japan's Liberal Democratic Party secured a landslide victory in Sunday's election amid China's three-month pressure campaign over Taiwan, triggering market surges and strategic recalibrations across Asia.

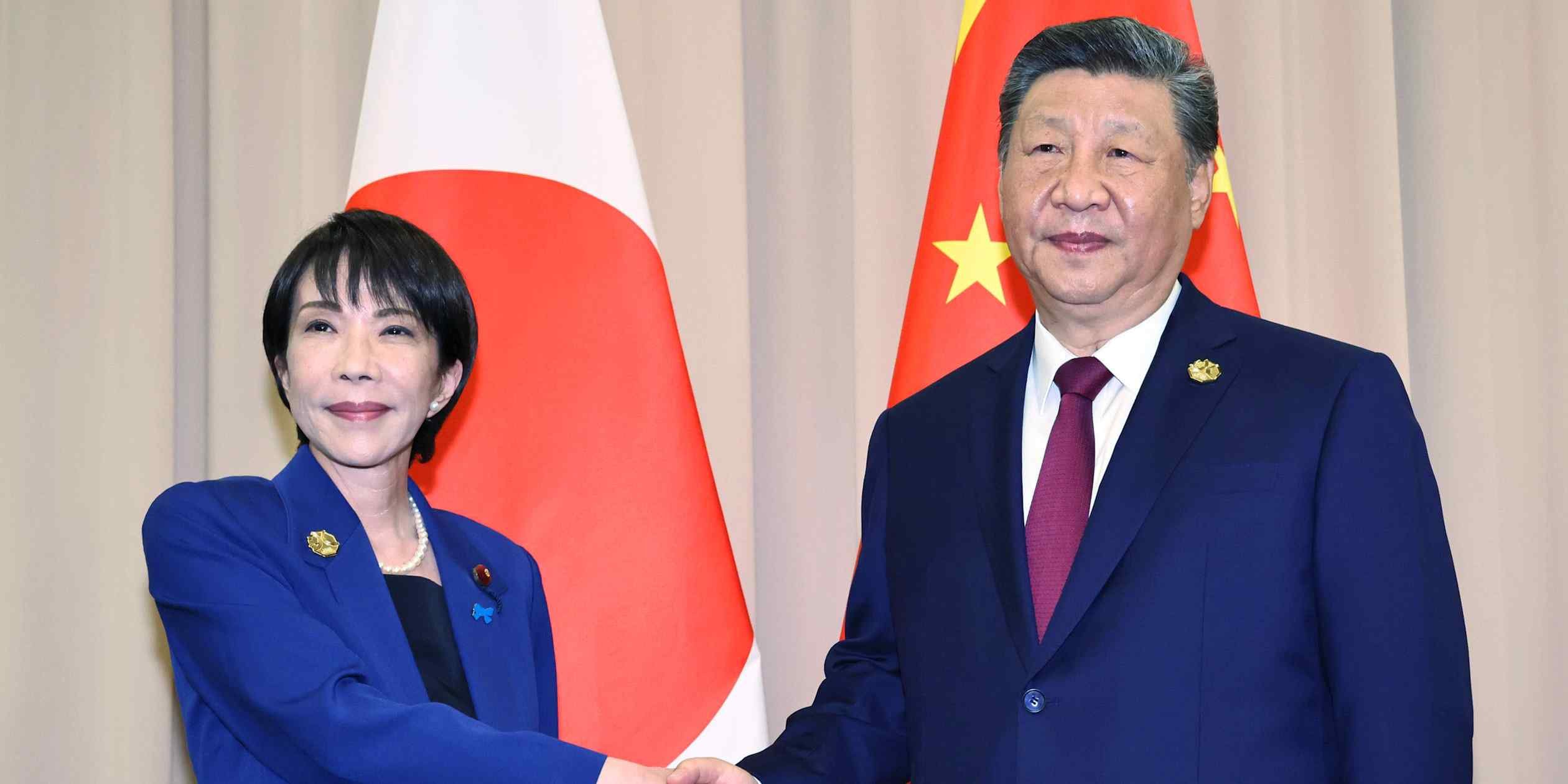

Japanese Prime Minister Sanae Takaichi's landslide election victory on Sunday delivered an unexpected political mandate amid escalating tensions with China, triggering immediate market reactions and forcing strategic reassessments across the region. The Liberal Democratic Party secured 293 of 465 lower house seats—a supermajority allowing constitutional amendments—while the Nikkei 225 stock index surged 2.4% to a record high on Monday as investors welcomed political stability.

China had intensified pressure against Takaichi's government for three months preceding the election, sharply criticizing Japan's stance on Taiwan following a September 2025 incident where Chinese coast guard vessels entered Japan's contiguous zone near Okinawa. Public statements from Beijing accused Tokyo of "interfering in internal affairs," while trade data shows China reduced rare earth exports to Japan by 18% year-on-year during the pressure campaign—a sector where Japan remains 60% dependent on Chinese supply.

Market analysts note the election outcome contradicts China's apparent objective to weaken Takaichi's administration. "Beijing's pressure tactics galvanized nationalist sentiment rather than diminishing support," observed Naomi Fink of Europa Japan. The Nikkei's record close reflects investor confidence in continuity of Japan's corporate governance reforms and semiconductor industry subsidies, with automakers Toyota and Honda gaining over 3%.

Strategic implications extend beyond immediate market movements:

- Economic Decoupling Acceleration: Japan's Ministry of Economy, Trade and Industry confirmed ¥42 billion ($280 million) in new funding for rare earth recycling projects, accelerating efforts documented in Japan's Critical Minerals Strategy. This follows 2025's 37% year-on-year increase in Japanese investment in Australian lithium and cobalt mines.

- Defense Industry Expansion: Defense contractors Mitsubishi Heavy Industries and Kawasaki Heavy Industries rose 5.2% and 4.7% respectively as Takaichi reaffirmed plans to double defense spending to 2% of GDP by 2027.

- Tech Supply Chain Shifts: Taiwan Semiconductor Manufacturing Company (TSMC) announced expanded capacity at its Kumamoto plant, capitalizing on Japan's $13 billion semiconductor subsidy program initiated under Takaichi.

Chinese state media downplayed the election results, with the Global Times editorial stating the outcome "won't affect China's core interests." However, customs data reveals China's exports to Japan grew at just 1.2% year-on-year in Q4 2025—half the rate of Japan-bound exports from South Korea—suggesting economic friction persists.

For Japanese corporations, the supermajority enables swift legislative action on pending economic security bills, including tighter restrictions on technology transfers and expanded screening of foreign investments. "The mandate removes procedural hurdles for policies protecting critical supply chains," noted JPMorgan Japan analyst Rie Nishida, citing pending legislation to regulate 14 high-priority materials including gallium and germanium used in chip manufacturing.

Regional observers now watch for Beijing's next moves, particularly regarding Taiwan Strait patrols and rare earth export policies. With Japan accounting for 22% of global semiconductor equipment production and China representing 31% of global chip consumption, any escalation risks disrupting a $150 billion annual bilateral trade relationship central to technology supply chains.

Comments

Please log in or register to join the discussion