Corning's once-struggling fiber-optic division is now driving record growth, fueled by insatiable data center demand and a landmark $6B deal with Meta. Nvidia's exploration of Corning's co-packaged optics signals broader industry shifts toward integrated photonics.

Five years ago, analysts urged Corning to abandon its fiber-optic division. Today, that same unit powers the company's stock to historic highs, thanks to a perfect storm of hyperscaler demand and optical innovation. The transformation highlights how fundamental connectivity infrastructure has become the unglamorous backbone of our AI-driven era.

The Data Center Gold Rush

The surge begins with simple physics: moving data via light through glass fibers remains exponentially faster and more energy-efficient than copper alternatives. As AI workloads explode, hyperscale data centers now consume fiber at unprecedented rates. Corning's revenue from optical communications grew 35% year-over-year last quarter, directly correlating with the construction frenzy. Competitors like Sterling Infrastructure and Comfort Systems USA report similar stock surges as they race to build facilities capable of handling next-gen computing demands. According to Wall Street Journal analysis, US data center construction starts increased by 25% in 2025 alone.

Meta's $6B Bet

A pivotal moment came when Meta committed $6 billion to Corning for fiber-optic cables supporting its global infrastructure expansion. This wasn't a speculative purchase; Meta needs these materials to connect its AI training clusters across continents. The deal represents one of the largest single supplier agreements in Meta's history, signaling a long-term bet on fiber density as a competitive advantage. While Meta hasn't disclosed technical specifics, industry insiders confirm the order includes Corning's latest low-latency SMF-28® Ultra fiber, optimized for high-bandwidth data transfer between server racks.

Nvidia's Optics Exploration

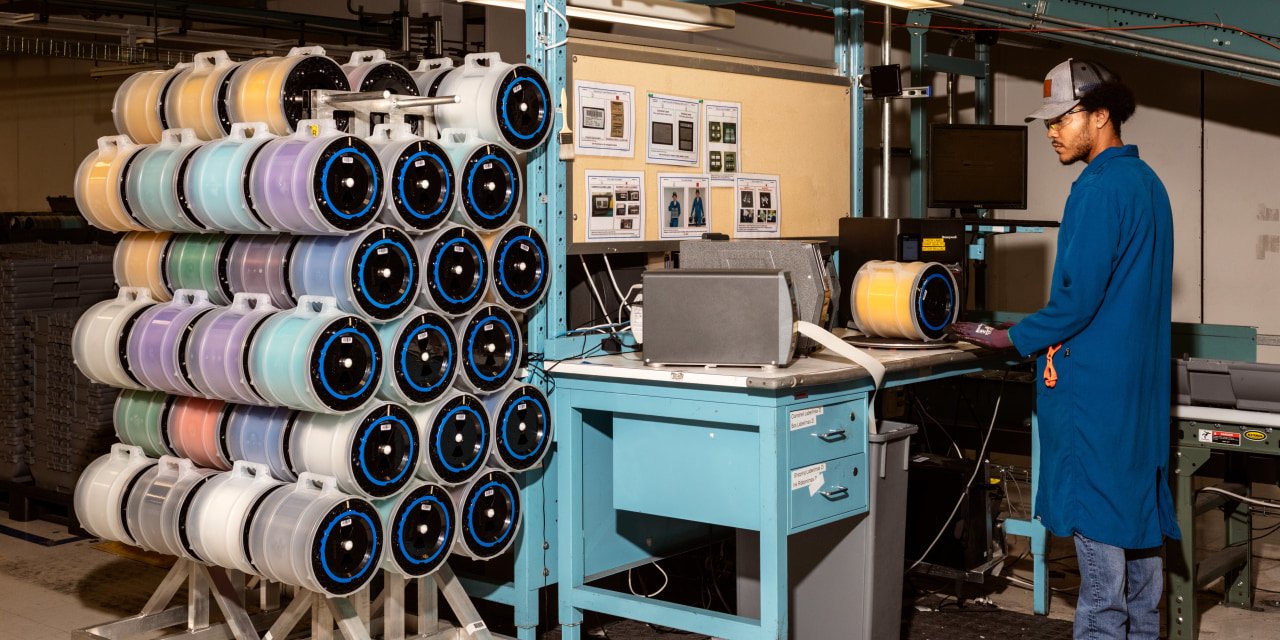

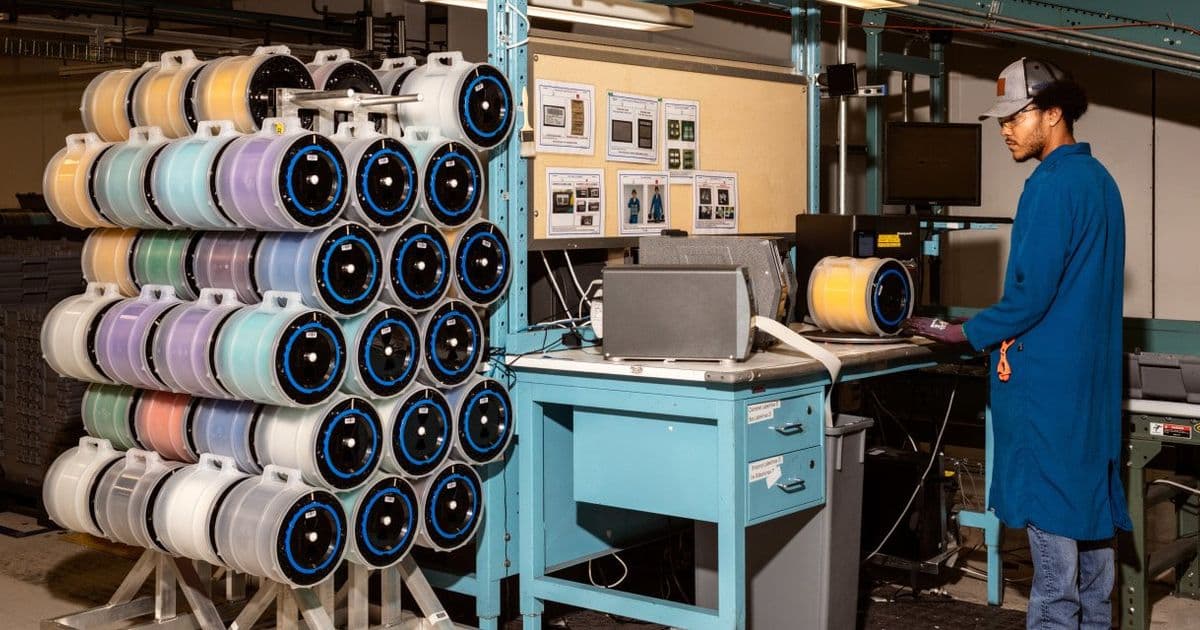

More revealing is Nvidia's experimentation with Corning's co-packaged optics (CPO) technology. Traditional servers use discrete pluggable optical modules connected via electrical traces—a setup becoming problematic as data rates exceed 200G per lane. CPO embeds optics directly onto the silicon package or nearby substrate, drastically reducing power consumption and latency. Sources familiar with the talks confirm Nvidia is testing Corning's CPO solutions for next-generation GPU servers, where moving vast datasets between processors requires radical rethinking of interconnect design. This aligns with Nvidia's broader push into data center infrastructure, moving beyond chips into full system architecture.

Why Co-Packaged Optics Matter

CPO isn't merely incremental improvement; it's a fundamental shift. By integrating lasers and photodetectors closer to processors, systems can:

- Reduce power consumption by up to 30% compared to pluggable transceivers

- Cut latency from nanoseconds to picoseconds

- Increase bandwidth density by 5x within the same physical footprint Corning's expertise in glass substrates and precision alignment gives it an edge in manufacturing reliability—a critical factor when embedding optics into expensive compute packages. As AI models grow larger, these efficiency gains directly translate to lower operational costs for cloud providers.

Counterperspectives and Risks

Despite the momentum, challenges persist. Skeptics note Corning's reliance on a handful of hyperscale customers makes it vulnerable to capex cuts; Meta already reduced data center spending by 9% last quarter. Competitors like Infinera and Lumentum are advancing competing CPO technologies, potentially fracturing the market. Some engineers also question whether CPO adoption timelines are realistic, citing thermal management hurdles when stacking optics beside high-heat GPUs. Meanwhile, alternative technologies like silicon photonics continue evolving—Intel's integrated photonics research could eventually challenge Corning's glass-based approach.

Corning's resurgence underscores a broader truth: the AI boom demands innovations beyond processors. As data becomes the new currency, the pipes carrying it—whether across oceans or between chips—are commanding unprecedented strategic value. Whether this marks a sustainable inflection point or another cyclical peak depends on how quickly optical integration evolves from server edge to silicon core.

Comments

Please log in or register to join the discussion