Panasonic Housing Solutions leverages YKK's manufacturing and distribution infrastructure to capitalize on China's shifting property market, where renovation demand now outpaces new construction.

Panasonic Housing Solutions, a subsidiary of Panasonic Holdings, is repositioning to capture China's accelerating home renovation market through a strategic partnership with Japanese manufacturing conglomerate YKK. The company plans to sell 80% of its shares to YKK by April 2027, leveraging YKK AP's established sales network and manufacturing facilities across China. This move comes as Panasonic Housing targets a doubling of China sales to ¥40 billion ($255 million) by fiscal 2030.

Market Shift Triggers Strategic Pivot

China's property sector faces unprecedented challenges, with new-home sales declining 23% year-over-year in Q4 2025 according to National Bureau of Statistics data. This contraction contrasts sharply with renovation demand, which grew 18% during the same period. The divergence stems from China's unique property delivery model, where approximately 67% of condos are handed to buyers as unfinished "bare-shell" units without interior fixtures. Panasonic Housing President Masashi Yamada notes: "Full-scale renovation demand in China now represents a market five times larger than Japan's entire home improvement sector."

Operational Integration Strategy

The partnership unfolds in three strategic layers:

- Distribution Access: Immediate utilization of YKK AP's existing sales channels across 12 Chinese provinces

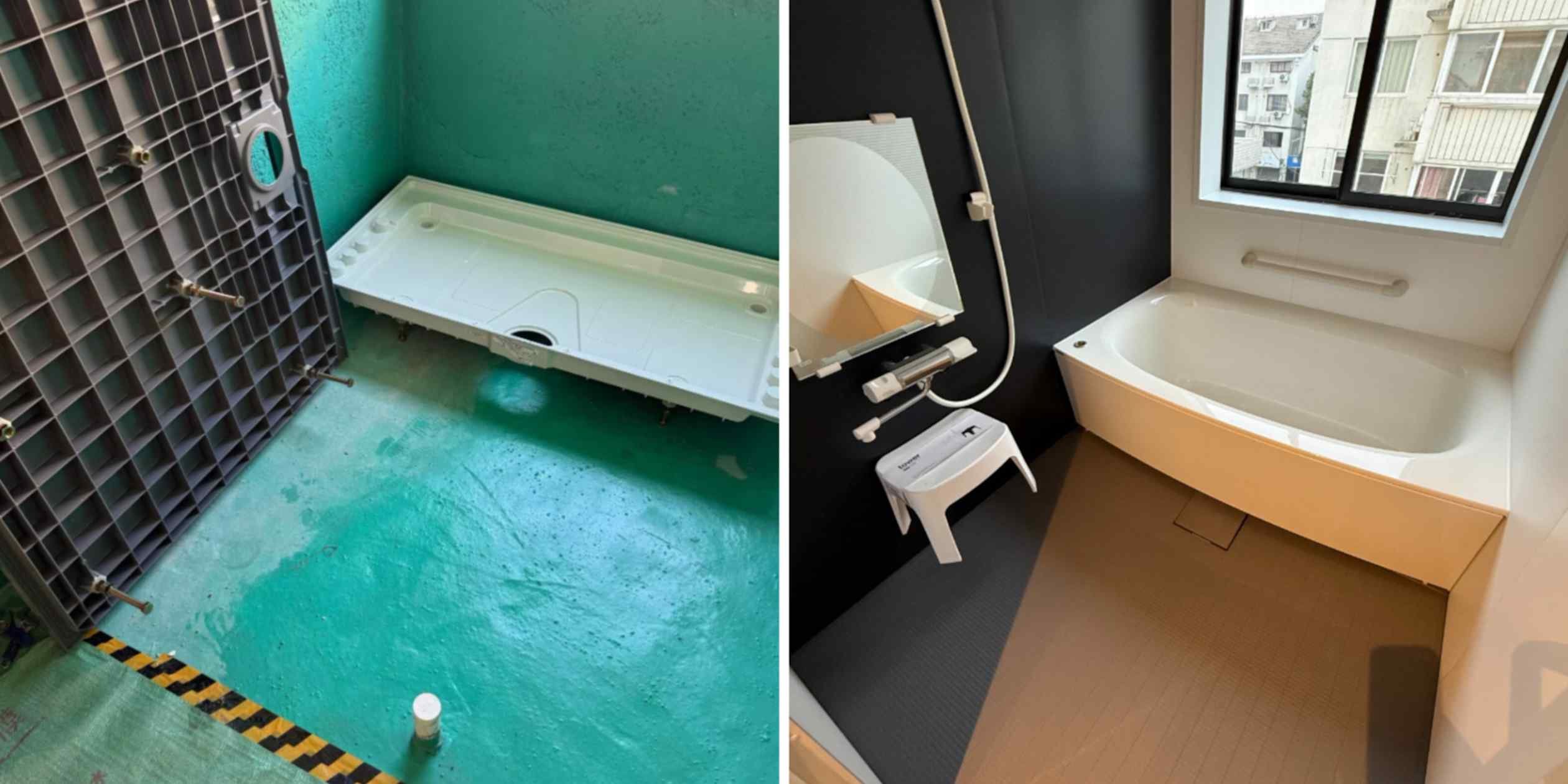

- Product Synergy: Combining YKK's window/sash systems with Panasonic's bath fixtures, bidets, and wall systems to create bundled renovation packages

- Manufacturing Optimization: Potential shift of door and flooring production to YKK AP's three Chinese factories, reducing outsourcing costs by an estimated 15%

Quantifying the Opportunity

Internal analysis identifies immediate demand for over 300,000 high-end residential renovations, concentrated in Tier-1 cities like Shanghai and Guangzhou. The premium segment commands average project values of ¥1.3 million ($8,300), nearly triple China's median renovation expenditure. Despite geopolitical tensions, Yamada emphasizes insulation from political headwinds: "Housing essentials for consumers show lower sensitivity to bilateral relations. We're entering a scalable growth phase."

Broader Industry Implications

This partnership reflects foreign manufacturers adapting to China's property transition. As developers like China Vanke project $11.8 billion losses for 2025, secondary markets gain strategic importance. The YKK-Panasonic model demonstrates how industrial networks can pivot from new construction to renovation without major capital expenditure, leveraging existing manufacturing footprints and channel relationships. With 230 million urban households in China built before 2010, this renovation wave presents a long-term structural opportunity beyond current market cycles.

Comments

Please log in or register to join the discussion