CTM360's latest report reveals a dramatic increase in fraudulent High-Yield Investment Programs (HYIPs) globally, with over 4,200 scam websites identified and 485+ monthly incidents. These sophisticated scams promise unrealistic returns through cryptocurrency and forex trading platforms, using professional interfaces and fake credentials to deceive victims.

A new report from CTM360 has sounded the alarm on a dramatic surge in fraudulent High-Yield Investment Programs (HYIPs) worldwide, revealing a sophisticated scam ecosystem that has already ensnared thousands of victims through promises of unrealistic returns.

The Anatomy of Modern Investment Fraud

These scams operate on a deceptively simple premise: deposit money, wait a short period, and withdraw substantial profits. Advertisements frequently boast returns as high as "40% in 72 hours" - figures that should immediately raise red flags for any experienced investor. The reality, however, is far more sinister.

Behind the polished websites and fabricated success stories lies a classic Ponzi scheme structure. Early investors receive initial payouts to create the illusion of legitimacy, while subsequent investors find their withdrawal requests mysteriously delayed or completely ignored. The cycle inevitably concludes with frozen accounts, vanished websites, and operators absconding with millions in stolen funds.

Scale of the Threat

CTM360's analysis, conducted through its WebHunt platform, identified over 4,200 websites promoting fraudulent HYIP schemes within the past year alone. The threat landscape shows no signs of slowing - December 2025 saw 485+ incidents detected, averaging more than 15 scam websites identified daily. This sustained activity indicates a well-organized, scalable criminal operation rather than isolated incidents.

Two Dominant Scam Variants

The report highlights two primary HYIP formats currently dominating the threat landscape:

Cryptocurrency Trading HYIPs: These platforms exploit the growing interest in digital assets, promising automated trading bots and guaranteed crypto returns.

Forex and Stock Trading HYIPs: These scams mimic legitimate market platforms, complete with fake trading charts and fabricated performance metrics.

Both variants share the same fundamental deception: professional-looking interfaces combined with fabricated performance claims designed solely to extract deposits rather than generate actual returns.

How Scammers Spread Their Web

CTM360 observed that threat actors heavily rely on social media distribution channels:

- Paid advertisements across major platforms including Meta/Facebook

- Telegram and WhatsApp groups for targeted outreach

- Bogus social profiles promoting "invest/profit/trade" themes

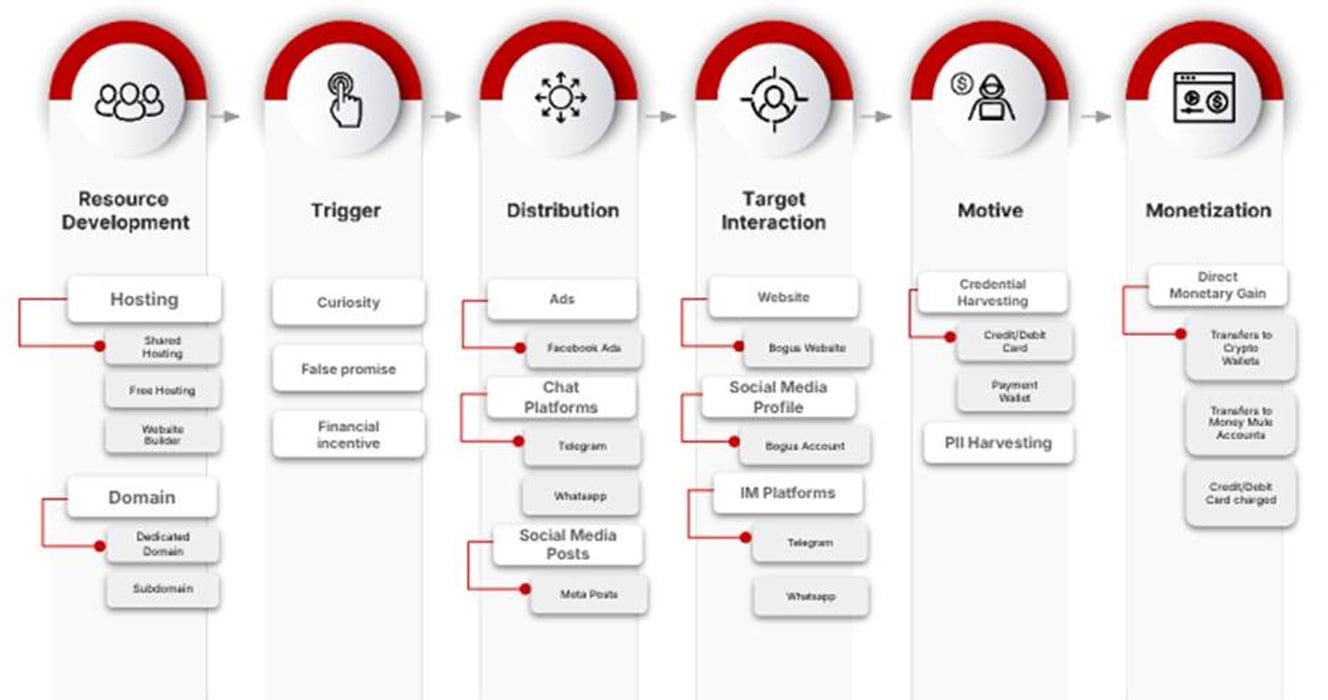

These promotions span 20+ languages, demonstrating sophisticated geographic targeting and victim outreach strategies. The company maps this activity using its Fraud Navigator framework, which traces the complete scam lifecycle from initial resource development through distribution, execution, and eventual monetization.

The Illusion of Legitimacy

To appear credible, HYIP websites employ numerous deceptive tactics:

- Forged international standards and licensing stamps

- Fake testimonials from supposed successful investors

- Fraudulent withdrawal and transaction histories

- Professional website templates mimicking legitimate financial platforms

CTM360 discovered that licensing details are frequently recycled across multiple scam sites. In one striking example, the same company registration number and address appeared across 270+ different websites, revealing the mass-produced nature of this criminal infrastructure.

The Referral Trap

A particularly insidious aspect of these scams is the referral program structure. Victims are incentivized to become distributors through promises of:

- Bonus rewards for successful referrals

- Increased profit rates for bringing in new investors

- Direct referral commissions

This multi-level recruitment strategy allows scams to scale rapidly beyond paid advertising into personal networks, with victims unwittingly becoming accomplices in recruiting others.

Payment Methods and Exit Strategies

While cryptocurrency remains the preferred payment method due to its anonymity and irreversibility, CTM360 also observed HYIPs accepting:

- Credit and debit cards

- Local payment gateways

- Bank transfers

Many platforms request Know Your Customer (KYC) documents to "activate" accounts, then repeatedly claim verification is still in progress to delay withdrawals and retain funds. This bureaucratic stalling tactic is a common precursor to the eventual exit strategy.

The Predictable Collapse

HYIP scams follow a remarkably consistent lifecycle:

- Setup of fake platforms with professional interfaces

- Promotion through social media and paid advertising

- Building trust with fabricated results and initial payouts

- Incentivizing larger deposits through referral schemes

- Collapse through withdrawal blocking and platform disappearance

The report emphasizes that these scams are not isolated incidents but part of a coordinated global campaign exploiting both technological sophistication and human psychology.

For the full technical analysis and detailed threat intelligence, read CTM360's complete report: https://www.ctm360.com/reports/hyip-risk

Detect Cyber Threats 24/7 with CTM360 - Monitor, analyze, and promptly mitigate risks across your external digital landscape with the CTM360 Community Edition.

Comments

Please log in or register to join the discussion